March 4 (Bloomberg) — Australian Prime Minister Julia Gillard talks about the country’s economy and local currency. Gillard highlighted risks posed by the nation’s ties to a global commodity boom, with a patchwork economy emerging from export gains accompanied by subdued domestic spending. She spoke yesterday in Canberra with Haslinda Amin for Bloomberg Television. (This is an excerpt of the full interview. Source: Bloomberg)

USD/JPY Targets the 84.50 Level

By Yan Petters

The USD/JPY pair has been range-trading for the past ten weeks, shifting between the 81.00 and the 84.50 levels. The pair recently reached a significant support level yet failed to cross it. As a result, the USD/JPY began climbing upwards, and still looks to reach higher. As several technical indicators show, the pair has potential to reach as high as the 84.50 level.

• The chart below is the USD/JPY 1-day chart by ForexYard.

• It is clearly seen that the pair’s trading was mainly characterized by ups and downs lately, without marking any real trend.

• The pair saw several failed attempts to breach through the 81.50 support level. As a result, it bounced back up and is currently trading near the 82.50 level.

• A bullish cross on the Slow Stochastic indicates that the bullish momentum has more room to go.

• The RSI has recently crossed the 30-level and is still pointing upwards. This indicates that the bullish move could proceed.

• In addition, the MACD looks to complete a bullish cross soon. If the bullish cross will indeed takes place, it could be used as further evidence that the upward movement will continue.

• The pair’s next resistance levels are located at the: 82.85, 83.50, 84.00 and the 84.50 level.

• The pair’s next support levels are at: 82.30, 81.50 and 80.90.

Forex Market Analysis provided by ForexYard.

© 2006 by FxYard Ltd

Disclaimer: Trading Foreign Exchange carries a high level of risk and may not be suitable for all investors. There is a possibility that you could sustain a loss of all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with Foreign Exchange trading.

FOREX Update: Nonfarm Jobs Report shows rise of 192K, unemployment rate falls to 8.9%. US Dollar trades mixed

By CountingPips.com

Today’s government nonfarm payrolls employment data came in better than expected with a gain of 192,000 jobs for February and the unemployment rate fell to 8.9 percent. The February data marked the fastest pace of hiring in almost a year and follows a revised gain of 63,000 jobs in January. Market forecasters and economists were  expecting the nonfarm payroll report to show a gain of approximately 185,000 jobs and the unemployment rate to rise to 9.1 percent for the month.

expecting the nonfarm payroll report to show a gain of approximately 185,000 jobs and the unemployment rate to rise to 9.1 percent for the month.

The unemployment rate, at 8.9 percent, fell from 9.0 percent in January and has reached its lowest point in nearly 2 years.

December’s employment data was also revised higher to show an increase of 152,000 jobs after a gain of 121,000 jobs previously reported.

Private companies created 222,000 jobs in February as the service sector added 152,000 jobs and the goods producing sector increased by 70,000 jobs. Government hiring fell by 30,000 workers for the month.

Professional and business services led the way in the service sector with job creation of 47,000 workers while education and health services hiring added 40,000 jobs in February. In the goods producing sector, manufacturing jobs rose by 33,000 workers while construction jobs increased by 33,000 workers.

US Dollar mixed in early US session Fx Trade

The US dollar has been mixed in volatile forex trading action following the monthly government jobs report released today. The American currency has been gaining versus the British pound sterling, Japanese yen, Australian dollar and the New Zealand dollar today while showing a decline versus the euro, Swiss franc and the Canadian dollar at time of writing.

Forex Daily Market Commentary: The dollar stabilized against the euro after yesterday’s heavy losses

By GCI Forex Research

FUNDAMENTAL OUTLOOK at 0800 GMT (EDT +0400)

USD

The absence of news flow and economic data releases made for a quiet Asia session. The dollar stabilized against the euro after yesterday’s heavy losses in the wake of ECB President Trichet’s hawkish commentary. EURUSD traded 1.3930-1.3972, USDJPY 81.73-82.52. The S&P 500 finished +1.7% higher, and the Nikkei is +1% stronger at the time of writing. The nonmanufacturing ISM index rose to 59.7. Jobless claims fell sharply to 368k and the downtrend continues after having been interrupted by January storms. Our analysts forecast a +235k rise in total nonfarm payrolls (cons. +195k) and a +250k rise in private payrolls (cons. +200k). They also expect the unemployment rate to stay unchanged at 9.0% (cons 9.1%). Before the payrolls report, attention will likely be on today’s speeches from several ECB policymakers, where corroboration of Trichet’s remarks could lead to further euro upside. We still think the dollar could strengthen in the medium term but the latest ECB comments put the dollar on rockier footing in the near term.

EUR

Market participants had been expecting a hawkish tone and ECB President Trichet definitely delivered, noting the need for “strong vigilance” as risks to the inflation outlook had moved to the upside. The phrase has been used previously to signal an imminent rate hike and Trichet later said that vigilance could mean a rate hike next month, though he stressed this is not certain. The ECB also increased its staff forecasts for inflation in both 2011 and 2012, with the upward revision for 2011 larger than our analysts had expected, to between 2.0% and 2.6% from 1.2% to 2.2% previously. Our European economists now look for a 25bp hike at the April meeting. The ECB kept the rules of the 3m repo operation unchanged at full allocation, a fact which was largely overshadowed by the discussion on rates.

The hawkish comments point to continued euro upside, at least in the near term. But EURUSD failed to go above 1.40 as market participants await the US labour data release. An above-consensus print in the US will likely be needed to help the dollar recover some of its losses versus the euro.

The series of services PMIs was released across the Eurozone, with the composite indicator slightly softer at 58.20. Eurozone Q4 GDP was not revised, as expected.

A Spanish auction was well received with a bid-to-cover ratio in the 5y at 2.17, up from 2.11 last time.

CHF

SNB’s Jordan said that the deflation risk in Switzerland has largely disappeared but the question of raising rates is not one for “today or tomorrow”.

TECHNICAL OUTLOOK

EURUSD 1.4000 resistance.

EURUSD BULLISH The pair targets 1.4000 with scope for 1.4086 next. Near-term support is defined at 1.3833.

USDJPY BEARISH Break of support 81.57 would open the way to 81.13/80.93 area. Resistance is at 82.89.

GBPUSD BULLISH The pair eyes resistance 1.6379, break of this would pave way to 1.6458 next, Support lies at 1.6216.

USDCHF BEARISH Bearish pressure holds above 0.9200, move below this level would expose 0.8951 next. Near-term resistance at 0.9392.

AUDUSD BULLISH Climb through 1.0202 would open up key resistance 1.0256. Near-term support at 1.0085.

USDCAD BEARISH Focus is on 0.9684; break below the level would expose 0.9600. Resistance at 0.9800.

EURCHF NEUTRAL Abrupt rise through 1.2893 has initial resistance at 1.3138 while support is at 1.2788.

EURGBP BULLISH Break of 0.8555 has exposed 0.8593 ahead of 0.8619. Support at 0.8461 holds.

EURJPY BULLISH Sharp recovery through 114.19/94 has exposed 115.42/68 resistance area. Support defined at 113.10.

Forex Daily Market Commentary provided by GCI Financial Ltd.

GCI Financial Ltd (”GCI”) is a regulated securities and commodities trading firm, specializing in online Foreign Exchange (”Forex”) brokerage. GCI executes billions of dollars per month in foreign exchange transactions alone. In addition to Forex, GCI is a primary market maker in Contracts for Difference (”CFDs”) on shares, indices and futures, and offers one of the fastest growing online CFD trading services. GCI has over 10,000 clients worldwide, including individual traders, institutions, and money managers. GCI provides an advanced, secure, and comprehensive online trading system. Client funds are insured and held in a separate customer account. In addition, GCI Financial Ltd maintains Net Capital in excess of minimum regulatory requirements.

DISCLAIMER: GCI’s Daily Market Commentary is provided for informational purposes only. The information contained in these reports is gathered from reputable news sources and is not intended to be U.S.ed as investment advice. GCI assumes no responsibility or liability from gains or losses incurred by the information herein contained.

Gold: Regaining some losses this morning

Gold Movement

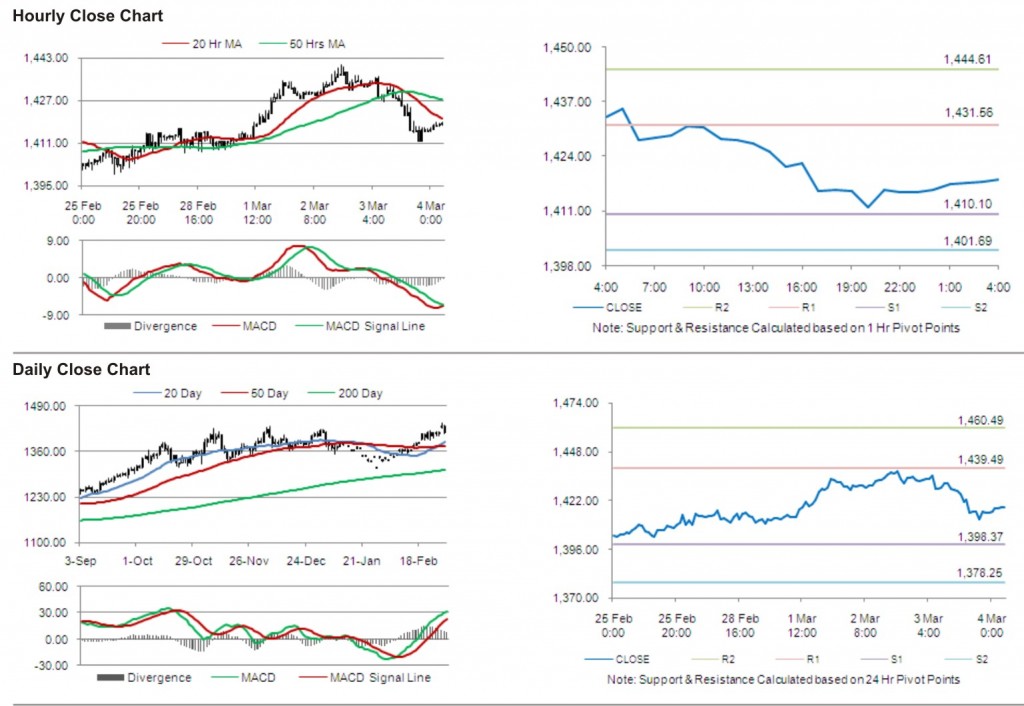

Gold prices traded lower by 1.33% against the USD in the 24 hour period ending 23:00GMT, at 1,415.51 per ounce, after the ECB President’s statement that euro-zone interest rates could be raised in the next month to curb inflation.

In the Asian session at 4:00GMT, gold is trading at USD 1,418.50 per ounce, 0.21% higher from 23:00GMT.

The pair is expected to find its first short term resistance at 1,431.56, with the next resistance at 1,444.61. The pair is expected to find support at 1,410.10 and subsequently at 1,401.69.

The pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.

Forex Daily Market Commentary provided by GCI Financial Ltd.

GCI Financial Ltd (”GCI”) is a regulated securities and commodities trading firm, specializing in online Foreign Exchange (”Forex”) brokerage. GCI executes billions of dollars per month in foreign exchange transactions alone. In addition to Forex, GCI is a primary market maker in Contracts for Difference (”CFDs”) on shares, indices and futures, and offers one of the fastest growing online CFD trading services. GCI has over 10,000 clients worldwide, including individual traders, institutions, and money managers. GCI provides an advanced, secure, and comprehensive online trading system. Client funds are insured and held in a separate customer account. In addition, GCI Financial Ltd maintains Net Capital in excess of minimum regulatory requirements.

DISCLAIMER: GCI’s Daily Market Commentary is provided for informational purposes only. The information contained in these reports is gathered from reputable news sources and is not intended to be U.S.ed as investment advice. GCI assumes no responsibility or liability from gains or losses incurred by the information herein contained.

Non-Farm Payrolls Report to Drive Today’s FX Trading

By Russell Glaser

All eyes will be fixed on the US jobs report due out today.

Yesterday the US dollar gained ground versus the majors with the lone exception being the euro as the ECB all but assured markets of an interest rate hike next month. The general positive tone for the dollar could carry over into today’s trading should the jobs data come in better than expected.

Today’s data releases:

GBP – Halifax HPI m/m – 08:00 GMT

Expectations: -0.6%. Previous: 0.8%.

The GBP was down yesterday following a weaker than expected services PMI. Disappointing housing data may also weigh on the pound. GBP/USD support is located at Friday’s low at 1.6030 with resistance found at Wednesday’s high of 1.6340. A move higher would target the November 2009 high at1.6880.

USD – Non-Farm Employment Change – 13:30 GMT

Expectations: 180K. Previous: 36K.

The weekly unemployment claims report was strong, as was the ADP jobs report. However, there is typically little correlation between these jobs data and today’s report. Expectations are high and may disappoint the market. Traders should look to continue bidding the euro higher against the dollar. The 1.4080 level could come into play today.

CAD – Ivey PMI – 15:00 GMT

Expectations: 50.6. Previous: 36K.

The CAD has been a strong performer versus the dollar; much of which can be attributed to higher crude oil prices as well as general dollar weakness. Following a breach of the 0.9800 level, the USD/CAD should continue to move lower with only the 0.9700 support that stands in the way of the November 2007 low at 0.9050.

Forex Market Analysis provided by ForexYard.

© 2006 by FxYard Ltd

Disclaimer: Trading Foreign Exchange carries a high level of risk and may not be suitable for all investors. There is a possibility that you could sustain a loss of all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with Foreign Exchange trading.

Euro Soars On ECB Interest Rate Expectations; Non-Farm Payrolls Eyed

Source: ForexYard

A day prior to the US Non-Farm Employment Change report, ECB President Jean-Claude Trichet set the stage for the first European interest rate increase since the financial crisis.

Economic News

USD – US Dollar Gains on Weekly Unemployment Data

A significant drop in weekly US unemployment claims helped spur dollar gains versus the major currencies. The lone exception to this price action was versus the euro where the pair surged to its highest level since November 2010 on the back of hawkish comments by the ECB. Weekly unemployment claims came in better than expected with new jobless claims falling to 368K from the previous week’s 388K. Labor economists had forecasted a rise to 394K jobless claims.

At the end of the day’s trading, the EUR/USD was up at 1.3960 from 1.3855. The USD/JPY surged to close higher at 82.40 from 81.83, while the GBP/USD was down at 1.6270 from 1.6312.

The drop in unemployment claims also spurred gains in higher yielding assets as the major US equity indices were up by more than 1%. The Dow Jones Industrials Average rallied by 1.59%.

All eyes now turn to the release of the US Non-Farm Payrolls report that is expected to show the US added 180K new jobs in the month of February after the economy added 36K jobs in January. However, this release may be taken with a grain of salt as the report could be subject to weather related effects. The trend of a weakening dollar looks to continue but could be reversed if the payrolls report surprises to the upside.

Following yesterday’s breakout, resistance for the EUR/USD is found at 1.4080 with a further target at the trend line that falls off of the January and November 2007 highs which comes in today at 1.4150. Support is located at yesterday’s low of 1.3830, 1.3700, and the rising trend line off of the February 14th low at 1.3640.

EUR – Euro Soars on Trichet Comments

The euro gained across the board today following ECB President Jean-Claude Trichet’s hawkish comments that solidified future interest rate increases in the euro zone. The message was crystal clear when Trichet stressed “strong vigilance is warranted.” He also suggested a rate hike could come as early as the next ECB meeting which is scheduled for April 7th.

Following the speech the EUR/USD rose to its highest level since November 2010, peaking at 1.3975 and closing near its high at 1.3960, up from 1.3855. The EUR/CHF was also up sharply, trading as high as 1.3019 and closed at 1.3000 from 1.2803.

These comments by Europe’s leading central banker show the ECB’s commitment to fight inflationary forces. Rising food and commodity prices have the ECB concerned that if it does not get out ahead of inflation concerns then rising prices could have a negative impact on the euro zone economy.

The ECB kept its rate steady at 1.00%. However, Trichet did emphasize that this may not be the start of a rate tightening cycle. These strong comments will increase expectations for quicker adjustments to rates as well as a faster timetable for interest rates to rise.

This is certainly a catalyst for the euro and further gains may be expected. The appreciation seen yesterday in the EUR/CHF took the pair as high as the 61.8% Fibonacci retracement level from the February downtrend. Further resistance may be found at 1.3080, a level that coincides with the falling downtrend from the November and February highs. A move above this level would target the 200-day moving average at 1.3170.

JPY – USD/JPY Rises on US Employment Data

Yesterday the dollar strengthened versus the yen following better than expected US weekly jobless claims. Weak capital expenditure also had traders buying the pair as Japanese companies increased capex spending, though at a slower pace than the market expected. Q4 capital expenditure rose by 3.8%. However, economists had forecasted an increase of 5.9%

Following the yen negative economic data, the USD/JPY rallied sharply higher, moving above its first resistance level at 82.20 to close at 82.40 after opening the day at 81.83.

Further gains in the pair may be expected tomorrow should the US Non-Farm Payrolls report show an improving employment picture in States. A minor resistance level at 83.50 looks to be reinforced as this price coincides with the 200-day moving average, a resistance level the pair failed to break previously in mid-February.

Crude Oil – Crude Oil Prices Rebound from Earlier Losses

The price of spot crude oil fell earlier in the day on reports of a possible settlement that would end the fighting in Libya. However, once this this rumor was dispelled by Libyan officials, spot crude oil rose from the daily low and is now trading back above the $102 mark.

Prices fell as low as $100.15 before rebounding to the opening day price near $102.21.

The drop in prices that moved in tone with a potential settlement of the conflict underscores just how closely the price of crude oil tracks the violence in the Middle East. An absence of Libyan crude supplies is also beginning to have an impact on European crude oil stocks as Europe is the main recipient of Libyan crude exports.

Tomorrow’s US jobs report will be moving crude oil markets. A better than expected jobs report may support rising crude oil prices. Resistance is found at last week’s high of 103.30, followed by $110.00.

Technical News

EUR/USD

Yesterday’s move puts the pair at its highest level since November 2010. A rising 20-day moving average points to further gains for the pair with targets at 1.4080 with a further target at the trend line that falls off of the January and November 2007 highs. This level comes in today at 1.4150. Support is found at yesterday’s low of 1.3830 and the rising trend line off of the February 14th low at 1.3640.

GBP/USD

The pair looks to make a close above the falling trend line off of the January, November, and February highs which bodes well for the pair. Traders may want to target the January 2010 high at 1.6450. Support is located at 1.6210 and the rising trend line off of the January 2011 low which comes in today at 1.6110.

USD/JPY

After breaking out of a triangle consolidation pattern, only to retrace back inside the upper boundary, the pair has once again moved above this falling support line off of the January and February highs and should continue to move higher. Initial targets should be the 83.50 resistance level followed by the February high of 84.00. Support comes in at this week’s low of 81.60.

USD/CHF

Yesterday’s sharp rise in the value of the pair looks to have stalled at the 0.9330 resistance level. With the 200-day, 100, 50, and 20-day moving averages aligned in a perfect order, this may present an opportunity to enter into the downtrend following the pullback in the price. Should the pair add to yesterday’s gains, resistance looks to be found at 0.9440 and 0.9500. Support is located at Wednesday’s low at 0.9200.

The Wild Card

Crude Oil

Spot Crude Oil is set to post its second consecutive week of strong gains. Currently the price is testing the 61.8% Fibonacci retracement level from the 2008 collapse in oil prices at $104.00. A move above this level would signal to forex traders to target the $110.50 resistance level.

Forex Market Analysis provided by ForexYard.

© 2006 by FxYard Ltd

Disclaimer: Trading Foreign Exchange carries a high level of risk and may not be suitable for all investors. There is a possibility that you could sustain a loss of all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with Foreign Exchange trading.

The US dollar posts gains in overnight trading

The US dollar surges in overnight trading versus its major counterpart currencies on Thursday’s Asian trading center ahead of major meeting of European Central Bank scheduled for today.

The single currency has been performing in last week versus the greenback on expectations on interest rate hike by ECB however it is widely expected now that the European Central Bank will keep its key lending rate at its ever low of 1 percent. However it is projected the region’s central bank will go for increase in the interest in the coming months. It is also expected that the ECB will wind up some of the emergency funding programs in the Thursday’s meeting.

The single currency finally witnessed correction in overnight trading as the Euro declined to 1.3850 against the US dollar as compared to 1.3861 on Wednesday’s North American trading session.

The dollar gained the on the expectations of end of riots and tensions in Libya as crude oil futures also witnessed correction on the news. According to the latest news the Moammar Gadhafi has agreed to the proposal of Venezuelan President Hugo Chavez for negotiations with opposition forces.

The dollar index DXY which measures the US dollar movement against it major six counterpart currencies traded at 81.83 in overnight market as compared to 81.90 on Wednesday’s late trading hours.

The British Pound reported the fall to 1.6314 versus the greenback as compared to 1.6329 on late Wednesday.

The US dollar declined slightly versus the Japanese Yen to 81.83 in Asian trading session as compared to 81.90 on Wednesday’ North American session.

About the Author

Daily forex trading news written by Rehan from DailyForexTrade.com

AUDUSD formed a sideways consolidation

Being contained by 1.0199 resistance, AUDUSD formed a sideways consolidation in a range between 1.0085 and 1.0201. The price action in the trading range is more likely consolidation of uptrend from 0.9943, a break above 1.0201 level could trigger another rise towards 1.0400 zone.

Written by ForexCycle.com

Emerging Markets Lose Investors

By Sara Nunnally, Editor, Smart Investing Daily, taipanpublishinggroup.com

Yesterday, I came across an article from the Associated Press warning that investors were pulling their money out of emerging markets and putting it in safer regions. The article listed the U.S., Europe and Japan as areas where investors will see higher returns.

Now, I’ve talked extensively about international markets for the Taipan Publishing Group. I’ve traveled to a myriad of places — from frontier countries like Vietnam and Morocco to emerging markets like Poland and the Czech Republic to developed markets like Italy and Singapore.

So I wanted to check to see if this was actually the case — whether or not emerging markets are still viable places to see investment returns.

The Associated Press says:

According to fund tracker EPFR Global, fund managers and other investors yanked $5.45 billion from emerging markets funds in China, India, Brazil and elsewhere in the second week of February and placed it in equity funds of advanced economies — their biggest weekly inflow in more than 30 months.

What’s behind this move is the undeniable fact that developed markets have outperformed some key emerging markets. The Dow is up more than 4%, as is Germany’s DAX. France is up nearly 7% and Japan’s Nikkei is up more than 5% so far this year.

In comparison, you have some major emerging market indexes down… Brazil is down about 4.5% and India is down 10%.

But this isn’t true of all emerging markets. Russia is up 10.5%. China’s up 4%. In other words, money may be flowing back into developed markets, but some international arenas are still pretty hot.

The truth behind this news report is that some investors are focusing on safety and value. There is no denying that companies in the United States and Europe look like good values right now, and the hope of an economic recovery makes developed markets look awfully safe compared to the turmoil in the Middle East and North Africa.

Increased Investment Doesn’t Mean Decreased Risk

Here’s the thing: There’s risk on both sides.

The economic situation is just barely starting to get cleaned up in the U.S., and the debt in some European countries is still a huge issue. Japan — one of the biggest export economies in the developed world — is struggling with an appreciating currency that could confuse exports.

Emerging markets are dealing with increased food and energy prices as grains and oil spike to new highs, and they are dealing with growing inflation, making them less competitive on the global stage. Combine these things with investment capital fleeing to safer havens and you’ve got a risky setup that could keep investors away.

Foreign Direct Investment, FDI, as defined by the International Monetary Fund, “refers to an investment made to acquire lasting or long-term interest in enterprises operating outside of the economy of the investor.”

FDI can be a good gauge of how much faith global investors (including other countries themselves) have in a particular country.

“Safe Havens” Are Losing Money

Foreign Direct Investment totals for the first three quarters of 2010 (according to the most recent data from Organization for Economic Cooperation and Development) show a decrease for more than half of all OECD countries as compared to the first three quarters of 2009.

Making up the list of countries that saw FDI drop are 11 of the 27 European Union member states — including Germany and France — and Japan. The U.S. saw FDI climb significantly.

It should be noted that this list includes only 34 member economies — and therefore does not report on emerging market FDI flows.

China reported a banner year for FDI, with investments totaling $105.7 billion.

Here’s the thing… FDI flows to emerging markets made up more than half of all foreign direct investment flows by the end of 2010. This is important, because this is the first time it’s happened since the United Nations Conference on Trade and Development (UNCTAD) started keeping track in 1995.

Before that, most of FDI was flowing into developed economies, like the U.S. and members of the European Union.

(Investing doesn’t have to be complicated. Sign up for Smart Investing Daily and let me and my fellow editor Jared Levy simplify the stock market for you with our easy-to-understand investment articles.)

Find a Balance

As a whole, FDI to Europe dropped 21.9% in 2010 year-over-year, Japan saw a massive drop of 83.4%, while developing economies in Latin America climbed 21.1%. Emerging markets in much of Asia — excluding Western Asia and Turkey — saw FDI climb 17.8%.

The UNCTAD report notes, “Developed countries did not return to FDI growth in 2010. UNCTAD’s latest estimates show that FDI flows to this group of economies fell some 7% to $527 billion, despite the robust recovery in some countries.”

The U.S. is in this group.

As I said before, we can’t deny that emerging markets have seen their indexes and stock markets take a hit so far this year. But FDI flows show that faith hasn’t left developing economies. The correction we’ve seen in such international markets could be an opportunity for investors to balance out their portfolio if they’re overly weighted in domestic stocks and funds.

Editor’s Note: It Can Happen in Just 72 Hours. There’s an event that could rattle the very foundations of America unlike any other… and it has very little to do with the value of the dollar. Follow this link for more details on this financial investment opportunity.

About the Author

Sara is Managing Editor of Smart Investing Daily. As Senior Research Director and global correspondent, Sara Nunnally’s diverse resume includes studies in art history, computer science and financial research. She has appeared on news media such as Forbes on Fox, Fox News Live, and CNBC’s Squawk Box, as well as numerous radio shows around the country. Most recently, Sara co-authored a book with Sandy Franks called, Barbarians of Wealth.

As Senior Research Director, global correspondent and managing editor of Smart Investing Daily, Sara has traveled all over the world in search of the best investment opportunities to recommend to her readers, be they in developed economies like France and Italy, in emerging markets like the Czech Republic and Poland, or in frontier terrain like Vietnam and Morocco. Her unique “holistic” approach of boots-on-the-ground research has given her an edge in today’s financial marketplace as she searches for the next investment opportunities in hot sectors like alternative energy, currency markets and commodities.