By CountingPips.com

Weekly CFTC Net Speculator Report

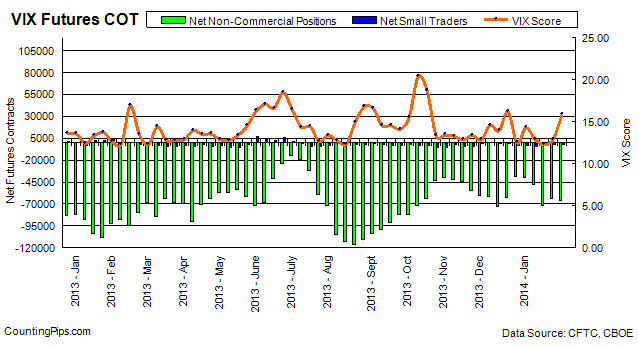

VIX Futures Contracts: Large trader and speculator positions were virtually unchanged from the previous week in the VIX futures market last week, according to the latest data from the Commodity Futures Trading Commission (CFTC) released on Friday.

The VIX non-commercial contracts, traded by large speculators and hedge funds, totaled a net position of -65,504 contracts in the data reported for January 28th. This was a change of -1,198 contracts from the previous week’s total of -64,306 net contracts that was recorded on January 21st.

The VIX index, meanwhile, rose to its highest levels in six weeks through January 28th as unease from emerging-market economies and the uncertain effects of the US Fed tapering led to volatility in the markets. The VIX increased from 12.87 on Tuesday January 21st to 15.80 on Tuesday January 28th, according to the Chicago Board Options Exchange (CBOE) Volatility Index.

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Net Non-Commercials | Weekly Change | VIX Score |

| 12/24/2013 | 354273 | -38125 | 24512 | 12.48 |

| 12/31/2013 | 349696 | -39992 | -1867 | 14.28 |

| 01/07/2014 | 359668 | -47472 | -7480 | 12.92 |

| 01/14/2014 | 397328 | -71496 | -24024 | 12.28 |

| 01/21/2014 | 416956 | -64306 | 7190 | 12.87 |

| 01/28/2014 | 376043 | -65504 | -1198 | 15.8 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article by CountingPips.com – Forex Apps & Analysis