By Orbex

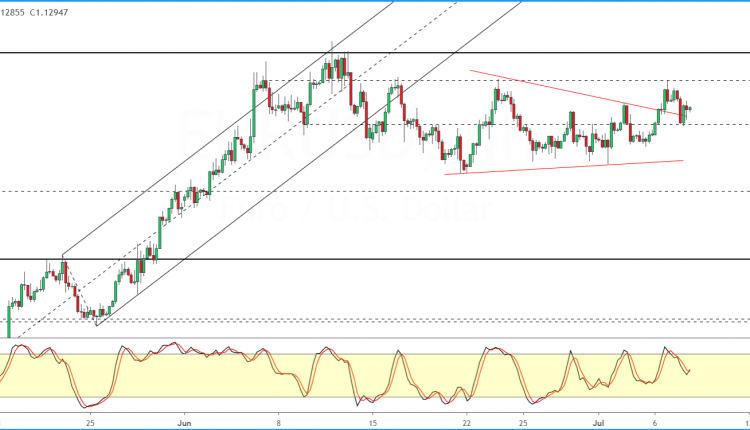

Euro Finds Support At 1.1261

The euro currency is trading mixed with prices confined within Monday’s range. In the short term charts, we see the euro holding on to the support area near 1.1261.

We now expect the consolidation between the 1.1261 support and 1.1347 resistance levels.

A breakout from this level will confirm the near term upside in prices. The bias is to the upside as we see the Stochastics likely to move higher.

The upside breakout from the ascending triangle is also giving validation to this view.

However, a close below 1.1261 will see the euro posting declines.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

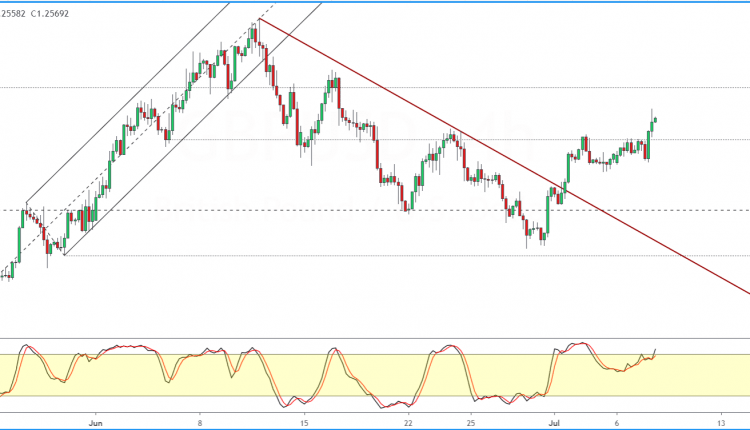

Sterling Jumps On Brexit News

The Pound sterling broke out above the key resistance level of 1.2516. Fundamentals drove the gains.

Talks of Brexit dinner raised hopes that the UK might be able to move forward with a deal.

From a technical perspective, GBPUSD is now cleared for a test of 1.2643.

A retest of this will confirm a full recovery in the prices from mid-June.

In the near term, any dips around 1.2516 will likely be supported. This will keep the cable from posting further declines.

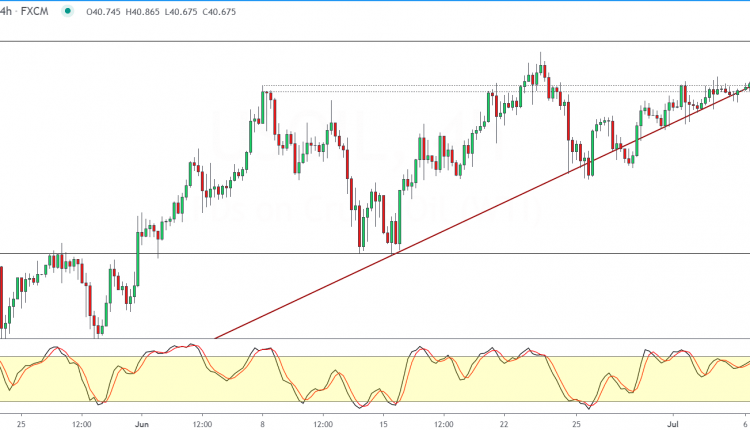

Oil Markets Remain Flat Despite Concerns Of Demand Slowdown

Crude oil prices continue to trade softly with prices holding on above the 40.00 handle. But price action is now challenging the rising trend line from below.

A breakout above this trend line will confirm a further upside in oil prices.

The next main target is seen at the 42.00 handle. To the downside, failure to breakout might keep price action subdued.

We could see some consolidation taking place near the 40.00 handle.

But a close below this level could open the oil markets towards a stronger correction lower.

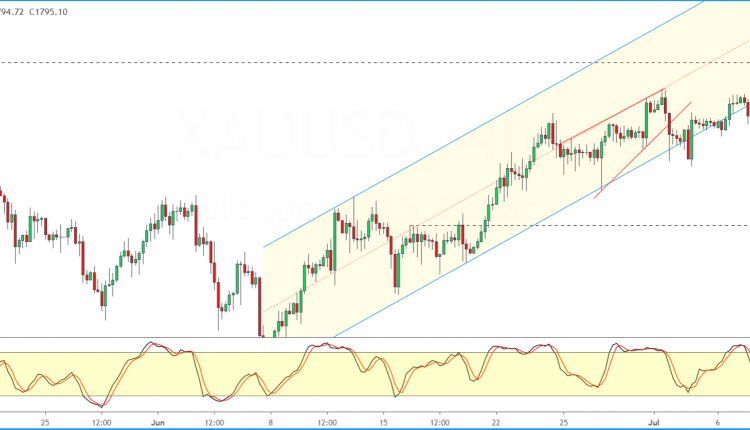

Gold Rises Sharply As Investors Take Caution

The precious metal is making the final push towards the 1800 handle. Price action is gaining momentum as gold is a few points away from the elusive price target.

The Stochastics oscillator is also showing renewed momentum to the upside.

However, we could expect some profit-taking at this level. This means that gold prices might be at risk of a pullback.

Initial support can be seen at the recent swing high point of 1787.

A close below this level will see gold prices pushing down to the 1760 handle.

By Orbex