Article by Investment U

Someone in my office recently called me a finance geek. I was actually a little bit insulted. But then, as I started to write this column, I realized she spoke the truth.

You see, I enjoy looking over financial statements and seeing how the numbers interact with each other. I like to look for clues about what the future might hold.

And if there’s a surprise in earnings, I go back to previous quarters to figure out if I could have detected it earlier. It’s kind of like a big puzzle with lots of interconnecting parts that, once you understand them, give you a clear picture of the company and its prospects.

Today, I’m going to use one of the metrics we’ve discussed before to see if we could have predicted an earnings warning by Qualcomm (Nasdaq: QCOM).

That metric is inventory turnover – an often-overlooked measure that can tell you a lot about a company’s operations.

Inventory turnover is essentially how many times a company turns over its inventory in a quarter or a year, or how many times it sells through the products on it shelves.

I decided to look at Qualcomm’s inventory turnover because, although the company reported stellar quarterly results a number of weeks ago, it issued an earnings warning because it couldn’t keep up with demand due to a shortage from one of its vendors. Therefore, I assumed inventory turnover should have spiked.

Let’s see if it did…

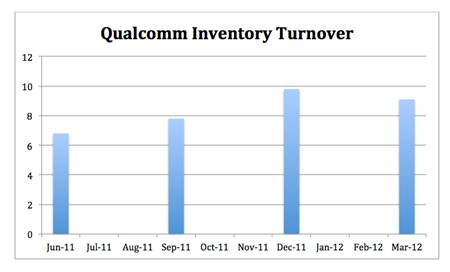

Over the last four quarters, Qualcomm’s inventory turnover climbed from 6.8 to 9.7. In other words, a year ago it was selling through its inventory 6.8 times per year. In December, it spiked to over nine, and in the most recent quarter the company was turning over its inventory 9.7 times per year.

In fact, the inventory turnover is higher than it’s been since 2006.

Now, an earnings warning isn’t a positive, but not being able to keep up with demand is a good problem to have. I expect that Qualcomm’s earnings will be excellent once it gets its distribution issues straightened out.

Earnings per share popped in December and March, as well. Qualcomm earned $0.83 per share in December versus $0.61 in the previous quarter. More importantly, the higher inventory turnover may signify what’s going to happen in the next quarter.

In the September quarter, inventory turnover began to rise and we saw a pop in earnings in December. December’s inventory turnover rose sharply, and earnings in March were also strong.

With another quarter of high inventory turnover in March, I would expect a stronger June quarter in terms of earnings than Qualcomm is letting on.

Keep in mind – most companies give very conservative guidance. But even if June isn’t especially strong, I’d expect earnings to pick back up in the September quarter, as it’s clear that Qualcomm is moving product off its shelves at a rapid pace.

Like I always say, earnings can be and are manipulated to tell the story that management wants to tell.

Looking at inventory turnover can give you a strong idea as to how well a company is operating and what the future may be bring.

Good Investing,

Marc Lichtenfeld

Article by Investment U