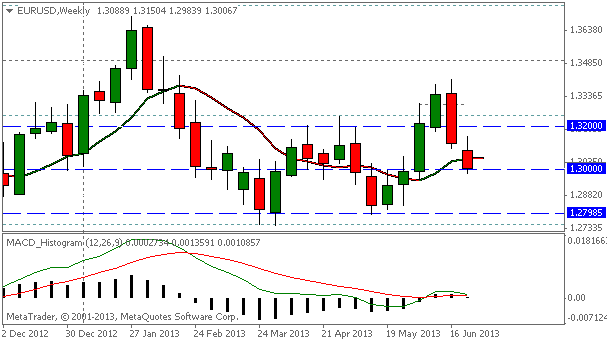

Forex Outlook: US Dollar gained last week vs Major Currencies, Non-Farm Payrolls Report Highlights this week’s trading

The US dollar advanced versus all the major currencies last week and rose higher against most of them for a second straight week as market traders continued to position themselves for the potential unwinding of the US Federal reserves quantitative easing program. This week has some very big fundamental events to watch for with the highlight being the US Non-Farm Payrolls Employment data on Friday.

There are also interest rate decisions out of Australia, the United Kingdom and the Eurozone to look out for as well as some manufacturing data out of the US and China and other 2nd tier releases. See more currency pair comments and economic event highlights below.

Read more Currency Pair Commentary Here….

Large Currency Speculators trimmed US Dollar bullish bets last week for 4th straight week

The weekly Commitments of Traders (COT) report, released on Friday by the Commodity Futures Trading Commission (CFTC), showed that large futures traders and speculators decreased their total bullish bets of the US dollar last week for a fourth consecutive week.

Non-commercial large futures traders, including hedge funds and large International Monetary Market speculators, trimmed their overall US dollar long positions to a total of $13.28 billion as of Tuesday June 25th. This was a decline from the total long position of $14.55 Billion registered on June 18th, according to position calculations by Reuters that derives this total by the amount of US dollar positions against the combined positions of euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

USD net long positions are at their lowest level since February 19th when bullish positions equaled $1.481 billion, according to Reuters data calculations.

See full COT Report & Charts here…

Highlights of Fundamental Economic Events Next Week

Sunday, June 30

China — leading index

Japan — Tankan manufacturing data

Australia — manufacturing index

Monday, July 1

China — manufacturing PMI

euro zone — consumer price index

United States — ISM manufacturing data

euro zone — purchasing managers index

United Kingdom — purchasing managers index

Tuesday, July 2

Australia — interest rate decision

euro zone — producer price index

United States — factory orders data

Wednesday, July 3

China — non-manufacturing PMI

Australia — retail sales data

Australia — trade balance

United States — ADP employment data

euro zone — retail sales

United States — weekly jobless claims

United States — trade balance

United States — ISM non-manufacturing

Thursday, July 4 – *American Holiday

United Kingdom — BOE interest rate decision

euro zone — ECB interest rate decision

Friday, July 5

Japan — leading index

Switzerland — consumer price index

United States — non-farm payroll report

Canada — employment change report

Canada — Ivey purchasing managers index