By Lukman Otunuga Senior Research Analyst, ForexTime

European and Asian stocks are mixed while the dollar and Treasury yields are unchanged after their sharp jump higher following Friday’s strong US jobs report. But a rising greenback and yields are not a good combination for commodities which are continuing to suffer losses.

Oil is extending Friday’s price action, falling close to 4% this morning as the Delta Covid-19 variant spreads across Asia. After a 6% slump last week, Brent suffered its biggest weekly loss in four months.

Fears around potential global oil demand erosion are resurfacing with new restrictions in China, the world’s second largest oil consumer, raising increasing concerns about the short-term outlook.

Brent has broken through the 100-day moving average this morning and is now trading around the July support zone lows at $68. With the daily RSI not oversold, a weak close may see more downside into the May lows around $64.75.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

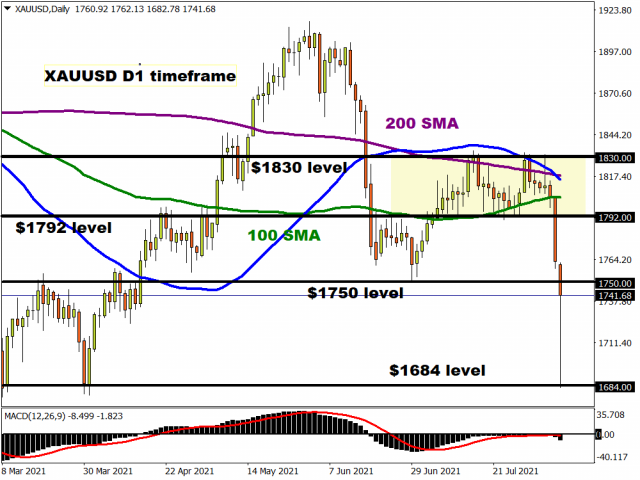

Gold flash crash

Sentiment has also been tempered by a sudden dive in gold prices at the start of the Asian session. A break of $1750 triggered stop losses in thin market conditions, taking the precious metal to lows at $1684. This level coincides with the double bottom March lows. Prices have since rebounded this morning with bugs desperately trying to hold onto the previous cycle lows from June at $1750. There is also long-term uptrend support from the May 2019 lows in this area.

Gold hasn’t been trading as it historically should recently. Falling yields have failed to boost the price but their turnaround last week triggered a strong negative reaction. Flash crashes and capitulation like this can signal a major low is in place but the dollar move especially is hard to ignore at the moment.

NFP and the Fed

After the all-round buoyant US employment data, markets are now keen to see the colour of the Fed’s money; in other words more detail on tapering asset purchases at Jackson Hole towards the end of the this month.

With unemployment benefits expiring in early September in many US states, healthy jobs gains are expected to continue. Labour supply remains the key issue as the demand side remains robust.

The latest spread of the Delta variant does pose some questions for the Fed going forward, but more job reports similar to this one may also mean further pressure on wages. Short-term direction for markets will now shift to the other part of the Fed’s mandate – inflation – with the July CPI data out on Wednesday.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024