U.S. Dollar managed to regain part of lost positions

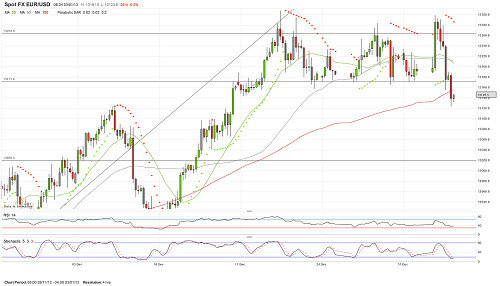

EURUSD

Despite the festive mood with which EUR/USD pair made an attempt to rise to 33rd figure, but the pair failed after all. After testing 1.3299 level, the pair turned and was gradually decreasing, it fell to support near 1.3170 level. Today during the Asian session this level has been overcome, and rate of the pair fell to 1.3124, it found itself below 100-day moving average on the 4-hour chart. Thus, the pair formed out of the emerged diapason, but in a downward direction. Nevertheless passing of supports does not mean a reversal of the current trend, because the correction down to 1.3020 is quite normal and does not cause feelings of acute anxiety among bulls on the single currency. But loosing of this level will make nervous a lot of traders and then the pair may fall to 1.2876 level, which can be seen as the last bastion of the bulls on euro. 1.3170 level will now act as a resistance and, in theory, should attempt to limit the growth of euro/dollar pair.

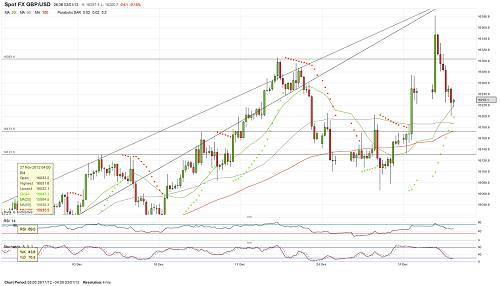

GBPUSD

In the first trading night after New Year’s GBP/USD has jumped to 1.6382, breaking, thus, an important resistance at 1.6303. This was to be a contributing factor for further growth, if, of course, the pair could hold above 63rd figure. But this never happened, because pound lost all positions it gained at night, it crossed in the opposite direction 63rd figure and fell to 1.6201. As long as the GBP/USD is trading above 1.6120-1.6080, this downward movement should be viewed as corrective. The nearest support is around 1.6200-1.6170. For resumption of upward trend the pair needs to overcome resistance at 1.6303 again.

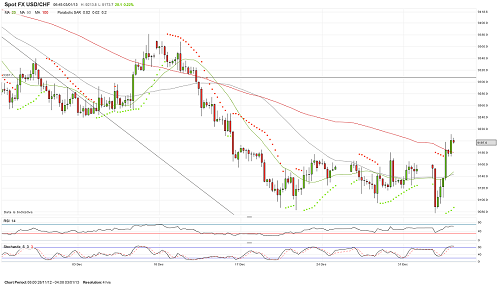

USDCHF

U.S. dollar decided to show its nature in pair with Swiss franc too. Falling to 0.9078 attracted buyers, as a result the pair bounced back from an important support and increased to 0.9211. Thus, the dollar could rise and is now holding above the 100-day moving average through the 0.9182 level. Now, pair bulls need to keep a positive attitude and not let the dollar to fall below this level. In this case, an American will develop upward trend towards 0.9240-0.9300. While any strengthening of it should be viewed as corrective, so approaching to the 93rd figure one may consider opening of short positions on the dollar.

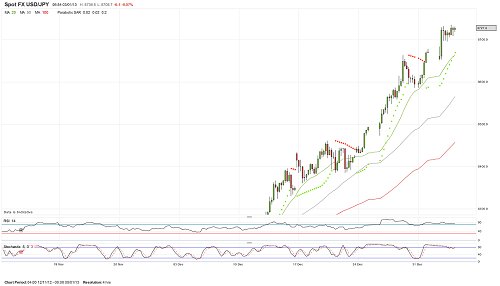

USDJPY

After rising to another maximum at 87.35 the next move in dollar/yen pair was stopped for now and all yesterday the pair was trading within the limits of this level and support at 86.96. The mood is still positive, as evidenced by the lack of any substantial rebounds, and the pair seem to be capable of continuing growth until the 88th figure. But consolidation at current levels did not lead to getting out of overbought zone and it was not supposed to, so risks of a downward correction are preserved. However, in terms of the clear negativity against the Japanese currency, to open short positions on the pair one should not be groping the top, but wait for signs of its formation.