Dec. 28 (Bloomberg) — Jane King summarizes the top stories this morning on the Bloomberg Business Report. (Source: Bloomberg)

London Precious Metals Catch Up with Indian Slump, China Ban, Fall to 2-Week Low

London Gold Market Report

from Adrian Ash

BullionVault

Weds 28 Dec., 07:00 EST

THE PRICE OF physical gold bullion fell again as London re-opened Wednesday after the Christmas and Boxing Day holidays, dropping to two-week lows against all major currencies in what dealers called a “very quiet session”.

London dealers returning to work caught up with a 1.4% drop for the week so far, plus news of falling industrial output in Japan, seasonally low jewelry demand in Indian – the world’s No.1 gold buying nation – and also a new edict from the People’s Bank of China, banning all non-official gold trading exchanges in the world’s No.2 gold consuming country.

Silver prices also hit a 2-week low, dropping 2.1% from London’s last session, while Asian stock markets closed Wednesday lower – tracking industrial commodities down – following a raft of weak economic data from Japan.

But European equities ticked higher as Italy successfully raised more than €10 billion in new loans.

Buyers of Rome’s new 6-month bonds demanded an average annual interest rate of 3.25%, down from 6.50% at a sale in November.

Commercial banks in the 17-nation Eurozone last night parked a record €452 billion on deposit with the European Central Bank, beating the previous day’s record of €412bn, and more than €187bn larger than before the ECB lent the banks €489bn in 3-year money at a cost of just 1% last week.

“The Rupee has gone down considerably,” says a Mumbai-based Gold Dealer quoted by the Economic Times of India, “and general feeling among consumers is that gold will fall from the current [high Rupee-price] levels.

“That’s why demand is not improving.”

The Rupee has sunk to all-time lows on the foreign exchange market in 2011, despite the strongest interest-rate hikes since the Great Depression of the mid-1930s.

The Bombay Bullion Association said Tuesday that December’s imports of gold bullion to India – which has no domestic gold mining output – will likely stand 50% below the level of Dec. 2010.

“Inflation is too high and buying is not very aggressive,” says Prithviraj Kothari, president of the BBA, adding that gold needs to fall back to 25,000 Rupees per 10 grams to “spur some buying interest” after rising more than 30% and hitting new records above Rs29,000 earlier this month.

Tuesday also saw the People’s Bank of China order the closure of all Gold Trading platforms and services outside the Shanghai Gold Exchange and Shanghai Futures Exchange, which – as it notes – are “approved by the State Council.

“Since 2001,” the PBoC said in a press release accompanying the edict, “China’s gold market has developed very rapidly…[as part of] the financial market system in which it plays an important role.

“The impact of enthusiastic investors in recent years…highlights the problem of illegal trading exchanges.”

China’s move comes seven months after the United States banned leveraged commodities and gold trading by “retail” investors outside the recognized investment exchanges such as Comex.

At the official-sector level, “The Chinese government should…further optimize its foreign-exchange portfolio and purchase gold assets when the gold price shows a favorable fluctuation,” says Zhang Jianhua, director of a research bureau affiliated with the PBOC, writing Tuesday in Beijing’s Financial News, which is also run by the central bank.

It is now almost 3 years since the PBoC last updated its official gold bullion holdings, announcing a 75% uplift from 2003 at 1054 tonnes.

That took China to No.5 in the world league table of national central-bank gold holders. As a proportion of total reserves however, China stands at No.65, holding just 1.6% of its $3.2 trillion forex hoard in physical gold bullion.

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK’s leading financial advisory for private investors, Adrian Ash is head of research at BullionVault – winner of the Queen’s Award for Enterprise Innovation, 2009 and now backed by the World Gold Council market-development and research body – where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2011

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Revealed: A Top 10 Stock for 2012 Yielding 11.1%

By Paul Tracy, GlobalDividends.com

Without a doubt, it’s our most popular piece of research. Each year we publish our annual “Top 10 Stocks” list. Put simply, these are the 10 stocks my research staff and I think have the best chance of beating the market in the coming year.

We’ve published this annual list since 2003. And over the years, literally tens of thousands of investors have read — and profited — from the advice.

We’ve published this annual list since 2003. And over the years, literally tens of thousands of investors have read — and profited — from the advice.

There’s a good reason why this research is so popular year-in and year-out.

In our inaugural edition in 2003 our top picks ideas beat the S&P by 12.0 percentage points over the course of the year. And then came 2004… 2005… 2006… 2007… 2009… and 2010 — our Top 10 Stocks trounced the overall market in those years as well.

In fact, through 2010 (2011 results haven’t been finalized yet) this annual list has returned 16.8% on average each year… compared to 7.8% for the S&P 500. And if you look at the compounded returns, we’re beating the S&P 157.1% to 55.5%. That’s more than 101 percentage points.

With this performance in mind, I wanted to share a sneak peek into our Top 10 Stocks for 2012. And as a thank you for being a Dividend Opportunities subscriber, I’ve selected one of the many high-yielders that made our list this year to share with you…

A Stake in Dozens of Oil Wells… and a Double-Digit Yield

SandRidge Mississippian Trust (NYSE: SDT) has only one mission — take in royalties and pay them out to investors.

As a royalty trust, SDT owns a stake in dozens of wells run by its parent company, SandRidge Energy (NYSE: SD). SandRidge Energy takes care of the drilling, production, marketing, and selling of the oil and gas produced (production is split roughly 50/50 between oil and gas). The royalty trust — SDT — is passive in the relationship. It doesn’t have to do a thing. In return for the initial investment when it went public, its investors get a cut of all the oil and natural gas sold from the wells.

For the Mississippian Trust, SandRidge Energy packaged a 90% interest in 37 of its oil and natural gas wells in Oklahoma. In other words, for every dollar in oil or gas pumped by these more than three dozen wells, owners of the royalty trust are now entitled to 90 cents in royalties.

But that’s just the start…

That’s because in addition to the 37 wells it owned at its inception, the trust also gets a bonus. Between its inception in December 2010 and December 2015, parent company SandRidge must drill an additional 123 wells, of which SDT will own a 50% stake.

In other words, over the next several years each unit of this trust will have a stake in an increasing number of wells. And there is a powerful incentive in place for the parent company to get those wells drilled… and increase distributions… sooner rather than later.

As is common practice, SandRidge Energy retained ownership of over 10 million of the 28 million outstanding units of SDT. But most of those (7 million units) are subordinated shares. Unlike the shares we’re investing in, those subordinated shares don’t receive dividends unless regular common unitholders get a predetermined minimum payment each quarter. If the distribution falls below that threshold, the payments to the subordinated shares will be reduced to make up the difference to the regular units.

That means these shares have a built-in buffer to ensure we see strong distributions going forward.

In the latest quarter, SDT paid a distribution of $0.82 per unit, giving a forward yield of 11.1% at today’s price.

Shares of SDT have run-up in the past few weeks, but I think the high yield still makes the shares attractive at these levels. But if you’re a more conservative investor, waiting for a pullback before buying isn’t a bad idea.

[Note: One stock has raised dividends 110% in five years… another has $8.25 per share in cash (45% of its share price)… another yields 8.0% while it has nearly doubled its net income year-over-year. These are the type of investments that make up my Top 10 Stocks for 2012 report.

To learn more about these top picks for the coming year, visit this link.]

All the best,

Paul Tracy

StreetAuthority Co-founder, Chief Investment Strategist — Top 10 Stocks

Disclosure: Paul Tracy owns shares of SDT. StreetAuthority owns shares of SDT as part of Top 10 Stock’s $100,000 “real money” portfolio. In accordance with company policies, StreetAuthority always provides readers with at least 48 hours advance notice before buying or selling any securities in any “real money” model portfolio.

Forex CT 28-12-11 Market Video Update & Outlook

Video courtesy of ForexCT – A leading Australian forex broker, liscensed by the Australian Securities & Investments Commission, offers the MetaTrader4 and PROfit Platform to retail traders. Other services include Segregated Accounts, Trading workshops, Tutorials, and Commodities trading.

Euro Hovers around 11-Month Low against USD

Source: ForexYard

Low liquidity in the marketplace kept the euro relatively unchanged in trading yesterday. With the currency currently hovering close to an 11-month low versus the US dollar, traders are waiting to see if ongoing the euro-zone debt crisis will bring it down any lower.

Economic News

USD – Dollar Takes Light Losses in Thin Trading Day

The US dollar registered mild losses against most of its main currency rivals in trading yesterday, as the lack of significant news combined with low liquidity in the marketplace resulted in an uneventful session. That being said, rumors that the Fed may consider another round of quantitative easing next year has put pressure on the greenback. While the dollar registered losses against currencies like the yen and British pound, it managed to maintain its recent gains against the euro. Investors continue to flock to the safe-haven dollar against the euro as the euro-zone debt crisis threatens to bring the EUR further down.

Turning to today, traders can look forward to another slow market session. The lack of significant economic news will likely lead to low liquidity in the marketplace as many investors are still on holiday. That being said, traders will want to watch out for irregular price movements. The low liquidity environment means that prices may jump or fall for seemingly no reason.

EUR – Euro-zone crisis continues to bring EUR down

The euro hovered close to an 11-month low versus the dollar on Thursday, as low liquidity in the marketplace resulted in a slow trading day. The euro-zone debt crisis is largely to blame for the currency’s low levels. In addition, with many investors currently on holiday until the New Year, trading has been particularly thin.

Despite the uneventful trading environment in recent day, there is still some significant euro news on the horizon. Specifically, the Italian debt auction scheduled for Thursday is likely to generate heavy market volatility. Should the Italian government struggle to sell their debt, market analysts will likely take it as a sign that the euro-zone debt crisis is worsening going into 2012.

JPY – Yen Maintains Strength in Low Liquidity Session

The yen once again proved that it was the ideal safe haven currency on Tuesday, as it registered gains against most of its main currency rivals despite a thin trading session. Rumors of another round of quantitative easing in the US next year as well as the ongoing euro-zone debt crisis helped steer customers toward the Japanese currency throughout the day.

Turning to today, a lack of significant news will likely mean that yesterday’s positive trend for the yen will continue. That being said, the low liquidity environment in the marketplace means that unexpected price movement could occur at any time. Traders will want to pay particular attention to the USD/JPY and GBP/JPY pairs, as they have seen some dramatic shifts in recent days.

Crude Oil – Oil Sees Mixed Trading Tuesday

Crude oil had a decidedly mixed day yesterday, as poor European economic news combined with worries about supplies in the Middle East brought the commodity down. Still, oil was able to eventually rally above the psychologically significant $100 a barrel level. Analysts attributed the late day spike in prices to increased demand from China. Meanwhile, demand in the US for oil has increased recently as cold weather across the country has led to more energy consumption.

Today, oil appears ready to continue with its bullish trend. Traders will want to keep their eyes on the markets though as the low liquidity environment means that unexpected price movements can occur for seemingly no reason.

Technical News

EUR/USD

The weekly chart is telling. After a break of the support line from the January and October lows the pair rose back to this line where it turned into resistance at 1.3200 as often occurs with previously broken trend lines. Weekly stochastics are oversold though the monthlies may still have room to run. 1.2670 will be an important support level as the triangle pattern from the 2008 and 2010 lows on the monthly chart is found here. Below this support there is the 2008 low of 1.2520. Resistance is located back at the 20-day moving average of 1.3215, and the December 9th high of 1.3430, which coincides with the 38% Fibonacci retracement from the October high to the December low.

GBP/USD

In a similar fashion cable has weekly stochastics which are oversold while the monthlies continue to decline. Over the course of December sterling has failed multiple times to establish a beachhead above the 1.5770 resistance. The October low of 1.5270 is the initial support though market participants will likely eye the rising trend line from 2009 which is found at 1.5110. A break of the 1.5770 resistance could spur a bout of short covering where the bears may regroup near the November 18th high of 1.5890. This level coincides with the 61% retracement of the October to December move. Only a break of the October high at 1.6165 would turn the technical sentiment from bearish to bullish.

USD/JPY

The USD/JPY is testing the downward sloping trend line from the 2007 high which comes in this week at 78.30. A break here and the USD/JPY would most likely encounter selling pressure at the October high of 79.50 and the July high of 81.50. The 100-week moving average at 83.30 is an additional level that long-term players will be watching for confirmation of a bullish technical move. That being said the long term trend remains to the downside and the pair has support at the December low of 77.15, and the November low of 76.50, before the pair’s all-time low.

USD/CHF

A monthly close above the 20-month moving average at 0.9385 would confirm USD strength. This will put in play the 2011 yearly high of 0.9780, and the December 2010 high of 1.0065. The technical level that stands out the most is 1.1140, off of the long-term downtrend line from the 2003 high. Initial support is back at 0.9065, with the potential for a deeper move back to the pivot from October at 0.8565.

The Wild Card

EUR/CAD

The EUR/CAD has breached the significant support level at 1.3400 which has served as support multiple times this year. Forex traders should note only the February low of 1.3265 stands in the way of 1.2775 from the January low.

Forex Market Analysis provided by ForexYard.

© 2006 by FxYard Ltd

Disclaimer: Trading Foreign Exchange carries a high level of risk and may not be suitable for all investors. There is a possibility that you could sustain a loss of all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with Foreign Exchange trading.

USDCHF had formed a cycle bottom at 0.9244

USDCHF had formed a cycle bottom at 0.9244 on 4-hour chart. Now the rise from 0.9244 would possibly be resumption of uptrend from 0.8569 (Oct 27 low), further rise to test 0.9546 resistance would likely be seen later today, a break above this level will confirm resumption of the uptrend. Key support is at 0.9244, only break below this level could indicate that the uptrend from 0.8569 has competed at 0.9546 already, then the following downward move could bring price back to 0.8700-0.8800 area.

What Will 2012 Bring for Global Monetary Policy?

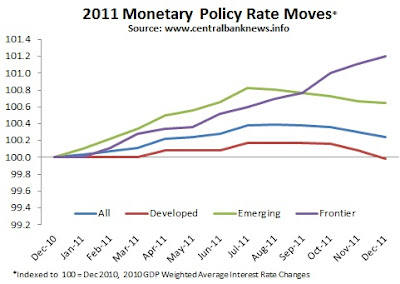

The year of 2011 was an interesting and eventful year in monetary policy. As the chart below shows, the GDP weighted average interest rate of central banks crept up in the first half of the year as commodity prices remained buoyant, economic recoveries showed signs of gaining momentum, and inflation was the key concern in emerging markets. But this was then followed by a reversal in course in the later part of the year as the specter of the European debt crisis and slowing global growth raised downside risks for growth and price stability, spurring central bankers to cut rates and otherwise ease policy settings.

So as we enter 2012, it is a worthy and formidable question to ask what will 2012 bring for global monetary policy? Will it be a one way road to lower interest rates as emerging markets like China start to loosen policy? Will there be more non-conventional policy moves like quantitative easing in the US or EU? Or will inflation and growth actually surprise to the upside and catch central bankers off guard?

At this point we turn it over to our loyal readers to come up with their own predictions for monetary policy in 2012. Please submit your top 5 predictions for monetary policy and central banking in 2012 in the comments below, or email them to us. We will post a follow up article with the most popular and controversial predictions, with due attribution and links to blogs where appropriate (or no attribution for those who wish to remain anonymous).

Permalink: http://www.centralbanknews.info/2011/12/what-will-2012-bring-for-global.html

National Bank of Belarus Increased Rate 500bps to 45.00%

The National Bank of the Republic of Belarus hiked its refinancing rate by another 500 basis points to 45.00% from 40.00% on the 12th of December. The Bank said [translated]: “Further tightening of monetary policy is warranted due to the necessity of fixing the positive trends in the balance of payments and foreign exchange market. Besides these measures will reduce inflation and devaluation expectations in the economy, which would be more limiting factor by way of the growth rate of prices. The National Bank will continue to monitor the situation in the economy and monetary developments and to take the necessary decisions on interest rate policy.”

The National Bank of the Republic of Belarus hiked its refinancing rate by another 500 basis points to 45.00% from 40.00% on the 12th of December. The Bank said [translated]: “Further tightening of monetary policy is warranted due to the necessity of fixing the positive trends in the balance of payments and foreign exchange market. Besides these measures will reduce inflation and devaluation expectations in the economy, which would be more limiting factor by way of the growth rate of prices. The National Bank will continue to monitor the situation in the economy and monetary developments and to take the necessary decisions on interest rate policy.”The latest move marks a continued string of aggressive rate increases, with the move being the third 500 basis point increase in a row. The total amount of increases since the start of the year is now 3450 basis points. Belarus reported consumer price inflation at hyperinflationary levels of 92.3% in October, up from 79.6% in September, and 36.2% in the year to June, according to the National Statistic Committee, meanwhile the government is forecasting 2011 inflation of as much as 39%.

The Bank also said that interest rates on liquidity management operations would also increase, with the overnight deposit rate rising to 30% and the overnight credit rate rising to 70%. The USD-Belarussian ruble (BYR) exchange rate has doubled on the black market, rising to as much as 7,000 per dollar (approx. 6,000 in July), and currently trades around 8510 (5350 in September) against the US dollar, according to quotes from Yahoo Finance.

Westmoreland Coal Acquires Kemmerer Mine

Westmoreland Coal Company (WLB) said today it has agreed to acquire Chevron Mining’s (CVX) Kemmerer mine in the Hams Fork Region of Southwestern Wyoming for $179 million plus $14 million in working capital. The deal includes 118 million tons of coal reserves, enough for 20 years of production, as well as a skilled workforce and state-of-the-art coal preparation and loadout facilities.

Sears Holdings to Close 100-120 Sears, Kmart Stores

Sears Holdings (SHLD) announced today it plans to close some stores in an update on its quarter-to-date and year-to-date performance. The company plans to close 100 to 120 Kmart and Sears stores, which is expected to generate $140 million to $170 million in cash as inventory is sold.