By MoneyMorning.com.au

The easiest way to not lose money on the stock market is to not invest in stocks.

It’s an investment strategy advocated by the newest member of the Money Morning team, Vern Gowdie.

It’s a radical position. And we thought we were contrarian. But Vern’s strategy takes the biscuit on that score.

But as we wrote yesterday, there are things to think about before you rush out to sell your stocks.

For a start you need to think about the opportunity cost of not owning stocks. Plus there are the tax implications.

The truth is that most investors find selling stocks a lot harder than buying stocks. But there is good news. There’s a way to make the job of selling much easier…

Before we get into that, why is it that investors find selling a stock so hard?

The simple answer is that investing in stocks is a much more emotional experience than you may think.

Few investors have ice running through their veins when it comes to stocks. Even before an investor buys a stock they develop an emotional attachment to it.

That’s understandable. You put so much research and background reading into a stock, by the time you invest the money it doesn’t seem possible the stock could fall.

But sometimes against your hopes, the stock falls. And rather than admitting you may have made a mistake, you hang with it and justify your decision; ‘the market is wrong, not me!’

Even Billionaire Investors Get it Wrong

Look, we’ve all done it. Your editor has done it. And some of the world’s biggest investors have done it too.

Big hedge fund manager Bill Ackman bought into US retailer JC Penney [NYSE: JCP] in late 2010 when the stock traded between USD$20 and USD$35. His aim was to turn around the ailing retailer.

His hedge fund ended up owning 18% of the company.

But even a billionaire investor doesn’t get it right all the time. Last week Ackman finally announced he had had enough. He’s decided to sell his stake in the company. The shares are trading at USD$12.50.

Ackman’s hedge fund is looking down the barrel of at least a 50% loss on the investment.

Now, let’s make one thing clear. You will make losses as an investor. Anyone who tells you they’ve never made a loss or can show you a way to not make losses isn’t being truthful.

So if you’re looking for the magic investment that eliminates all losses, forget about it. You’re wasting your time. Such an investment doesn’t exist.

The best thing you can do is find ways to help minimise losses…or trying to avoid them in the first place.

This is where we recommend using stop orders. Again, they aren’t perfect, but if you use them wisely it’s a handy way to stop a big profit turning into a small profit, or a small loss turning into a big loss.

Taking the Emotion Out of Investing

So, what is a ‘stop order’?

Put simply, a stop order is an order you place with your broker to automatically sell a share if the price falls to a certain level.

For instance, if you bought a stock at $5, you could place a stop order to sell the stock if it falls to or below $4.50. The great thing about stop orders is that it takes the emotion out of investing.

Rather than sticking with a stock because you don’t want to admit you’re wrong, a stop order will automatically sell your shares if it falls to the pre-set price.

Now, this doesn’t mean you should use stop orders for every stock position – although some people do.

And stop orders aren’t a substitute for doing your homework. As you can picture, if every share you buy hits the stop level, odds are you’ll end up losing a lot of money.

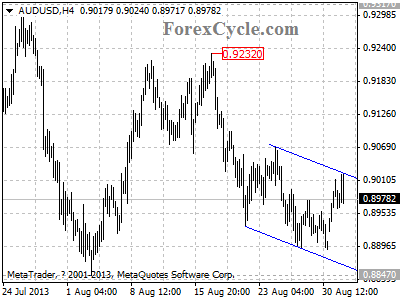

The best way to use stop orders is when a stock is trending one way or the other in a gradual fashion. This is when you can use a ‘trailing stop order’. That is, as the share price goes up, you move your stop order higher.

So, just say your $5 stock is now $6, you could move your stop order to $5.50. If the share price falls back to $5.50 it triggers the stop order and you’ve locked in a profit of 50 cents.

(By the way, if you plan on using stop orders check with your broker on how they execute the trades. If the market ‘gaps’ lower, i.e. it doesn’t trade at your stop level, the broker may sell at a price lower than you expected.)

It’s also handy if you’re buying into a stock that’s trending lower where you’re betting on the stock reversing its trend. If you’re wrong, the stop order will kick in and you’ll get out of the position.

The stocks where stop orders don’t always work are the particularly volatile stocks. That doesn’t mean you shouldn’t use stop orders. It just means you may need to set your stop further away from the prevailing price to ensure you don’t sell during short-term volatility.

An Investor’s Duty

As we say, stop orders aren’t perfect and they aren’t for everyone.

If you’ve bought a dividend paying stock for the long term and you’re comfortable the company will keep paying out a dividend, then it probably doesn’t make sense to use a stop order on these shares.

In fact, you’re arguably better off buying more shares when the share price falls – especially if it’s a stable and dependable dividend payer.

But if Vern’s prophecy is right and the markets are due to suffer the consequences of the Great Contraction, it’s every investor’s duty to manage their portfolio in a way that will minimise losses if the market suffers a huge fall.

We’ll have more advice on ways to lock in profits and reduce losses in tomorrow’s Money Morning.

Cheers,

Kris+

Join The Daily Reckoning on Google+

From the Port Phillip Publishing Library

Special Report: GET OUT & STAY OUT

Australian Small-Cap Investigator:

How to Make Big Money from Small-Cap Stocks