Article by Investment U

Economist and best-selling author Mark Skousen doesn't think much of Keynes' economic views, but you can't dispute his track record as an investor.

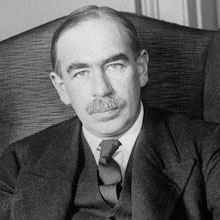

“When the facts change, I change my mind. What do you do, sir?”

– John Maynard Keynes

As longtime subscribers and readers of my books know, I’m no fan of John Maynard Keynes as an academic economist. His legacy is the welfare state, trillion-dollar unfunded liabilities and uncontrolled deficit spending. (See chapter 13, The Keynes Mutiny: Capitalism Faces Its Greatest Challenge of my book The Making of Modern Economics.)

But when it comes to Keynes the investor, it’s a different story, and the man deserves credit for being an outstanding stock picker during a period of war, uncertainty and depression…

According to a study published last month by two U.K. economists, David Chambers and Elroy Dimson, Keynes was a “star investor” who managed to gain 8% annualized returns from 1924 until he died at the age of 63 in 1946. And this was at a time when there was very little inflation and, in fact, much deflation.

What can we learn from this Cambridge wizard of finance? Here are three key lessons:

The Bottom-Up Approach

First, he became a much better investor by switching from being a top-down strategic macro manager and a technical momentum player to being a bottom-up stock picker and fundamentally contrarian value investor.

In the Roaring Twenties, he boasted of his ability to predict the ups and downs of the credit cycle, and was a bullish advocate of a “new era” of permanent prosperity. He once famously told a Swiss banker, “There will be no more crashes in our lifetime!” Two years later, in October 1929, the stock market crashed and Keynes’s portfolio of stocks and commodities was “wiped out.” Keynes recognized that he had no ability to pick tops of markets. (See my chapter, Keynes as a Speculator in Dissent on Keynes.)

After being chastened, he wisely changed his investment philosophy to become a contrarian and fundamentalist. “My central principle of investment is to go contrary to general opinion,” and to buy stocks that are “cheap” relative to “intrinsic” value and to hold these investments through “thick and thin.” He aggressively bought bank, utility and gold mining stocks in the 1930s, using leverage when appropriate. He was better at buying value near the bottom of markets than selling out at the top. He was, in short, a one-armed contrarian.

Investing in High-Yields

Second, Keynes switched out of fixed-income bonds and into on high-dividend paying value stocks rather than growth stocks. He bought utilities, banks and gold mining stocks that paid on average 6.1% annualized yields. He figured dividend-paying shares offered a much better deal with more upside potential than fixed income bonds.

Keynes’ approach was revolutionary at a time when banks and universities invested 90% or more of their portfolios in property and government bonds. He did almost the reverse in the discretionary accounts he managed at King’s College and insurance companies.

Even though he was anti-gold standard, he had the sense to recognize a good deal when Roosevelt went off the gold standard and raised the price of gold to $35 an ounce. Starting in 1934, he bought heavily gold stocks and profited handsomely.

Stick With What You Know

Third, Keynes avoided extreme diversification, but carefully bought a handful of publicly traded companies that he knew well. He was what we call a fundamental analyst who invested in a few companies where he knew management and the true value of the firms. They were primarily small- and mid-cap stocks. Some say he had insider information, at a time when insider information was legal. (Insider trading was not outlawed in the United Kingdom until 1980.)

I recommend you do the same today. Buy a few well-managed companies that pay rising dividends and buy them cheaply. To find out two energy plays that I’ve been recommending lately, check out today’s edition of Investment U Plus.

Good Investing, AEIOU,

Mark Skousen

Special TV appearance TONIGHT: I’ll be appearing tonight (Friday, April 27), on the PBS’ Nightly Business Report, where I will be interviewed by host Tom Hudson about the market outlook and my favorite stocks.

My last three picks (made on November 4, 2011) are up an average 20%, including dividends. (The market average has been 12% during this time). I’ll have some new recommendations tonight.

Check local listings; the Nightly Business Report usually begins at 6:30 PM ET.

Steve Forbes did what in Las Vegas?!

Steve Forbes speaks at hundreds of conferences every year. His normal routine is to come in, give a speech, sign a few books and leave. But he makes one exception: FreedomFest in Las Vegas. There he attends all 3 days! So does John Mackey, CEO of Whole Foods Market: “I wouldn’t miss it for the world, especially the debates.” And Senator Rand Paul liked it so much last year that he is returning this year with his wife – and staying all 3 days.

Alexander Green says this: “Next to my wedding day and the birth of my children, FreedomFest was the highlight of my life!”

Why would speakers say such things? What’s it all about? Everything! For 3 glorious days, the “best and the brightest” get together to discuss and debate politics, philosophy, history, geo-politics, science and technology, art and literature, healthy living, music, dance, religion, you name it. The Washington Post calls it “the greatest libertarian show on earth.” It even includes a 3-day investment conference, co-sponsored by The Oxford Club, with your favorite experts – Alex Green, Keith Fitz-Gerald, Marc Lichtenfeld, Karim Rahemtulla, Steve McDonald, Peter Schiff and many others.

As one attendee told me: “You don’t know me but my name is Tony Tardino from Phoenix, Arizona. I just want you to know that FreedomFest in Vegas is by far THE best conference I’ve ever attended, and I’ve attended all of them.”

To learn more, go to http://freedomfest.com.

Article by Investment U