By CountingPips.com

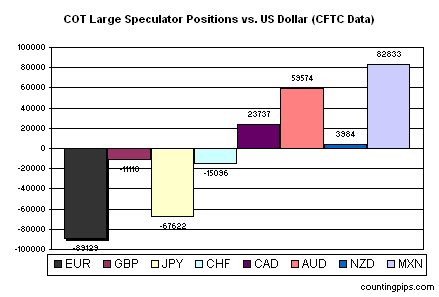

The latest Commitments of Traders (COT) report, released on Friday by the Commodity Futures Trading Commission (CFTC), showed that large futures speculators raised their overall US dollar long positions last week while Japanese yen positions decreased sharply to their lowest level since 2007.

Non-commercial futures traders, including hedge funds and large speculators, increased their total US dollar long positions to $19.58 billion on March 27th from a total long position of $11.67 billion on March 20th, according to the CFTC COT data and calculations by Reuters which calculates the dollar positions against the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

Individual Currencies:

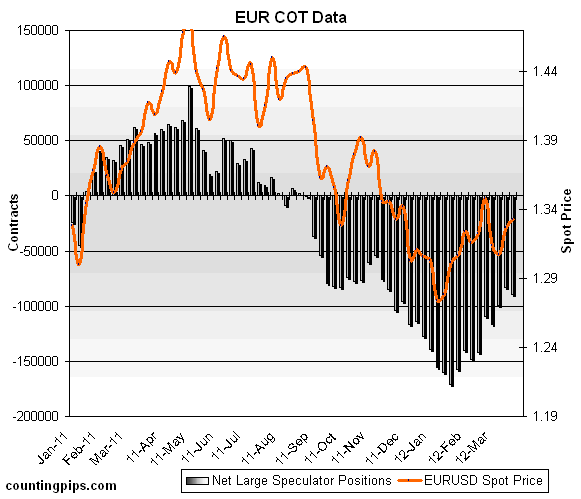

EuroFX: Currency speculators decreased their sentiment for the euro currency following two consecutive weeks of improvements in the euro positions. Euro net short positions or bets against the currency rose to 89,129 contracts on March 27th from the previous week’s total of 82,954 net short contracts. Euro contracts on March 20th were at their best position since November 22nd when short positions totaled 85,068 contracts.

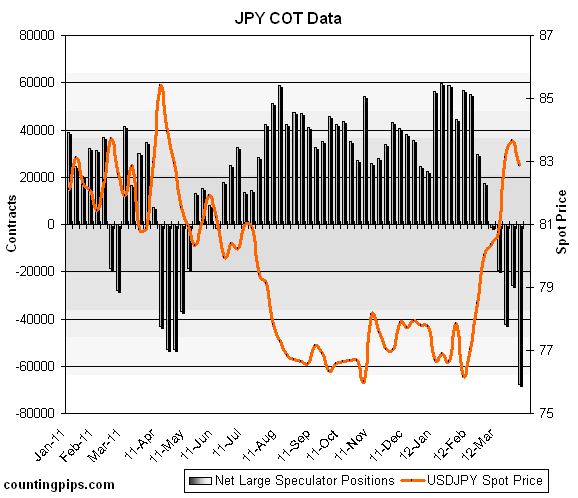

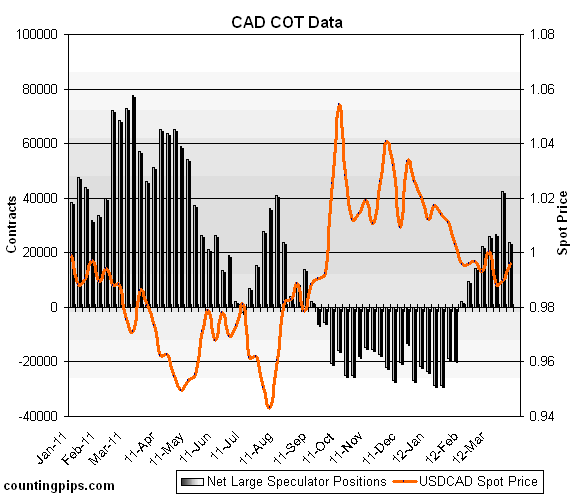

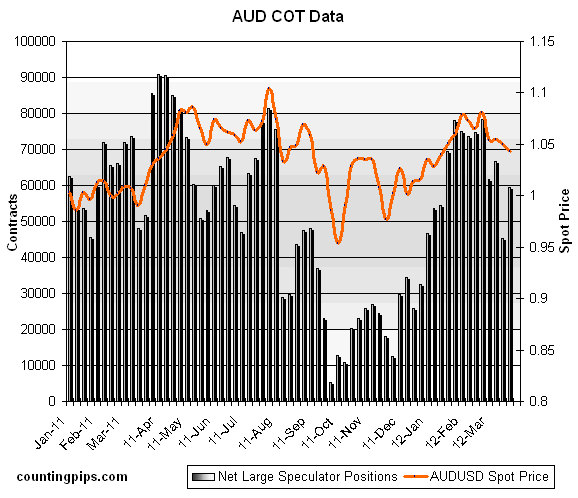

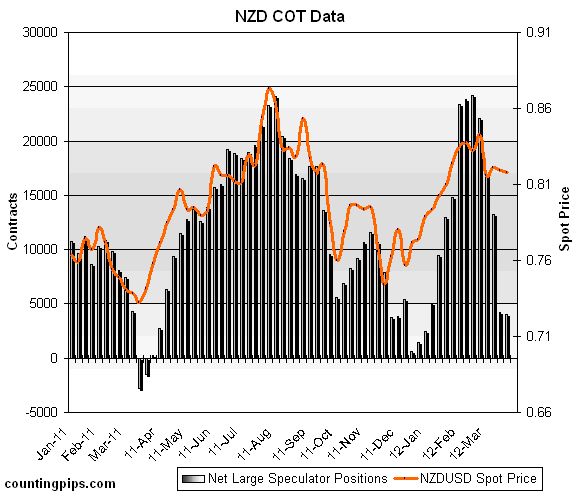

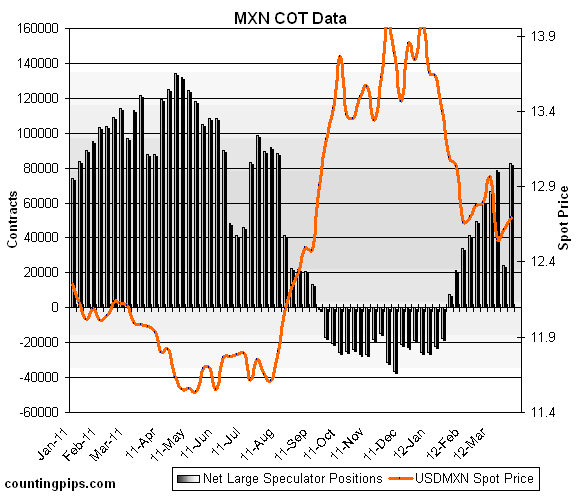

The COT report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions as of the previous Tuesday. It can be a useful tool for traders to gauge investor sentiment and to look for potential changes in the direction of a currency or commodity. Each currency contract is a quote for that currency directly against the U.S. dollar, where as a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and net long position expect that currency to rise versus the dollar. The graphs overlay the forex spot closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.

GBP: British pound sterling positions saw improvement last week for a second consecutive week and brought pound positions to their best placement since August. British pound positions saw a total of 11,110 net short positions on March 27th following a total of 15,852 net short positions registered on March 20th. British pound sterling positions continue to be on the short side but are at their best level since August 30th when positions equaled 444 long contracts.

JPY: The downtrend continued last week in the Japanese yen speculative contracts as positions fell to their lowest level since 2007. Yen positions dropped sharply to a total of 67,622 net short contracts reported on March 27th following a total of 25,821 net short contracts on March 20th.

CHF: Swiss franc speculator positions declined last week after improving the two previous weeks. Speculator positions for the Swiss currency futures registered a total of 15,096 net short contracts on March 27th following a total of 11,191 net short contracts as of March 20th.

CAD: Canadian dollar positions declined after previously trending higher for seven consecutive weeks and rising to their highest level since May 2011. Canadian dollar positions fell to a total of 23,737 net long contracts as of March 27th following a total of 42,315 long contracts that were reported for March 20th. CAD positions on March 20th were at their highest position since May 3rd 2011 when long contracts equaled 54,041.

AUD: The Australian dollar long positions rebounded after falling sharply the previous week. Australian dollar positions increased to a total net amount of 59,574 long contracts on March 27th after dropping to 45,191 net long contracts reported as of March 20th. The AUD speculative positions on March 20th had declined to their lowest level since long positions totaled 32,637 on December 27th 2011 before turning around last week.

NZD: New Zealand dollar futures speculator positions edged lower and decreased for a fifth consecutive week after they had risen for nine straight weeks through February 21st. NZD contracts dropped to a total of 3,984 net long contracts as of March 27th following a total of 4,210 net long contracts on March 20th. This is the lowest level for New Zealand dollar contracts since January 3rd when contracts equaled 2,436 net long positions.

MXN: Mexican peso speculative contracts rebounded rather sharply following a sharp dip the previous week. Peso long positions increased to a total of 82,833 net long speculative positions as of March 27th following a total of 24,329 long contracts that were reported for March 20th.

COT Currency Data Summary as of March 27, 2012

Large Speculators Net Positions vs. the US Dollar

EUR -89129

GBP -11110

JPY -67622

CHF -15096

CAD +23737

AUD +59574

NZD +3984

MXN +82833

Other COT Trading Resources:

Trading Forex Using the COT Report