By CountingPips.com

AUD/JPY off multi-year highs of mid-April

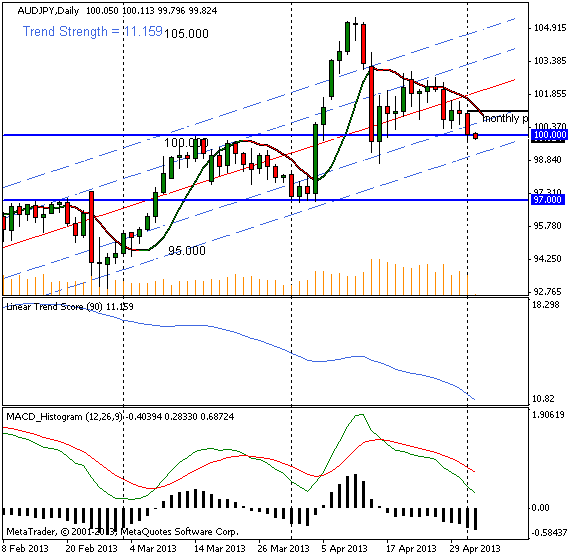

The Australian dollar declined today against the Japanese yen in forex trading for a second consecutive day and trades at a major level crossroads. The AUD/JPY currency pair closed the day right at the major level of 100 yen per aussie after opening the day just over the 101 yen per aussie level.

The Aussie had reached a multiyear high versus the yen in April after the Bank of Japan stated their monetary easing policy would be thoroughly implemented, bringing the yen crashing down against other currencies that soared to new highs. The AUD/JPY touched a high of 105.40 on April 11th but has steadily faltered from there to the current 100 exchange level.

Will falling under the 100 level end the uptrend for the AUDJPY?

The 100 level has previously been a major support and resistance level in trading the AUD/JPY pair as this threshold provided support in April and resistance in March. If prices can keep above this level, further bullish momentum would be possible into 101.50 with 102.50/65 lurking higher on the resistance ladder. Downside action would present the April 16th low near 98.70 as well as 98.50 and then another major previous support and resistance level at 97.00.

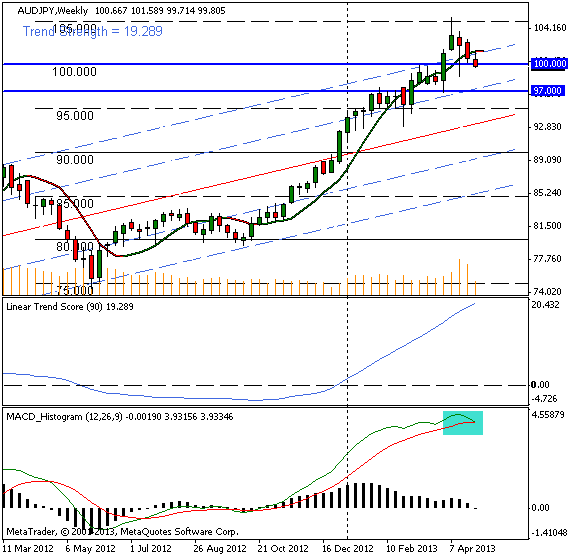

AUD/JPY Weekly Chart: MACD turning over

On the higher time frame, the MACD indicator (bottom window – green box highlighted) shows a crossover taking place on the weekly horizon that has held intact since the middle of October 2012. Of course, like with all indicators, this does not guarantee a downtrend is imminent as we could always reverse or trade sideways for a while but it does give some food for thought.

AUD/JPY Changes & Ranges: Past 6 Weeks

| week date | pct change | true range |

| 2013.03.24 | -1.27 | 1.849 |

| 2013.03.31 | +4.49 | 5.457 |

| 2013.04.07 | -0.34 | 3.747 |

| 2013.04.14 | +0.99 | 4.288 |

| 2013.04.21 | -2.17 | 2.542 |

| *2013.04.28 | -0.86 | 1.925 |

* so far this week at time of writing

Pivots and Trends Data:

Weekly Pivot Point: 101.24

Monthly Pivot Point: 101.03

Linear Regression Indicator Trend / Strength Data:

30-day current trend is BULLISH / Trend strength of 312.0 pips

60-day current trend is BULLISH / Trend strength of 756.1 pips

90-day current trend is BULLISH / Trend strength of 879.5 pips

180-day current trend is BULLISH / Trend strength of 2384.9 pips

365-day current trend is BULLISH / Trend strength of 1995.2 pips

Article by CountingPips Blog, News & Forex Analysis