The EURUSD Retreating from Support Around 1.3720

Another testing the support level of 1.3720 by the EURUSD was finished by a rebound and a rise to 1.3808. After failed attempts to break above, the pair retreated to the support around 1.3763. Its ability to hold bears` onslaught is a positive factor for the bulls, which keeps risks to grow to the 39th figure. On the whole, the picture remains unchanged; the pair is in a consolidation phase. To weaken a bullish impulse, the bears need to break below 1.3720—1.3700.

A Positive Sentiment Towards the GBPUSD Remains

The GBPUSD continues to be bought on dips, so yesterday’s decline to the 1.6611 level has not continued. Instead of this, the pair increased to 1.6683. A positive sentiment remains, though it is not the fact that the bulls could move higher above the 67th figure. Nevertheless, it should not be excluded that it can be tested in the short run. Loss of the support around the 1.6596 level will weaken a bullish impulse and lead to falling to 1.6560—1.6540. Growth and ability to consolidate above the 67th figure will put the resistance around the 68th figure at risk.

The USDCHF Taking Risk to Resume a Decline

The ascending correction of the USDCHF hauled at the 89th figure, which failed to rise higher. Offers, which are located here, throw the dollar away while every attempt to attack it. Yesterday, after the figure was tested, the dollar decreased to 0.8824. Pressure on it remains and it is running a risk to be below 0.8800. Loss of the support will open the way to the 87th figure, a rise and an ability to consolidate above 0.8800 will return optimism to the dollar bulls.

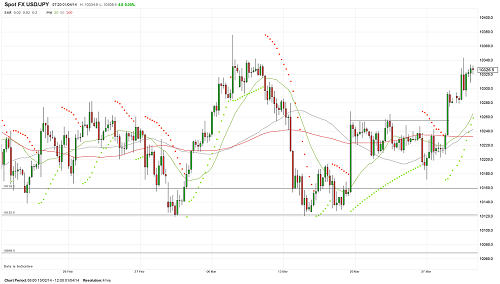

The USDJPY Can Test 103.76

The USDJPY found support around the 102.79 level, from which it rose to 103.43. Dips continue to attract interest to sales that keeps risks to break resistance at 103.76. In this case the bulls can test the 104.00 level. If it is overcome, it will open the way to 102.00. Falling below 102.79 will weaken a bearish impulse and lead to testing 102.00. Ahead of employment data in the U.S. are published, the pair can move higher, but it is hardly possible to expect strong directed movements.