London Gold Market Report

from Adrian Ash

BullionVault

Mon 2 Sept 07:55 EST

The PRICE of gold bullion bars slipped Monday morning, recovering early $25 drop in quiet dealing as Asian and European stock markets rose following strong manufacturing data.

With the US markets closed for the end-of-summer holiday, gold edged down to $1389 per ounce by lunchtime in London, just over 3% below last week’s three-month high.

The price of silver meantime whipped around $24.00 per ounce, almost 5% beneath Wednesday’s spike above $25 – the highest level since mid-April.

Commodity prices fell, as did major government bonds.

Official PMI data in China meantime showed its manufacturing sector growing at the best rate in 16 months, while the private Markit consultancy’s gauge showed expansion for the first time since April.

Markit’s PMI data for Italy and Spain leapt ahead of analyst forecasts.

“Uncertainty on whether or not military action will be taken against Syria has taken off some of gold’s safe-haven bid,” reckons Joni Teves at Swiss investment and bullion bank UBS in London.

“The recent move in [futures] positioning clearly indicates further reluctance to be short,” says Teves, “as geopolitical tensions add to looming event risks out of the US” such as the possible tapering of Federal Reserve asset purchases, and then the likely debt-ceiling deadline in mid-October.

Speculators in gold cut the number of bearish bets on US futures and options they held by 24% in the week-ending last Tuesday – the fastest pace since March 2009 – reducing it to near 7-month lows.

Net of those bearish bets, the so-called “net long” position held by non-industry players rose 173% from a month earlier, its fastest rise since June 2005.

“First it was short-covering,” said US consultancy CPM Group’s Jeffrey Christian to BNN late last week – “about half of the shorts liquidated. Now you’re seeing some long building, and you’re seeing trend followers.

“Soon as the price stalls out, and it will, you’ll see those trend followers back off.”

But “Bullish potential is beginning to emerge,” reckons a technical gold trading note from London market-maker Barclays in London.

“Price charts highlight the rare occurrence of a strong bullish month on the heels of corrective extremes, which previously led to a significant move higher.”

Last week’s rise above $1400 per ounce saw “considerably stronger demand” for gold investment bars, says a note from German refining group Heraeus. But “it resulted in lower premiums for physical metal in Asia…and some market participants cashed in on the higher price level.”

After a surge in first-half sales of gold coins worldwide, the US Mint reported its weakest month in six years for August.

Sales of American Eagle and Buffalo gold coins halved last month from July 2012.

“Market players are likely to be focusing most of their attention this week on the European Central Bank’s meeting on Thursday and the publication of the US labour market report on Friday,” says a note from German bullion dealers Commerzbank.

Meantime in India – the world’s No.1 gold consumer – the government’s raft of anti-gold-import rules have led to a doubling in gold smuggling since April, the Business Standard says today, citing strong flows from neighboring Pakistan and Bangladesh.

The Reserve Bank of India today denied press reports of a plan to buy gold from households and temples so it could offering it for sale to reduce the country’s annual imports.

On the supply side, two thirds of the 120,000 gold mine-workers in South Africa – now the world’s fifth largest producer – will begin a two-day strike over pay tomorrow.

World No.2 Australia grew its gold output by 4.7% between April and July, according to private consultancy Surbiton Associates, adding 3 tonnes from Q2 2012 to produce 67 tonnes.

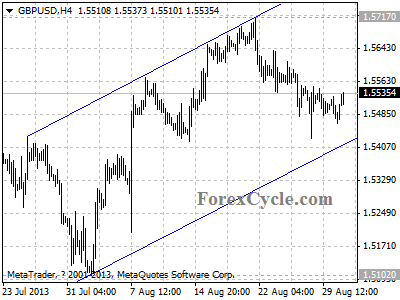

Gold price chart, no delay | Buy gold online

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold and silver in Zurich or Singapore for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.