August 18th – By CountingPips.com – Receive our weekly COT Reports by Email

Copper Non-Commercial Speculator Positions:

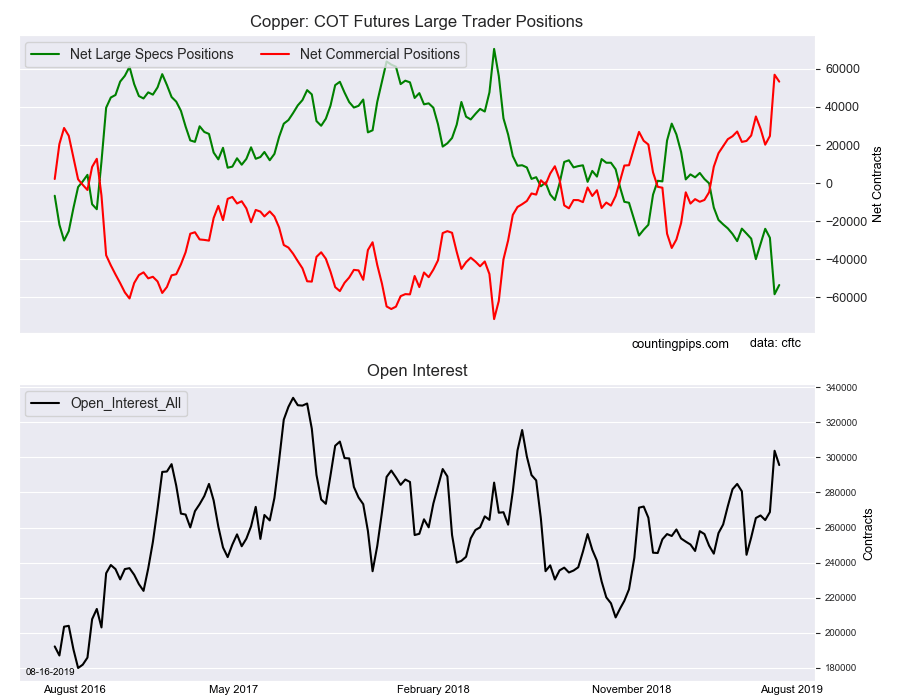

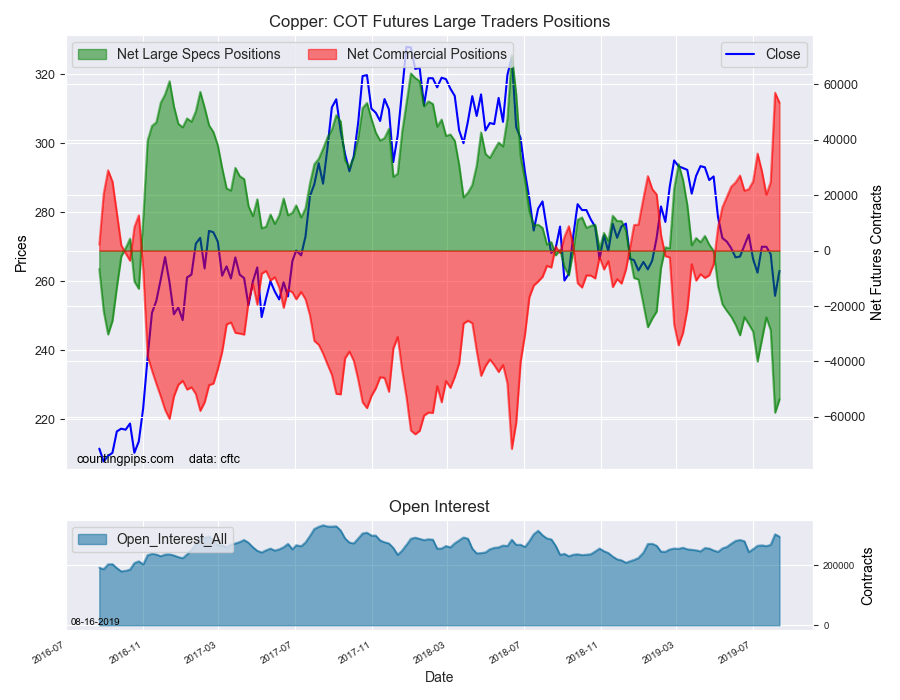

Large precious metals speculators cut back on their bearish net positions in the Copper futures markets this week following a large gain in bearish positions last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of -53,600 contracts in the data reported through Tuesday August 13th. This was a weekly change of 4,849 net contracts from the previous week which had a total of -58,449 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -2,926 contracts (to a weekly total of 76,207 contracts) while the gross bearish position (shorts) dropped by a greater amount of -7,775 contracts for the week (to a total of 129,807 contracts).

The decline in bearish bets this week comes after a sharp rise to a new record high bearish position last week at a total of -58,449 net contracts. The previous bearish record had been a total of -44,811 contracts on June 14th of 2016.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The current standing remains highly bearish above the -50,000 contract level for a second straight week. Copper has now been in a bearish overall level for sixteen straight weeks.

Copper Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 53,324 contracts on the week. This was a weekly decrease of -3,643 contracts from the total net of 56,967 contracts reported the previous week.

Copper Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Copper Futures (Front Month) closed at approximately $263.00 which was a boost of $7.25 from the previous close of $255.75, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article By CountingPips.com – Receive our weekly COT Reports by Email