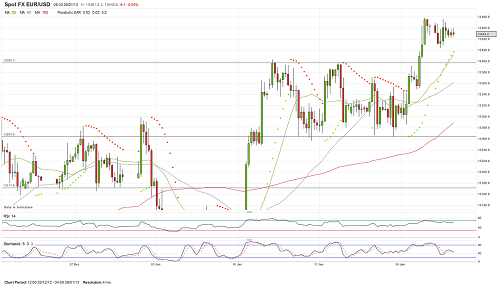

EURUSD

After its increase to the current high of 1.3479, the EUR/USD entered the consolidation phase. Drops down to 1.3425 continue to attract customers, and the growth is limited by the resistance near the level of 1.3480. Apparently, Bulls are going to break through the 35th figure, but it is possible that it will happen after a deeper decrease. The 34th figure will now act as the support and in theory, it should limit all the bears’ attempts to seize the initiative. Even if this level has been broken-through, the bulls have no reason to worry about it until the pair holds above 1.3300. Thus, the level of 1.3400 looks attractive for purchases, and the bulls’ ability to hold above will be the evidence for maintaining the growth potential towards the 35th figure.

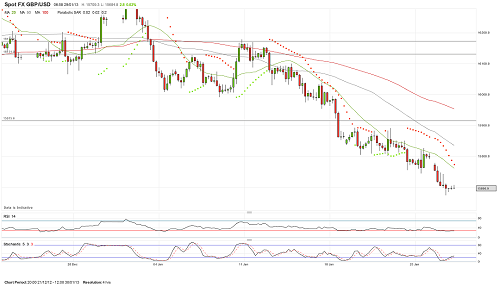

GBPUSD

As for the overall picture in the GBP/USD pair, it is unlikely that Bulls will see something good. The pound was loosing its positions through the whole day yesterday, then it overcame the support at 1.5745 and dropped to 1.5674. The increasing attempts are still unsuccessful and they only attract a fresh wave of sellers. However the pair’s oversold condition increases, as well as the overbought condition in the EUR/GBP pair, and every decrease increases the risk of the upward correction. The rise to 1.5900 — 1.6000 can be used to open short positions.

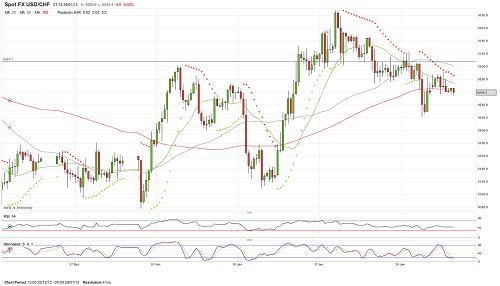

USDCHF

The USD/CHF returned to the level of 0.9288, which acted as the resistance, and it constrains the attempts to increase. The dollar’s drops face the bids near 0.9255. Thus, the pair was trading within the narrow range, limited by levels. High volatility in the EUR/CHF cross-rate complicates forecasting of USD/CHF pair’s dynamics, thus at this stage, it is still better to refrain from trading this pair.

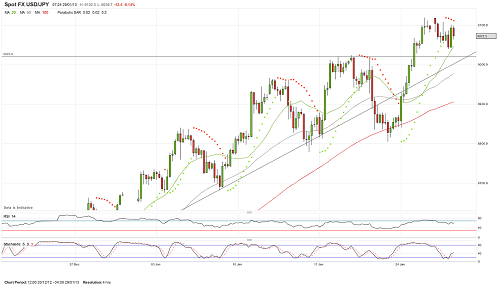

USDJPY

The yen has been decreasing, thus the dollar being in pair with it is not able to overcome the current high of 91.25, but its attempts to correct below are limited by the support at 90.40. If Bears manage to pass the support, the consolidation phase may turn into the correction one, and in this case we can expect the depreciation to 90.00 — 89.35. The Japanese currency’s state of being oversold may cause a deeper correction to 88.00 — 87.00, where customers expect the Dollar/Yen pair’s activation.