Source: ForexYard

Yesterday was fairly hectic for euro traders after the credit downgrade of several EU countries sent the common currency tumbling. The EUR saw a brief upward correction during mid-day trading after the release of a better than expected German ZEW Economic Sentiment figure. Today, investors will be eagerly awaiting any news out of a meeting of euro-zone finance ministers. Traders can expect heavy volatility, as the meeting is expected to determine whether Greece will receive the bailout package it needs to avoid defaulting on its debt.

Economic News

USD – USD Capitalizes on Euro-Zone, Japanese News

The US dollar was largely bullish throughout yesterday’s trading session, as news out of both Europe and Japan sent investors to the safe-haven currency. Following the credit downgrade of several EU countries, the euro tumbled against the greenback, dropping as low as 1.3126 before staging a mild upward correction. Against the yen, the dollar was boosted after the Bank of Japan announced that it was increasing its asset-buying program in an attempt to strengthen Japan’s economy.

Turning to tomorrow, traders will want to pay close attention to the meeting of euro-zone finance ministers. The meeting will finally determine whether Greece receives its bailout package or not. If the news out of the meeting is positive, investors are likely to move their funds back to the euro which could cause the dollar to stage a reversal.

Additionally, the US TIC Long-Term Purchases figure, scheduled to be released at 14:00 GMT, has the potential to generate some market activity. Should the figure come in above the forecasted level of 62.3B, the greenback may be able to extend today’s gains. At the same time, if the indicator comes in below expectations, the dollar may see a downward correction.

EUR – Euro-Zone Meeting May Lead to Heavy Trading Day

The euro tumbled against virtually all of its main currency rivals yesterday, following the credit downgrade of several EU countries. While the move by Moody’s Investors Service was not unexpected, investors still responded to the news by reverting back to safe-haven assets. The EUR/USD dropped as low as 1.3126, while against the Japanese yen, the common currency fell to 101.81.

The euro saw some relief later in the day, after the German ZEW Economic Sentiment came in well above the expected level. While the indicator led to moderate gains for the euro, the currency was not able to sustain its bullish momentum and eventually dropped again.

Turning to today, the main news event is likely to be a meeting of euro-zone finance ministers. The meeting will determine whether Greece will finally receive an EU bailout package it needs to avoid defaulting on its debt. While most analysts are convinced that the bailout will be approved, Greece still has to show how it plans to make additional budget cuts before any decision is made. Additionally, not all analysts are convinced that even with the bailout Greece will be able to avoid default. Regardless, tomorrow’s trading is likely to be heavily influenced by the meeting. Positive news may lead to a boost for the euro.

JPY – BOJ Actions Cause Yen to Drop

The Bank of Japan (BOJ) surprised many investors yesterday, after it announced that it was increasing its asset-buying program by 10 trillion yen. The move caused the yen to tumble throughout the day. The BOJ has often moved in to weaken the value of the yen in order to boost Japan’s export driven economy. As a result of the move, the USD/JPY shot up close to 100 pips throughout the European session. Meanwhile, the EUR/JPY, despite falling the previous night, was able to rebound and cross the 103.00 level.

Turning to today, traders will want to monitor any euro-zone developments for signs of investor risk appetite. Should positive Greek news be released, the yen could see some losses as riskier currencies are likely to move up. At the same time, even if Greece receives a bailout package, it is still not entirely certain that the money will be enough for the debt-strapped country. If investors continue to think that Greece could still default on its debt, safe-haven currencies like the yen may see a boost.

Crude Oil – Middle East Tensions Lead to Increase in Price of Oil

The price of crude oil spiked during yesterday’s trading session, reaching as high as $101.81 a barrel, before staging a slight downward reversal. Escalating tensions in the Middle East were largely to blame for oil’s bullish trend. Supply side fears are growing as threats from the West to boycott Iranian oil are being matched by Iranian threats to limit exports.

Turning to today, traders will want to continue monitoring the situation in the Middle East. Any increase in rhetoric from Iran is likely to cause the price of oil to go up once again. In addition, should a bailout agreement for Greece finally be reached, riskier assets like crude oil may move up as a result.

Technical News

EUR/USD

The weekly chart’s Stochastic Slow is currently forming a bearish cross, indicating that downward movement could occur for this pair in the near future. This theory is supported by the daily chart’s Williams Percent Range, which is hovering close to the overbought zone. Traders may want to go short in their positions.

GBP/USD

A bearish cross on the weekly chart’s Stochastic Slow indicates that downward movement may occur in the coming days. That being said, most other long-term technical indicators show that this pair is range trading at the moment. Traders may want to take a wait-and-see approach, as a clearer picture may present itself later in the week.

USD/JPY

Most technical indicators on the daily chart show that this pair is overbought and could see a downward correction in the near future. These include the Relative Strength Index, which has cross above 70, and the Williams Percent Range, which is at -10. Going short may be the preferred strategy for this pair.

USD/CHF

The daily chart’s MACD/OsMA has formed a bullish cross, which typically means that upward movement could occur in the near future. This theory is supported by the Stochastic Slow on the weekly chart. Traders may want to go long in their positions for this pair.

The Wild Card

GBP/CAD

Technical indicators are showing that this pair has crossed into oversold territory, and could see a bullish correction in the near future. The Stochastic Slow on the 8-hour chart is currently forming a bullish cross, while the Williams Percent Range on the daily chart is currently at -90. Forex traders may want to go long in their positions today.

Forex Market Analysis provided by ForexYard.

© 2006 by FxYard Ltd

Disclaimer: Trading Foreign Exchange carries a high level of risk and may not be suitable for all investors. There is a possibility that you could sustain a loss of all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with Foreign Exchange trading.

Looks like Valentine’s Day wasn’t only for lovers as the bank of Japan presented the Japanese economy with a present yesterday. Though the Bank of Japan left its interest rates near zero percent yesterday, the central bank shocked the markets by announcing not only an increase in its asset purchases, but also a new inflation outlook.

Looks like Valentine’s Day wasn’t only for lovers as the bank of Japan presented the Japanese economy with a present yesterday. Though the Bank of Japan left its interest rates near zero percent yesterday, the central bank shocked the markets by announcing not only an increase in its asset purchases, but also a new inflation outlook.

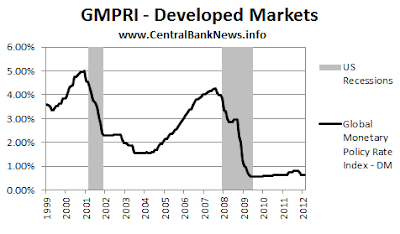

Last week, major central banks gave their semiannual reports on foreign exchange turnover. It revealed that though trading improved in the United States, it dipped severely elsewhere. The Chart shows some vital data released.

Last week, major central banks gave their semiannual reports on foreign exchange turnover. It revealed that though trading improved in the United States, it dipped severely elsewhere. The Chart shows some vital data released.