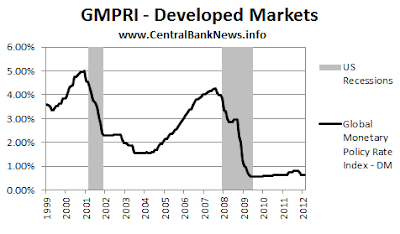

Following on from the initial launch of the GMPRI [Global Monetary Policy Index] this research note focuses on the Developed Markets sub-index. The first point to note is that we have developed history for the index back to January 1999 (data file is available at the bottom of this article). While the method of GDP weighting is also discussed, we have overlain a couple of key data series with the index to demonstrate the value of the index in strategy and forecasting.

The first chart shows the index history back to January 1999, unsurprisingly the index drops during recessions due to the generally pro-cyclical nature of monetary policy (rates rise during boom times, and drop during recessions). It is also worth noting that we modeled four alternative GDP weighting methods (static weight from 2010, a static long term average, monthly phasing of annual data, and a moving average of the monthly phased annual data); while there were no considerable differences between the series, the fourth method makes most intuitive sense as it allows the expression of structural changes but without being too abrupt (which may cause noise).

On the topic of GDP (Gross Domestic Product), the chart above shows the annual rate of economic growth of the countries in the GMPRI-DM index (using the same GDP weighting method). Again the index shows aspects of pro-cyclicality, however there is a weak link between high interest rates and low growth in the following period, and for low rates leading to higher growth in the following period.

Finally, applying the index to a financial market perspective, the above chart shows the annual percent change of the S&P500 along side the index. Two conclusions can be drawn: 1. the stock market appears to anticipate interest rate cuts; and 2. periods of low interest rates are generally supportive of positive equity market returns.

No doubt there are further uses for the index, and other interesting correlations to examine; particularly through transforming the index data e.g. annual percentage change, periods of rising vs falling rates, etc. The data is available for you to use (please cite us as the source), please do let us know if you find any interesting links with the index.

Also stay tuned for more releases; we are presently working on building out history for the emerging market index, and have plans to expand the history for the developed market even further back (which may help provide more robust findings for use in forecasting and strategy).

Access the index data here: GMPRI-DM Data