By GCI Forex Research

FUNDAMENTAL OUTLOOK at 0800 GMT (EDT +0400)

USD

FX markets remained tightly range-bound for most of the Asia session, as investors direct their attention to the upcoming ECB press conference. Headlines suggesting that a peace plan for Libya is being discussed led to a spurt of risk-seeking, but it was shallow and brief. EURUSD traded 1.3847-1.3876, USDJPY 81.65-81.93. The S&P 500 finished fractionally stronger. The Fed’s latest Beige Book was a bit more optimistic and the ADP employment data beat consensus, rising +217k in Feb. Fed Chairman Bernanke’s second day of prepared testimony was largely unchanged from the first. During the Q&A session, he said he would not rule out the possibility of a QE3 if conditions deteriorate, though he implied this was not his expectation. He added that monetary policy works with a lag and therefore “we cannot wait until we get to full employment and the target inflation rate before we start to tighten.” ADP estimates private payrolls rose +217k in Feb.

EUR

The ECB decision is due and our analysts are in line with the consensus in expecting no change to the policy rate. But during the ensuing press conference, we look for a more hawkish stance, an upward revision of inflation forecasts, and no change in the 3-month repo rules for forthcoming ECB tenders.

German Chancellor Merkel and Portuguese Prime Minister Socrates met and Socrates reiterated that Portugal does not need external help. Socrates said the March 11 summit aims to boost confidence for market participants and Merkel remained non-committal on possible reductions or alterations to current bailout packages for Ireland and Greece.

Eurozone PPI was stronger at 1.50% m/m compared to consensus of 1.10%. This will add to the ECB’s inflation concerns and provides further evidence of higher oil prices feeding through.

AUD

Trade data for January showed a -29.5% m/m decline in coal exports, due to flooding in Queensland, while exports in general fell -4.1% m/m. The AUD was not badly affected by the news, largely because of a compensating decline in imports, which caused the trade balance to come in ahead of expectations at A$1.875 bn (cons. A$1.55 bn).

Building approvals fell dramatically by -15.9% m/m (cons. -3.3%), and -24.8% (cons. -6.6%). The declines were even more pronounced in Queensland.

Our team of analysts stick to their view that the RBA will likely hike by a further +50bp in H2.

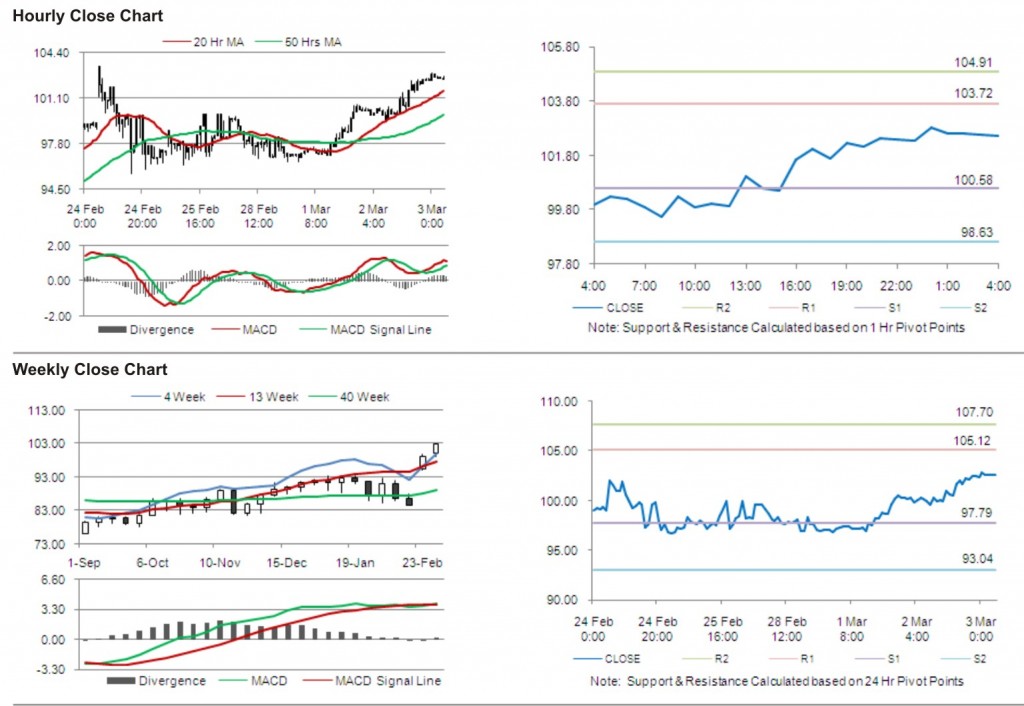

TECHNICAL OUTLOOK

USDJPY 81.13/80.93 support.

EURUSD BULLISH Recovery through 1.3862 has opened up the way towards 1.3948/74 zone. Near term support is at 1.3712.

USDJPY BEARISH Breach of 81.62 exposes 81.13/80.93 support area. Initial resistance is at 82.24.

GBPUSD BULLISH Clearance of 1.6330 has exposed 1.6379. Support is defined at 1.6216.

USDCHF BEARISH Pressure on 0.9200; breach of this would expose 0.8951 next. Near-term resistance at 0.9323.

AUDUSD BULLISH Rise above 1.0202 would open 1.0256 key resistance. Near-term support at 1.0085.

USDCAD BEARISH Initial support is at 0.9684, breach of this would expose 0.9600. Resistance at 0.9800.

EURCHF BEARISH Move above 1.2706 would expose 1.2686 and 1.2592 next. Near-term resistance is at 1.2893.

EURGBP BULLISH Support at 0.8423 continues to hold, expect gains towards 0.8555 ahead of 0.8593.

EURJPY BULLISH Momentum is positive; initial resistance at 114.19 ahead of 114.94 while support at 111.96.

Forex Daily Market Commentary provided by GCI Financial Ltd.

GCI Financial Ltd (”GCI”) is a regulated securities and commodities trading firm, specializing in online Foreign Exchange (”Forex”) brokerage. GCI executes billions of dollars per month in foreign exchange transactions alone. In addition to Forex, GCI is a primary market maker in Contracts for Difference (”CFDs”) on shares, indices and futures, and offers one of the fastest growing online CFD trading services. GCI has over 10,000 clients worldwide, including individual traders, institutions, and money managers. GCI provides an advanced, secure, and comprehensive online trading system. Client funds are insured and held in a separate customer account. In addition, GCI Financial Ltd maintains Net Capital in excess of minimum regulatory requirements.

DISCLAIMER: GCI’s Daily Market Commentary is provided for informational purposes only. The information contained in these reports is gathered from reputable news sources and is not intended to be U.S.ed as investment advice. GCI assumes no responsibility or liability from gains or losses incurred by the information herein contained.