US Dollar mixed last week in Forex Trading

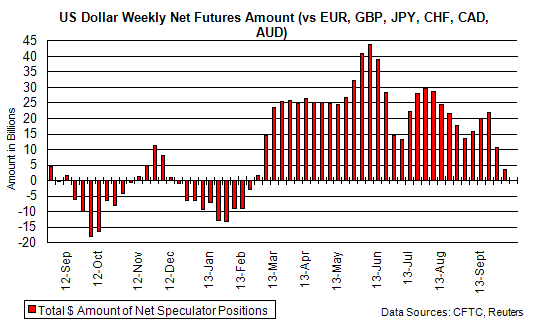

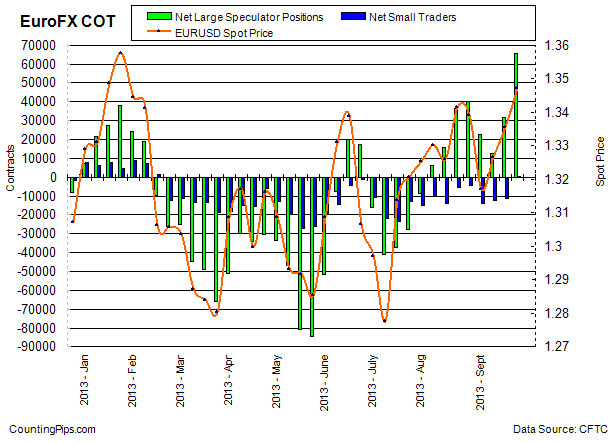

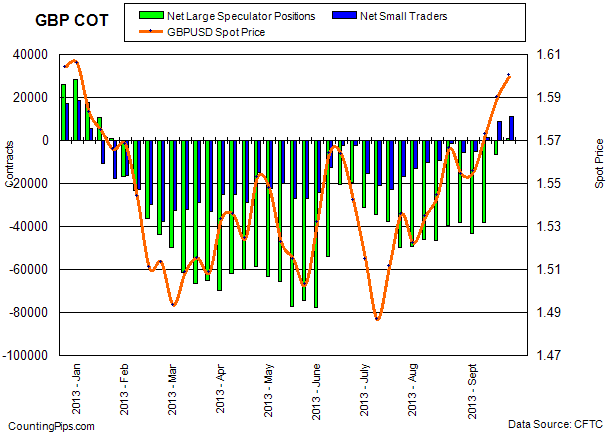

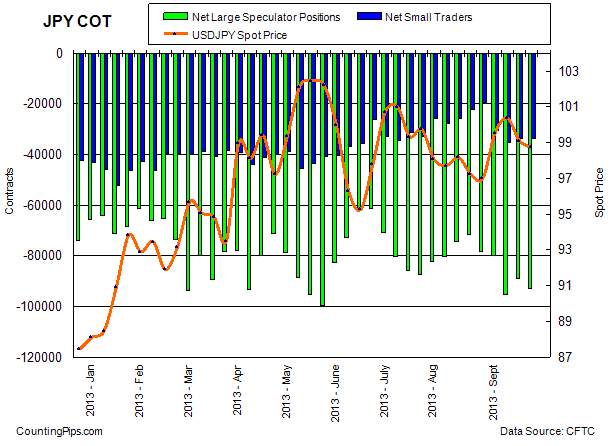

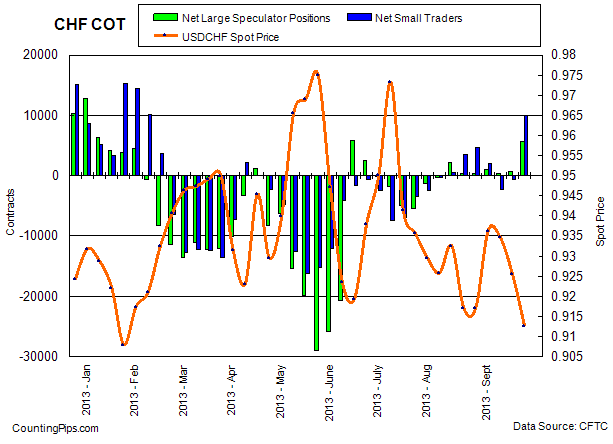

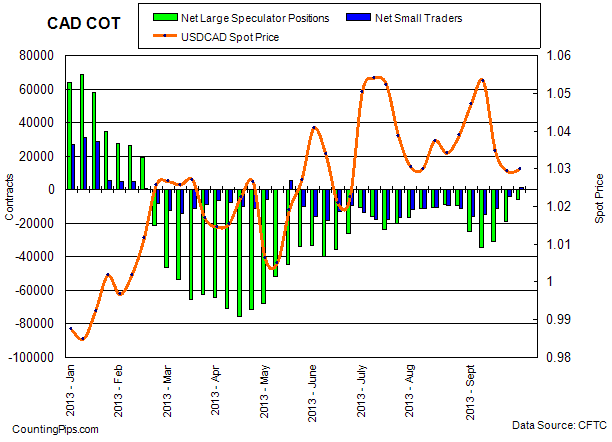

The US dollar was mixed against the other major currencies last week after the US currency had fallen for multiple weeks against most of majors. Overall for the week, the USD advanced against the euro, the New Zealand dollar and the Australian dollar while falling to the British pound sterling, Japanese yen and the Swiss franc. The USD was virtually unchanged against the Canadian loonie dollar for the week.

Non-Farm Payrolls & Interest Rate Decisions on tap this week

This upcoming week has a number of major economic news on the schedule that are worth watching for.

- Monday has the Eurozone consumer price index data due out as well as Canada’s GDP report for July.

- Tuesday’s major economic releases are the Chinese manufacturing PMI data, Australia’s interest rate decision, Germany’s unemployment change for September and the ISM manufacturing data out of the United States.

- Wednesday has the European Central Bank interest rate decision.

- Thursday will feature the United States ISM non-manufacturing index.

- Friday will have the United States non-farm payroll government employment report as well as the Bank of Japan interest rate decision and Japan’s monetary policy statement.

Please see the week’s highlighted economic events below:

This Week’s Economic Highlights:

Sunday, September 29

Japan — industrial production

Japan — retail trade

Japan — manufacturing PMI

Monday, September 30

New Zealand — nznb business confidence

Australia — securities inflation

China — manufacturing PMI

Japan’s — housing starts

euro zone — German retail sales

euro zone — consumer price index

Canada — GDP report

United States — Chicago purchasing manager

Australia — manufacturing index

Japan — jobless rate

Tuesday, October 1

China — manufacturing PMI

Australia — retail sales

Australia — interest rate decision

Switzerland — purchasing managers index

euro zone — Germany unemployment change

United Kingdom — manufacturing PMI

United States — PMI

United States — ISM manufacturing

United States — construction spending

Wednesday, October 2

Australia — new home sales

Australia — building approvals

Australia — trade balance

United Kingdom — PMI

euro zone — interest rate decision

United States — ADP employment data

Thursday, October 3

China — non-manufacturing PMI

euro zone — PMI

euro zone — retail sales

United States — weekly jobless claims

United States — ISM non-manufacturing

United States — factory orders

Friday, October 4

Japan — interest rate decision

Japan — monetary policy statement

China — services PMI

United States — nonfarm payrolls employment change

Canada — Ivey purchasing managers index

Article by CountingPips.com – Forex Trading News