Article by Investment U

I’ll never forget my first visit as a teenager to the commodity trading pit of Chicago’s Mercantile Exchange (CME). The swirling bright-colored jackets, the shouting and rapid hand signals (looked like arm wrestling to me) was captivating and reminded me of past family gatherings.

It was also the polar opposite of my later visit to the currency trading floor of JP Morgan at 1 Wall Street – row after row of white shirts hunched over computer screens and dry IMF statistics.

Commodities sure looked like more fun to me.

My image of commodity markets hasn’t changed all that much since. It’s a volatile and wild ride where even a tiny bit of new information affecting supply or demand can send prices spinning. Weather, transportation costs, economic forecasts, currency movements and many other factors go into how prices change minute to minute.

I approach commodities trading cautiously since expert traders focused all day on one commodity, such as wheat, get it wrong as often as they get it right.

Still, I have to admit, the idea of making or losing a pile of money in a very short time gets my blood pumping.

So how should you approach commodities and what should you do right now?

The Game Has Changed

Even a decade ago, most individual investors didn’t think of investing in commodities except through companies like Alcoa (NYSE: AA) for aluminum, Freeport-McMoRan (NYSE: FCX) for copper and Comstock Resources (NYSE: CRK) for natural gas.

But the game has changed.

Online brokerage accounts and the arrival of exchange-traded funds (ETFs) and notes (ETNs) give individual investors the chance to get into the game with just the click of a mouse.

The choices are staggering:

- Coffee – iPath Coffee (NYSE: JO)

- Sugar – iPath Sugar ETN (NYSE: SGG)

- Lead – iPath Lead ETN (NYSE: LD)

- Nickel – iPath Nickel ETN (NYSE: JJN)

- Corn – Teucrium Corn Fund (NYSE: CORN)

- Grains – iPath Grains ETN (NYSE: JJG)

- Cotton – iPath Cotton ETN (NYSE: BAL)

- Tin – iPath Tin ETN (NYSE: JJT)

- Aluminum – iPath Aluminum ETN (NYSE: JJU)

- Silver – iShares Silver Trust (NYSE: SLV)

- Oil – iPath S&P GSCI Crude Oil Total Return (NYSE: OIL)

- Palladium – ETFS Physical Palladium Shares (NYSE: PALL)

- Natural gas – iPath Natural Gas ETN (NYSE: GAZ)

- Timber – Claymore Beacon Global Timber Index (NYSE: CUT)

- Livestock – iPath Livestock ETN (NYSE: COW)

The “Core-Explore” Commodity Strategy

Given the complexity and volatility involved in commodities investing, you must have an established strategy if you plan on having any success. So here’s an easy one:

Rule No. 1: Having a small allocation in a broad basket of commodities in your core portfolio makes a lot of sense.

This should make your overall portfolio less volatile and help preserve capital since commodities don’t usually move lockstep with stocks. In addition, raw materials provide you with a natural inflation hedge.

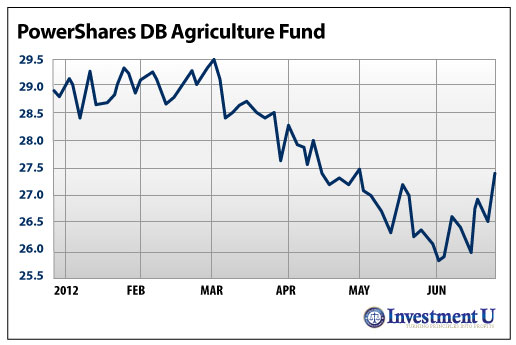

A great conservative play right now would be the PowerShares DB Agricultural ETF (NYSE: DBA). These agricultural commodities are down this year and tend to be less volatile than precious or industrial metals. In addition, the long-term bull story of a world population growing at a rate of 200,000 a day plus rising incomes driving higher food prices is very convincing.

To meet this growing demand, the World Bank estimates that farms worldwide will have to produce more food in the next 50 years than it did in the previous 10,000 years.

Here are the commodity weightings in this basket as of June 26:

- Soybean: 16.11%

- Corn: 14.17%

- Live Cattle: 12.39%

- Sugar: 10.97%

- Cocoa: 9.75%

- Coffee: 8.48%

- Lean Hogs: 8.25%

- Wheat: 6.71%

- Wheat (Kansas Wheat): 6.53%

- Cattle (Feeder Cattle): 4.45%

- Cotton: 2.19%

Rule No. 2: For your trading portfolio, explore for commodities that have pulled back sharply.

So far in 2012, the perception of a weakening world economy has driven many commodities lower. Industrial metals do well when the world economy is thriving. The concern that the world economy is slowing has hit them pretty hard in recent months.

This is exactly why you should be getting interested in these industrial metals. You want to get in when markets have pulled back and, even better, when they’re beginning to trend up. Keep an eye on the iPath Industrial Metals ETF (NYSE: JJM). The lower entry price gives you some downside protection, but remember to always have a sell stop in place in case markets move against you.

Now get out there and add some commodities to your global portfolio today.

Good Investing,

Carl Delfeld

Article by Investment U