By GCI Forex Research

For the 24 hours to 23:00 GMT, AUD strengthened 0.07% against the USD to close at 1.0098.

In Australia, seasonally-adjusted unemployment rate declined to 5.0% in February, from 5.1% in January. Additionally, in the US, wholesale inventories rose by 1.1% (M-o-M) in January, greater than market expectations, following an upwardly revised 1.3% rise posted in December.

In the Asian session at 4:00GMT, the pair is trading at 1.0040, 0.57% lower from the New York session close.

LME Copper prices rose 2.0% or $189.8/MT to $9,609.5/ MT. Aluminium prices rose 1.8% or $44.5/ MT to $2,579.3/ MT.

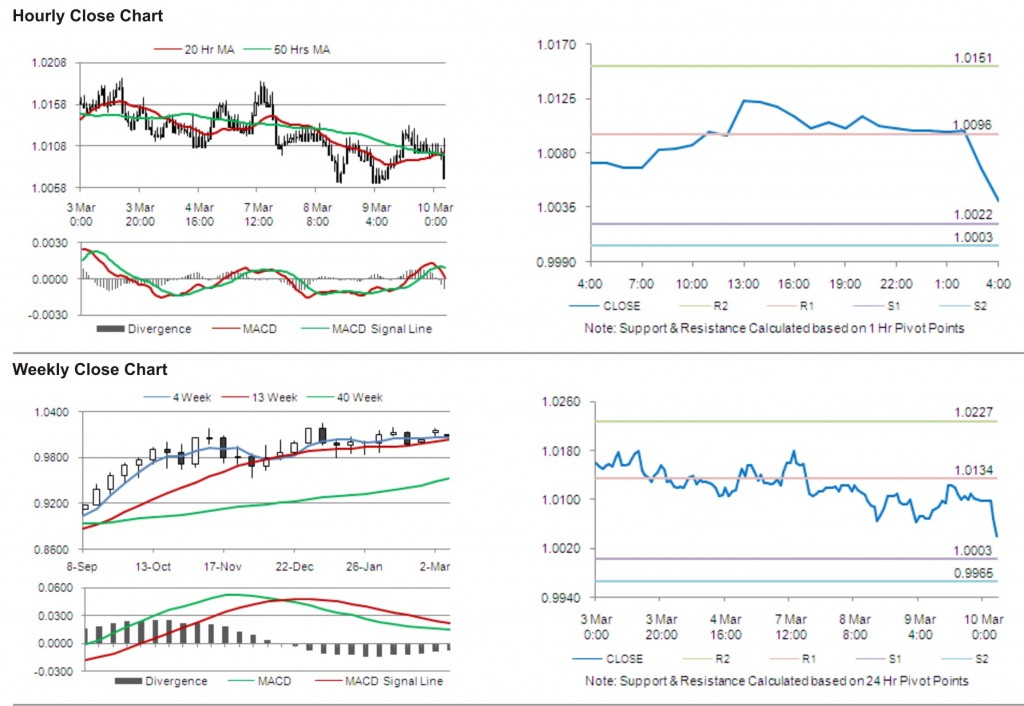

The pair is expected to find first short term resistance at 1.0096, with the next resistance levels at 1.0151 and 1.0225, subsequently. The first support for the pair is seen at 1.0022, followed by next supports at 1.0003 and 0.9929 respectively.

The currency pair is trading below its 20 Hr and 50 hr moving averages.

Forex Daily Market Commentary provided by GCI Financial Ltd.

GCI Financial Ltd (”GCI”) is a regulated securities and commodities trading firm, specializing in online Foreign Exchange (”Forex”) brokerage. GCI executes billions of dollars per month in foreign exchange transactions alone. In addition to Forex, GCI is a primary market maker in Contracts for Difference (”CFDs”) on shares, indices and futures, and offers one of the fastest growing online CFD trading services. GCI has over 10,000 clients worldwide, including individual traders, institutions, and money managers. GCI provides an advanced, secure, and comprehensive online trading system. Client funds are insured and held in a separate customer account. In addition, GCI Financial Ltd maintains Net Capital in excess of minimum regulatory requirements.

DISCLAIMER: GCI’s Daily Market Commentary is provided for informational purposes only. The information contained in these reports is gathered from reputable news sources and is not intended to be U.S.ed as investment advice. GCI assumes no responsibility or liability from gains or losses incurred by the information herein contained.