By Orbex

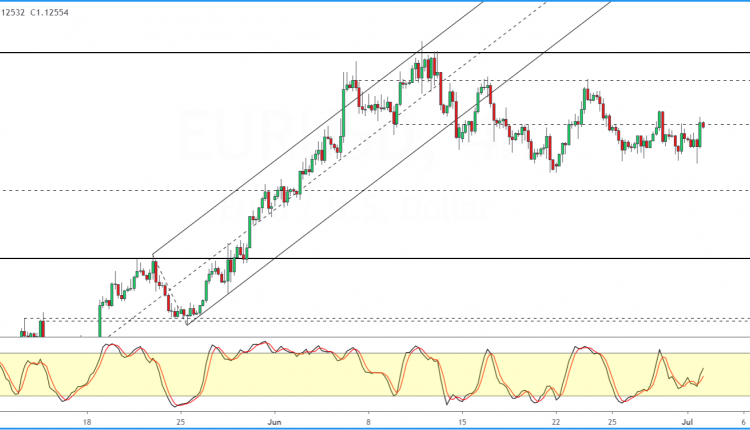

EURUSD Trades Flat As It Fails To Clear 1.1261

The euro currency is holding on to a sideways pattern. Price action once again attempted to breakout above 1.1261 level of resistance.

But failing to breakout higher is keeping the currency pair subdued. A smaller range is forming with the lower end at 1.1205.

Following this consolidation, we expect the euro currency to potentially breakout. The bias is mixed for the moment, given the consistent lower highs that are forming.

As a result, this opens the downside in EURUSD towards the 1.1132 level of support.

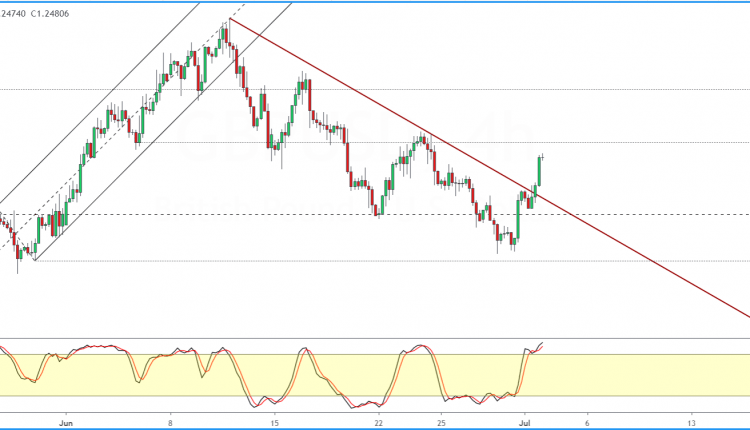

GBPUSD Breaks The Trend Line And Turns Bullish

The pound sterling is posting strong gains for the second consecutive day, with prices rising to a one week high.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The gains come following a successful breakout of the falling trend line. This opens up the upside toward the 1.2516 level where resistance could keep a lid on the gains.

We also suspect a pullback to the breakout level of the trend line. This will potentially cement the upside in GBPUSD for now.

However, further gains might be in store if the cable manages to clear the 1.2516 level of resistance.

Oil Prices Once Again Retreat From The Resistance Level

WTI Crude oil prices made an attempt to test the technical resistance level around the 40.18 – 40.42 region.

However, prices were pushed lower immediately. For the moment, the consolidation is showing a squeeze in the price between the trend line and the horizontal resistance level.

Therefore, we could expect a breakout in the near term. The bias is mixed for the moment.

If oil prices break the trend line, we expect a move lower to the 34.41 level of support.

Alternately, an upside breakout might see prices finally clearing the way for a move toward the 50.00 level.

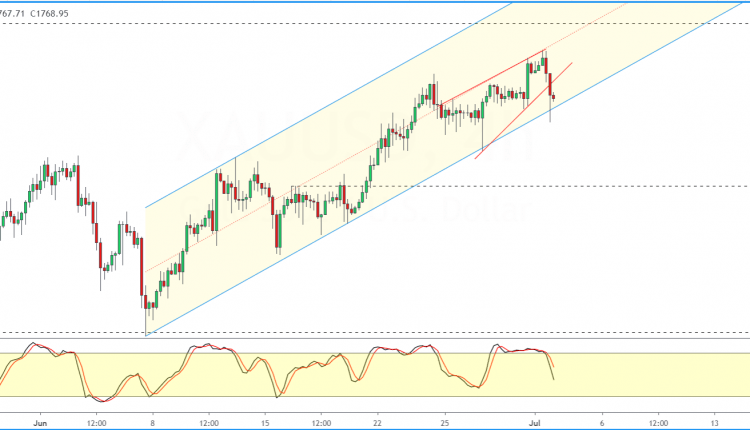

Gold Slips Off The Rising Wedge Pattern

The precious metal failed to make any major gains after prices rose to highs near 1788.

The rising wedge pattern signaled earlier results in prices making a short term correction.

However, gold is still trading within the larger bullish price channel. As a result, the upside bias is still intact.

But this could change if gold breaks out from the rising price channel. It will potentially set the stage for gold to correct lower to the 1732 level.

By Orbex