By CountingPips.com

Weekly CFTC Net Speculator Report

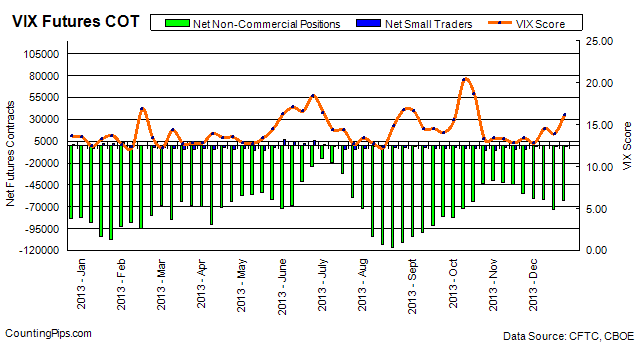

VIX Futures Contracts: Large traders and speculators pulled back on their bearish positions in the VIX futures market on December 17th, according to the latest data from the Commodity Futures Trading Commission (CFTC) released on Friday. The VIX non-commercial contracts, traded usually by large speculators and hedge funds, saw a total net position of -62,637 contracts in the data reported for December 17th. This was a change of +10,695 contracts from the previous week’s total of -73,332 net contracts on December 10th. Speculators had raised their bearish bets for the previous six weeks and December 17th was the first decrease in bearish bets since October 29th.

Meanwhile, the VIX index, also known as the fear index, rose from 13.91 on Tuesday December 10th to 16.21 on Tuesday December 17th, according to the Chicago Board Options Exchange (CBOE) Volatility Index.

Last 6 Weeks of Large Trader Positions

| Date | Net Non-Commericals | Change | VIX Score |

| 11/12/2013 | -44525 | -2617 | 12.82 |

| 11/19/2013 | -54855 | -10330 | 13.39 |

| 11/26/2013 | -60024 | -5169 | 12.81 |

| 12/03/2013 | -62050 | -2026 | 14.55 |

| 12/10/2013 | -73332 | -11282 | 13.91 |

| 12/17/2013 | -62637 | 10695 | 16.21 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article by CountingPips.com – Forex News & Analysis