The EURUSD Tests Resistance 1.3523

After the week of active declining the EURUSD has managed to be in consolidation. Yesterday, the pair was sluggish and corrected above 35th figure, it faced with compulsive resistance at the 1.3523 level. Consolidation above support 1.3475 gives the bears a hope for better pair’s resumption towards 36th figure, but the loss of this support will break their hope. The pair may trade in a range before the ECB announce the decision. The lack of demand above 1.3523 appears to be negative for the euro.

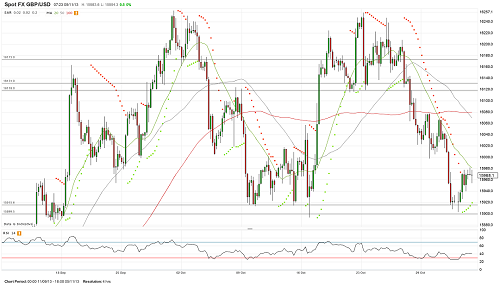

The GBPUSD Recovers to 1.5981

Yesterday, the GBPUSD found support around 59th figure again, and it consolidated above 1.5915.

Within the confines of resumption the pair’s rate increased to the 1.5981 level. The pressure on the pair is preserved, the RSI has managed to be out of the oversold area. Its rate may return to support.

The growth to 1.6000-1.6080 should be used for opening of shorts, but if the growth is above the latter level, the bearish impulse will be offset. The pound may trade in a range before the BoE committee will announce the results.

The USDCHF Trades Near 91th Figure

The USDCHF has managed to be in consolidation after the week of sustainable growth. The Swiss franc growth in cross with the single currency contributed to the declining of the pair USDCHF below 91th figure. In general, the pair was traded near 0.91 the whole day, it was unable to develop the movement in one or another direction. However, the dollar is in demand, this situation allows the dollar to hold above the 20-day MA. It may grow to 92nd figure, but the dropping of the EURCHF may restrain this growth.

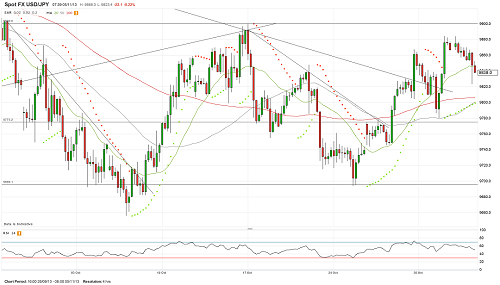

The USDJPY Dropping

The USDJPY was traded in a narrow range during the whole day, it was limited by the levels 98.84 and 98.53. During the Asian trading session the dollar dropped below the latter level and tested the 98.23 mark, and it retreated to 98.52. The pressure on the dollar remains, and it may drop to support 97.75 again. The situation in the pair is the same: the outcome from a range is required for movement development towards one or another direction. Inability to increase above 98.85 appears to be negative for the bulls.