The U.S. Dollar Stuck Ahead of U.S. Labour Market Data

The EURUSD Trading Below 1.3700

The first trading day of the new week was tedious and boring. The EURUSD exercised a kind of fluctuations within 38 points, between 1.3650 and 1.3688. Apparently, speculators are not in a hurry to do anything before the release of today’s data on the U.S. labor market. Thus, the situation remains the same: the bulls need to break through this year`s high of 1.3710 , but the pair may need some correction below to attack this level again. So do not exclude a decline towards the 36th figure. It is better to stay out of the market prior to nonfarm payrolls will be released.

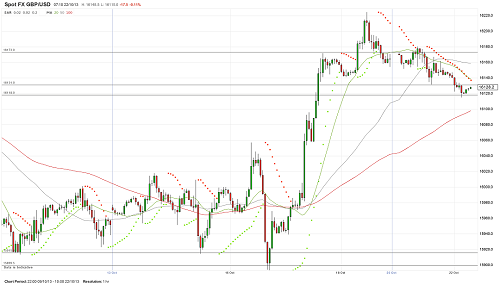

The GBPUSD Retreats to Support 1.6118

The GBPUSD was not very active. The pair slowly crawled until it reached to the support level around 1.6118. As might be expected, the pair has entered a phase of consolidation, which can end today, after U.S. nonfarm payrolls release. In general, a positive sentiment, as well as the likelihood of a return to the current maximum of 1.6259 remain. Nonfarms often provoke surge in volatility. So, it is better not to hasten with the opening of new positions before the release of statistics on the U.S. labor market.

The USDCHF Stays Above the 90th Figure

So far the U.S. dollar in pair with the Swiss franc have failed to stay above the 90th figure and the dollar cannot rise above 0.9044. The pressure on the dollar remains, although it may be corrected to 0.9100-0.9177 before returning to the current low of 0.8967. It is unlikely that the USDCHF may be corrected above 0.9177-0.9220. So approaching these levels should be considered as an opportunity to sell the pair.

The USDJPY Rises to 98.36

The USDJPY was traded with a positive sentiment during the entire trading day and the Asian trading session and rose 97.84 to 98.36. The overall picture remains unchanged: the pair continues to be traded within a range, the output of which will indicate its direction. The data on employment in the U.S. non-agricultural sector tend to have a strong impact on the USDJPY dynamics, so they are out of the market.