’2013 is the year that investors finally shake off their fear and dive back into the stock market.’

That’s something I’ve been hearing more and more often in recent weeks. There’s a ‘wall of money’ just waiting to pour out of bonds and flood into the stock market.

After all, why would anyone put more money into bonds? The returns are minuscule. Prices are so high and yields so low that even in the best-case scenarios, you’ll still barely make a bean. And with the worst of the crisis behind us, bonds now look very vulnerable to any rise in inflation.

So where else can people invest? It’s got to be good news for stocks.

At least, that’s what all the equity salespeople are saying. And their logic seems sound. There’s just one catch.

Bubbles don’t burst painlessly. And the bond bubble is highly unlikely to be any different…

1994 All Over Again?

2013 will be the year of what Bank of America Merrill Lynch analyst Michael Hartnett calls ‘the Great Rotation’.

Whatever you want to call it, it’s the point at which investors lose their terror of deflation, and instead start to fret about inflation. It’s the point at which they stop worrying about losing money, and start to worry about missing opportunities to make it.

And as far as the stock market bulls are concerned, it’s great news. All the talk of the ‘death of equities’ has been greatly exaggerated. This is their comeback moment.

This is when all that lovely money that has been locked up in the bond market comes flooding out and deluges the stock markets of the world, lifting all boats (not to mention fund managers’ pay packets).

It all sounds great. But as Hartnett points out: ‘the transition is very unlikely to be smooth’. He sees two big threats to ‘an orderly Great Rotation’ – 1994 and 1987.

First, there’s the ‘bond shock’ scenario. In 1994, yields on 30-year US Treasuries (‘the long bond’) jumped by 2.4 percentage points in just nine months, as Ambrose Evans-Pritchard noted in The Telegraph. In case you’re wondering, that’s a big move.

Why did it happen? There’s a good archived article from Fortune magazine on the 1994 crash here. It all sounds rather familiar.

‘In January 1994, the 34th month of economic expansion, bond yields were historically low and inflation seemed negligible: wages were going nowhere, and companies dared not raise prices.’

But there were some mild signs of inflationary pressures growing, with commodity prices rising. So the Federal Reserve started to very gently tighten monetary policy.

At the time, Fed governor Alan Greenspan thought that if he was seen to be acting to fend off inflation quickly, it would bring down long-term bond yields.

So he raised interest rates from 3% to 3.25% in February. That’s a tiny move. But markets weren’t expecting it. Yields on 30-year Treasuries leaped higher as prices slid. And it got worse through the year.

There were plenty of reasons for the slide, but it boiled down to this: investors had been planning for a low interest-rate world. They’d bought up bonds all across the globe, ignoring signs of burgeoning recovery, or the threat of political risk in emerging markets. And of course, they’d used borrowed money to do it.

So even a hint of a change in the mood music caused a panic as bond investors rapidly re-evaluated their positions.

As Hartnett suggests, if we see a repeat of 1994 this year – perhaps the Fed eases up on quantitative easing – then the hardest-hit would be investors in high-yield bonds and emerging market debt.

Or Worse Still – 1987?

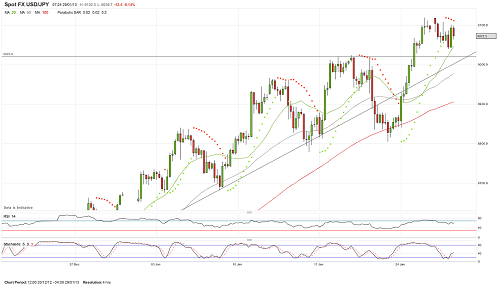

The other danger, says Hartnett, is that we see a repeat of the October 1987 stock-market crash. As well as rising bond yields, one of the many factors driving this crash was tension between the major economies over currency valuations. Again, this sounds worryingly familiar.

Hartnett sees a repeat of 1987 as ‘a low probability event’. However, at the same time, ‘many countries are trying to devalue their way to growth, risking a currency war… should gold start to respond favourably to this backdrop, we would certainly worry that a major risk correction is imminent.’

In short, whatever the equity sales people like to suggest, there’s unlikely to be a smooth sweep of all that lovely money directly from bond markets to stock markets. And the more bullish investors are (and they’re very bullish at the moment), the more likely we are to see a nasty correction happen in the process.

What Should You Do About It?

We’ve been saying for a while that bond markets look expensive. The main scenario in which government bonds would make you money from here is if there’s a major dose of deflation, and that now doesn’t look likely.

That makes them a very expensive form of deflation insurance.

Gold on the other hand is one of the best ways to insure against inflation. While gold is certainly not cheap today, given the reasonably high chance of inflation taking off in the future, it doesn’t look expensive either.

As for the rest of your portfolio, the key is to make sure you have a plan and stick to it. Hang on to cheap equities, maybe take profits on some of your more speculative positions, and keep some cash in reserve to take advantage of any crash opportunities that arise.

John Stepek

Contributing Editor, Money Morning

Publisher’s Note: This article originally appeared in MoneyWeek</em>