Article By RoboForex.com

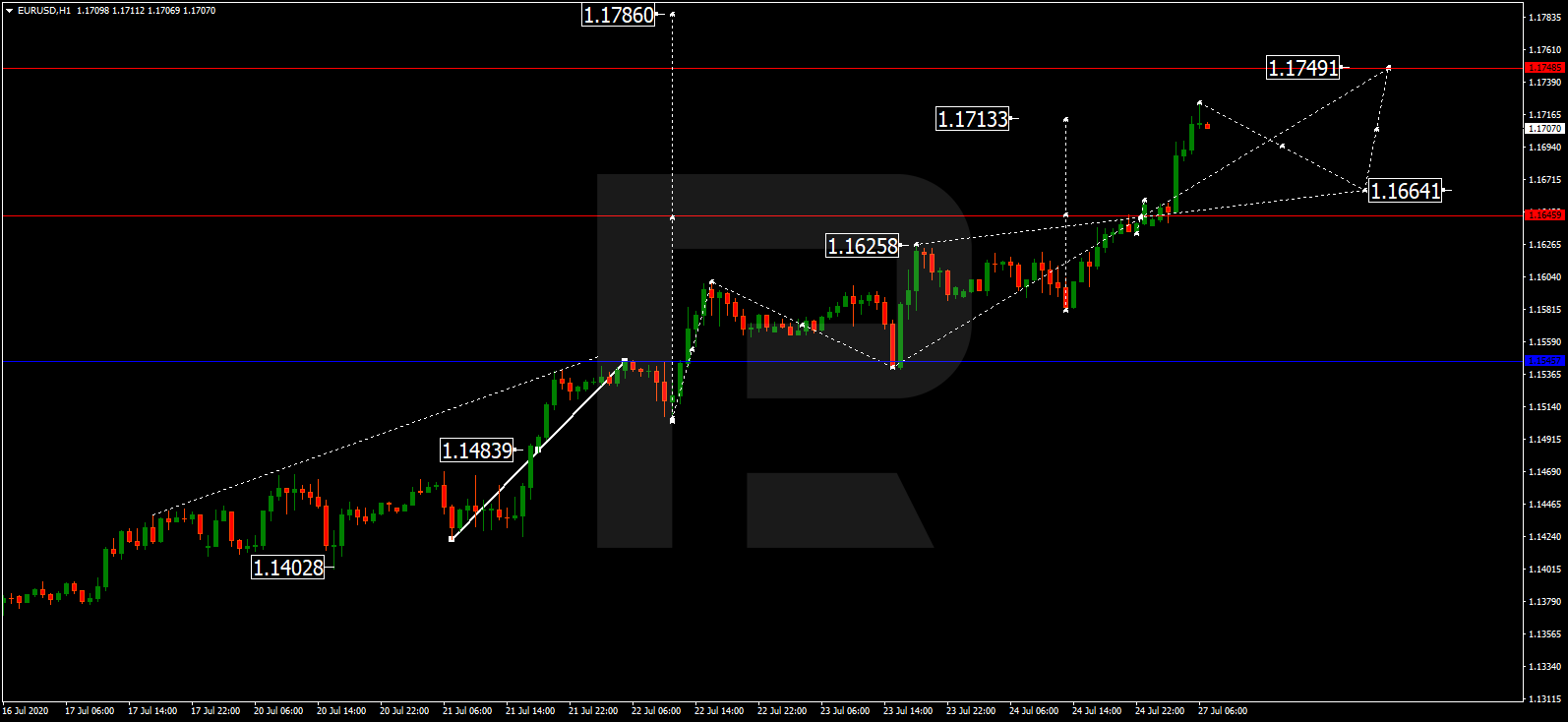

EURUSD, “Euro vs US Dollar”

After forming another upside continuation pattern at 1.1645 and then reaching 1.1713, EURUSD is still growing. Possibly, today the pair may correct towards 1.1666 and then form one more ascending structure with the target at 1.1750.

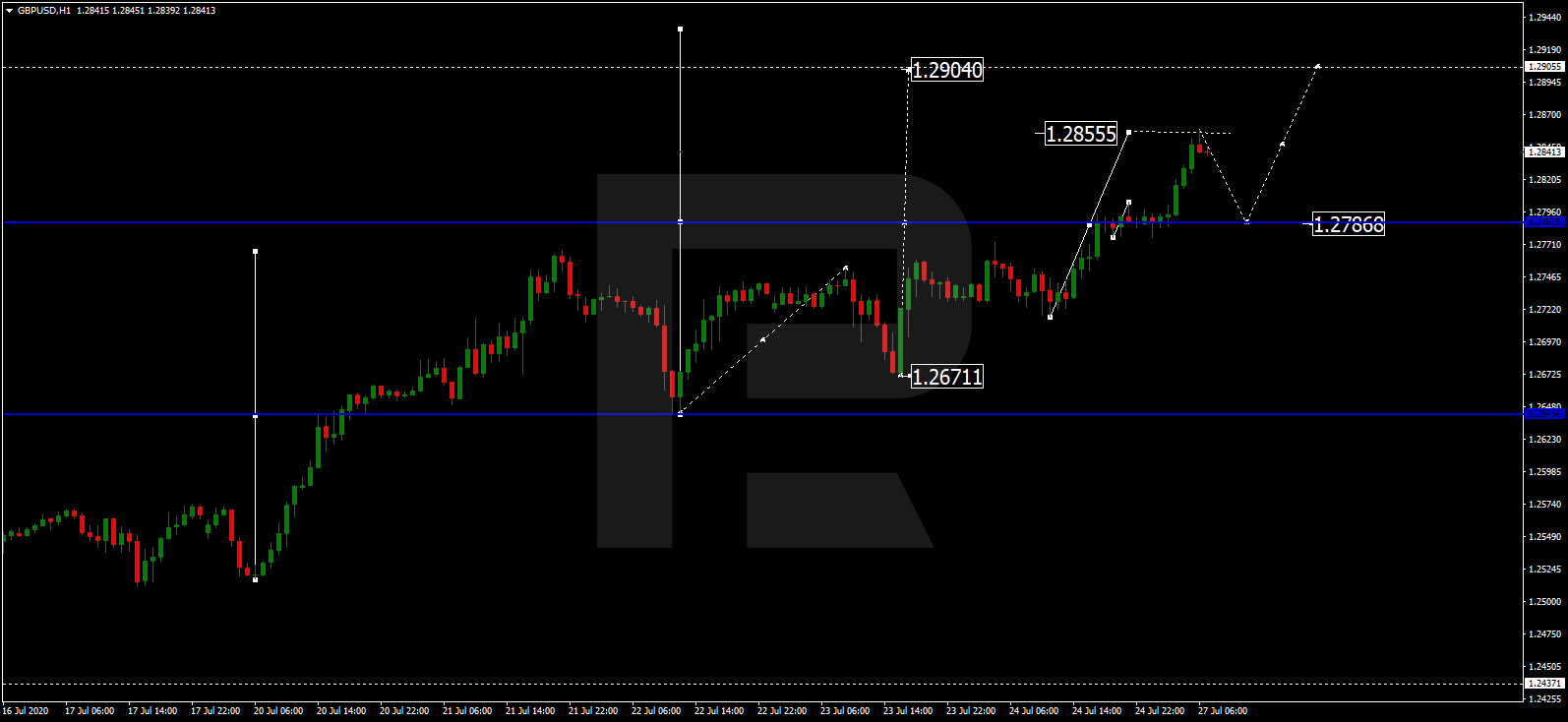

GBPUSD, “Great Britain Pound vs US Dollar”

After forming another upside continuation pattern at 1.2786 and then completing the ascending wave at 1.2885, GBPUSD continue trading upwards. Today, the pair may start a new decline to return to 1.2786 and then resume moving inside the uptrend with the target at 1.2904.

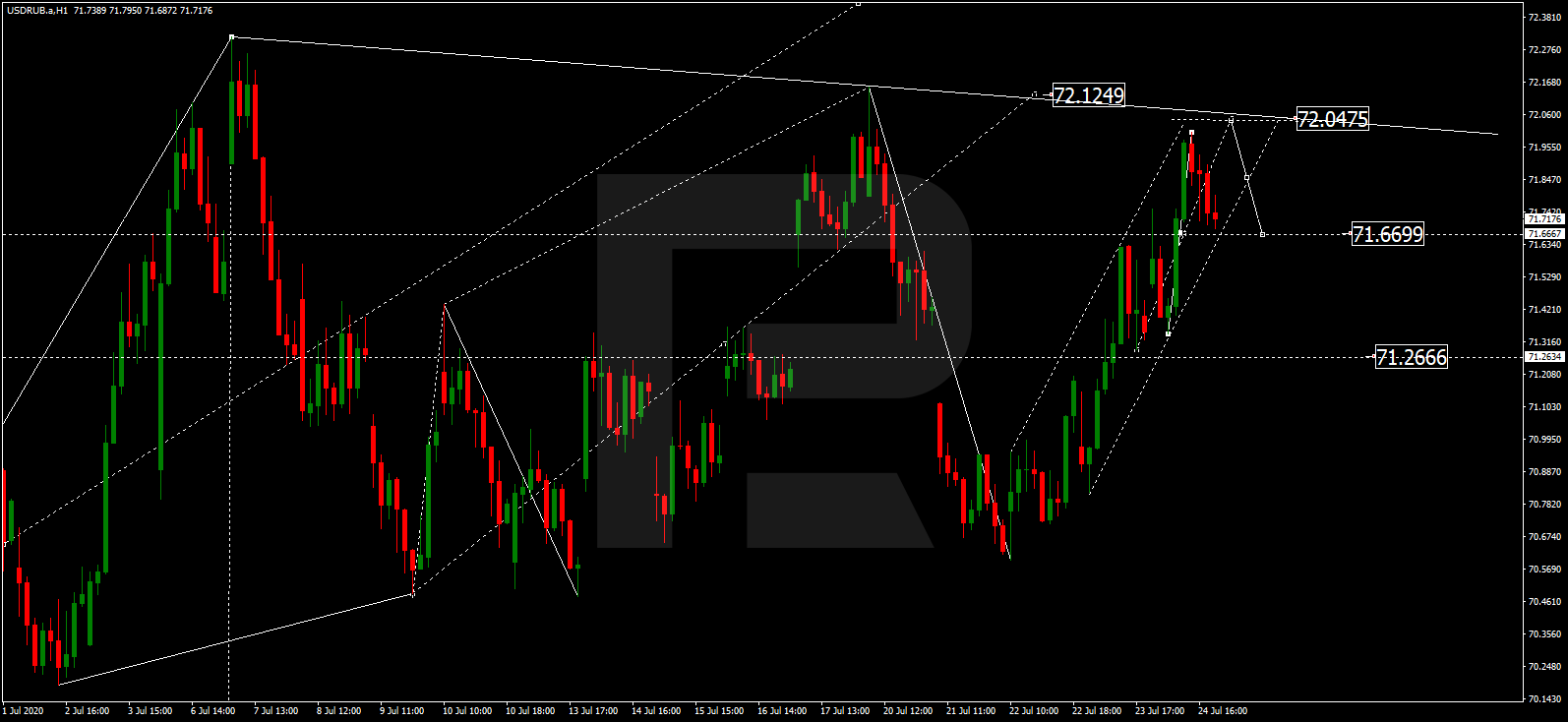

USDRUB, “US Dollar vs Russian Ruble”

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

USDRUB continues growing towards 72.04 and may later correct to reach 71.66, thus forming a new consolidation range between these two levels. If the price breaks this range to the upside, the market may form one more ascending structure to reach 72.80; if to the downside – resume trading downwards with the target at 71.25.

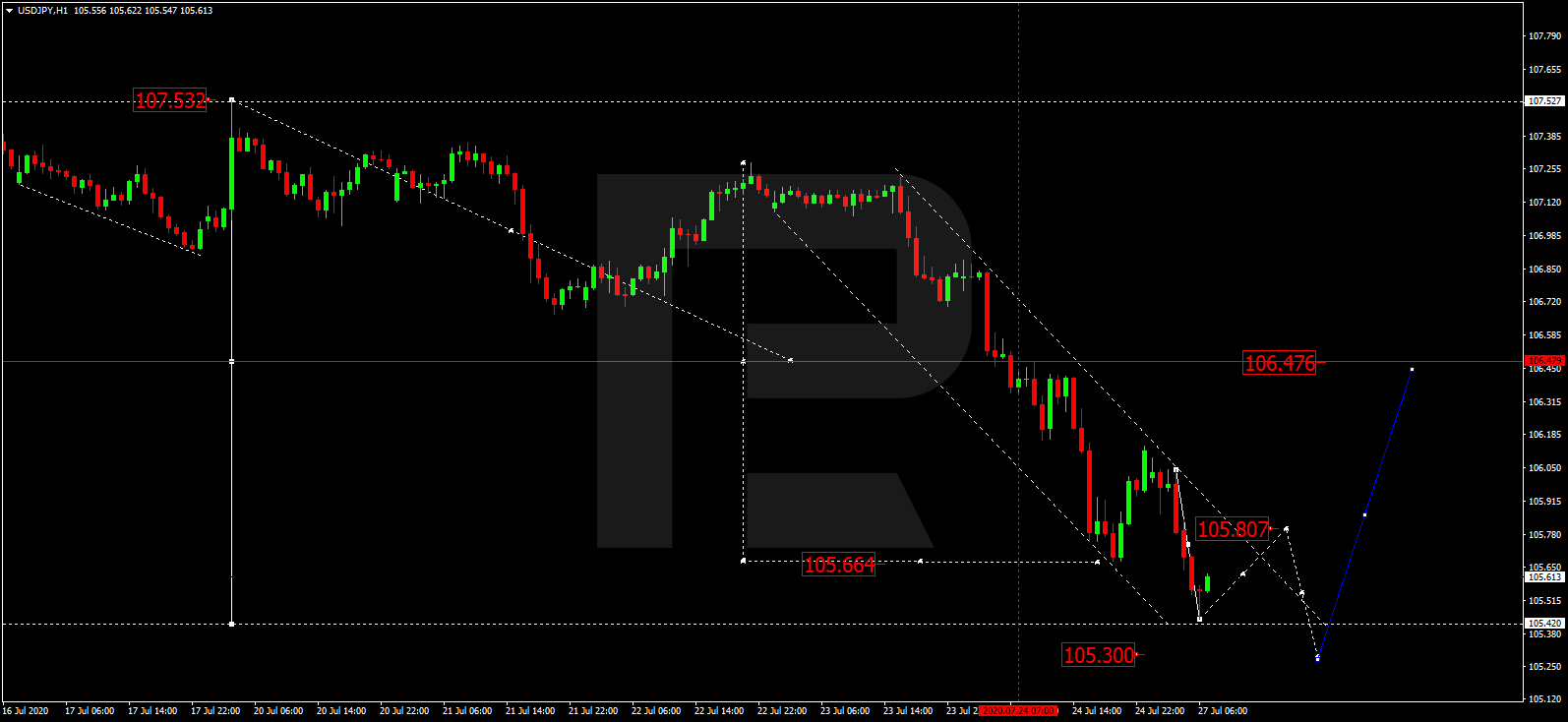

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed the descending wave at 105.44. Possibly, today the pair may test 105.80 from below and then resume trading downwards with the target at 105.30 or even 105.00.

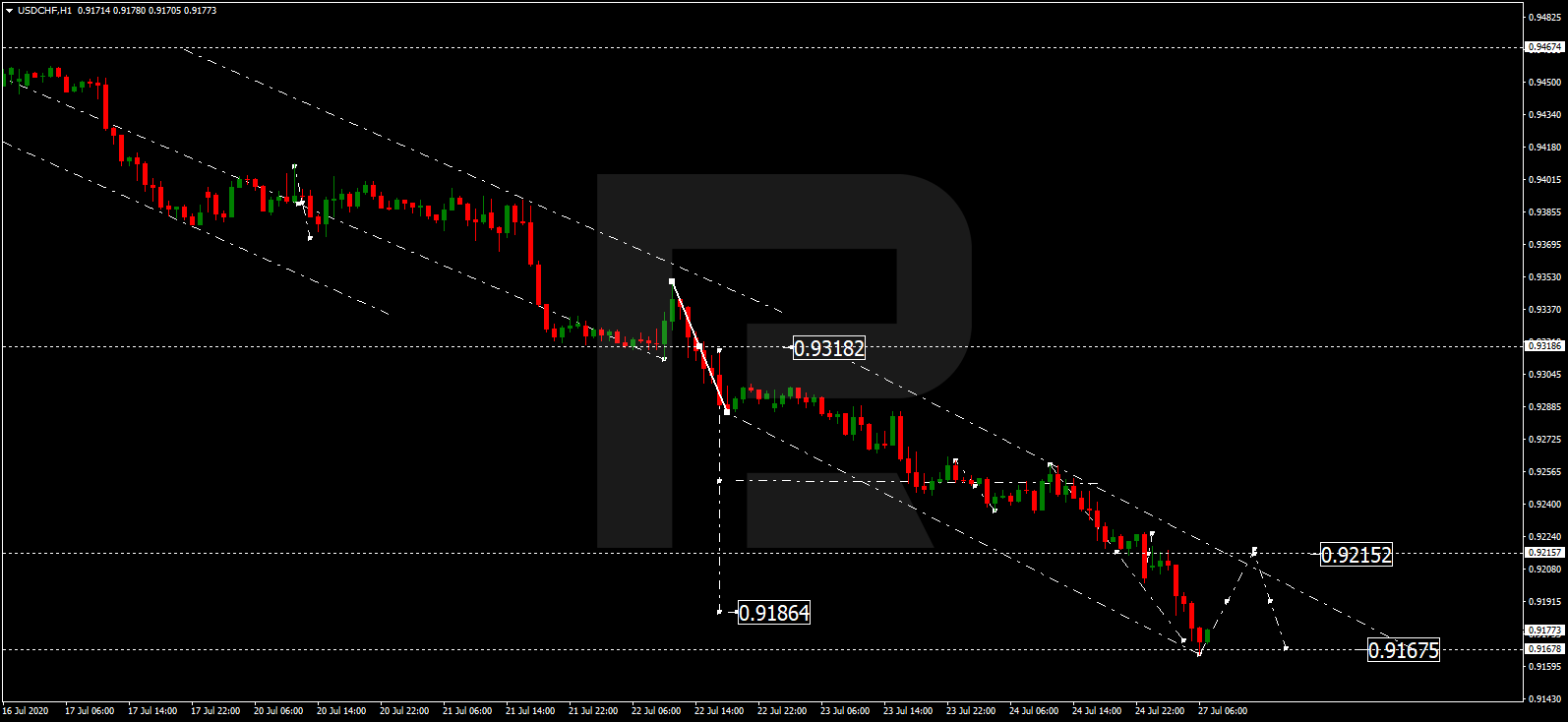

USDCHF, “US Dollar vs Swiss Franc”

After forming the downside continuation pattern at 0.9222 and then reaching 0.9167, USDCHF continues falling. Today, the pair may start another growth to return to 0.9222 and then resume trading downwards with the target at 0.9100.

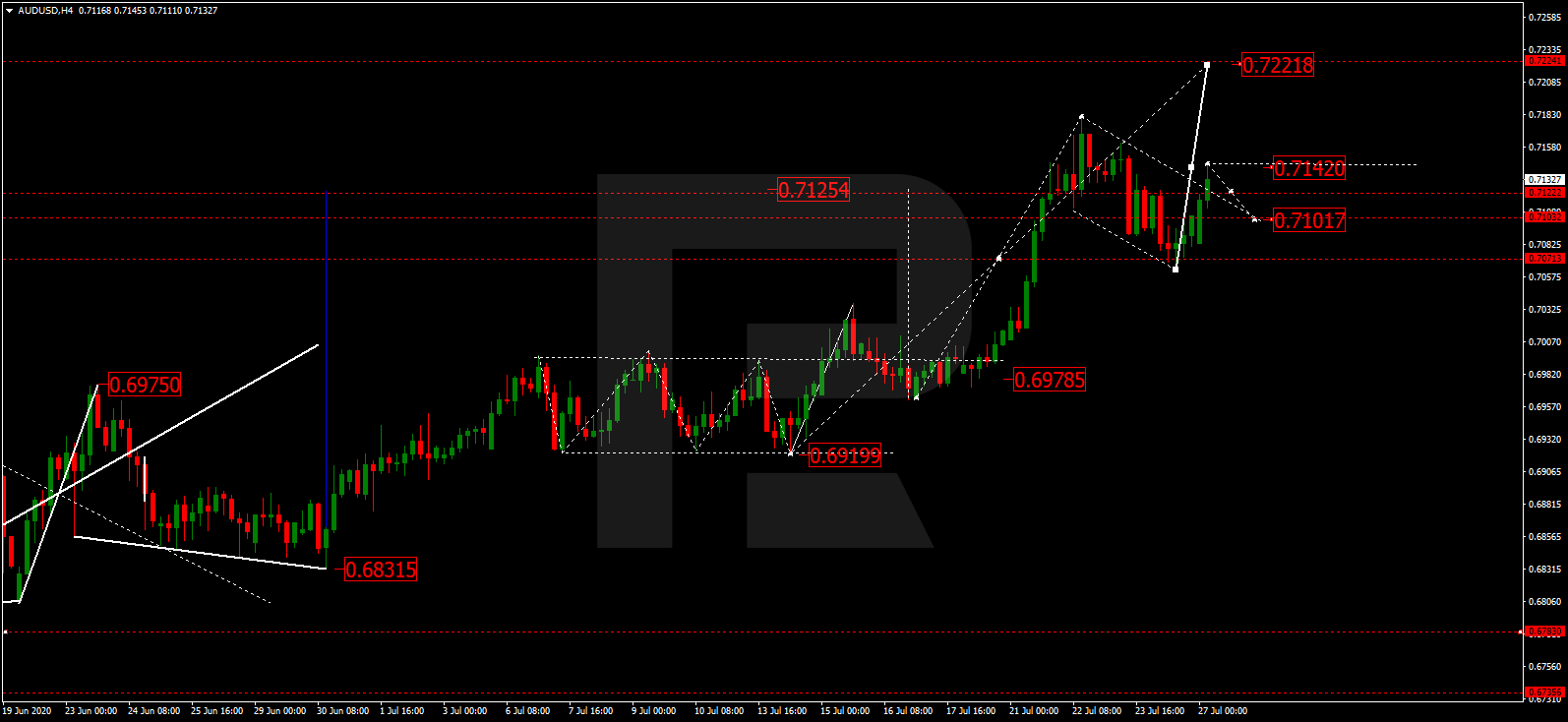

AUDUSD, “Australian Dollar vs US Dollar”

After finishing the descending wave at 0.7070 and then completing another ascending impulse towards 0.7142, AUDUSD is expected to reach 0.7101, thus forming a new consolidation range between the two latter levels. If the price breaks this range to the upside, the market may form one more ascending structure to reach 0.7222; if to the downside – resume trading downwards with the target at 0.6980.

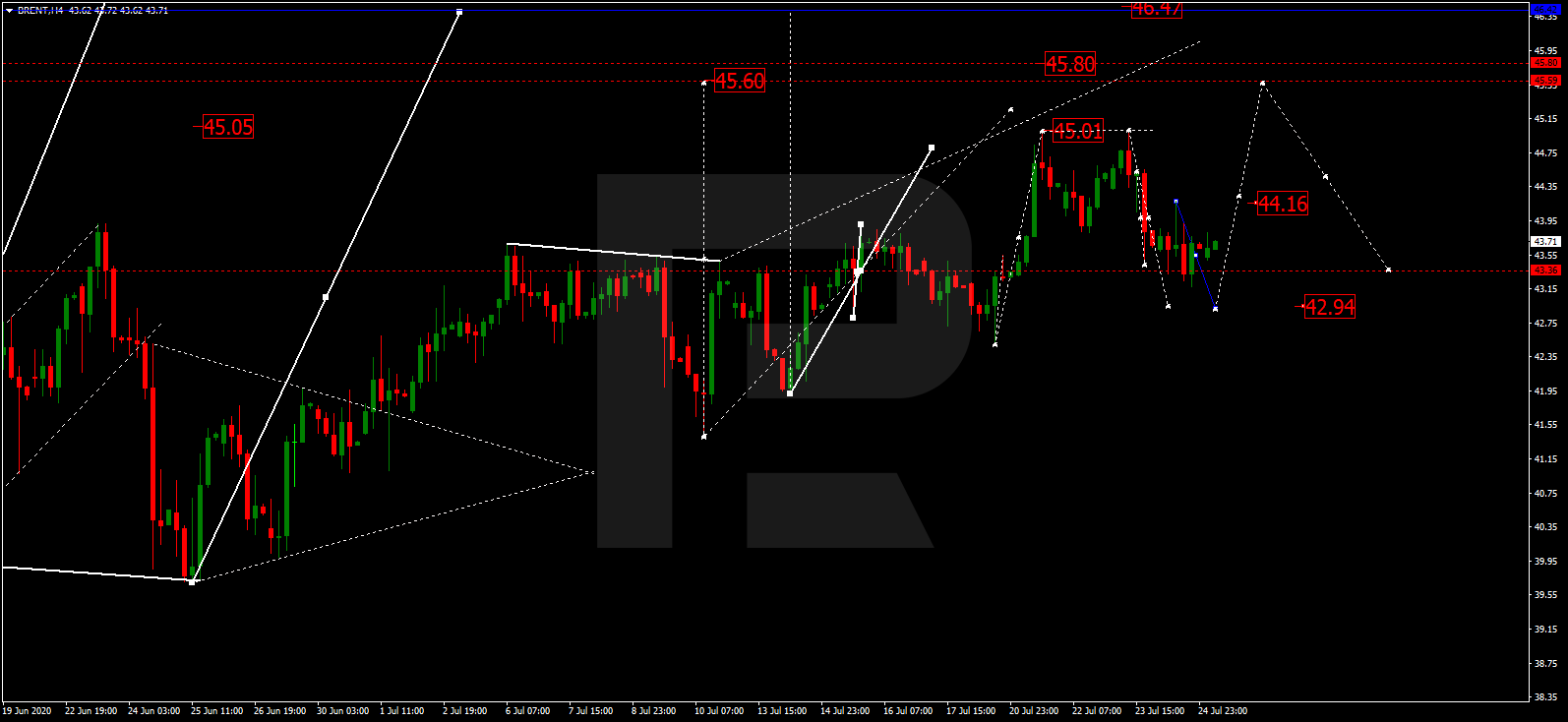

BRENT

After completing the descending structure at 43.33, Brent is consolidating around this level. Possibly, the pair may start another decline towards 42.95 and then grow to break 44.15. Later, the market may continue trading upwards with the target at 45.80.

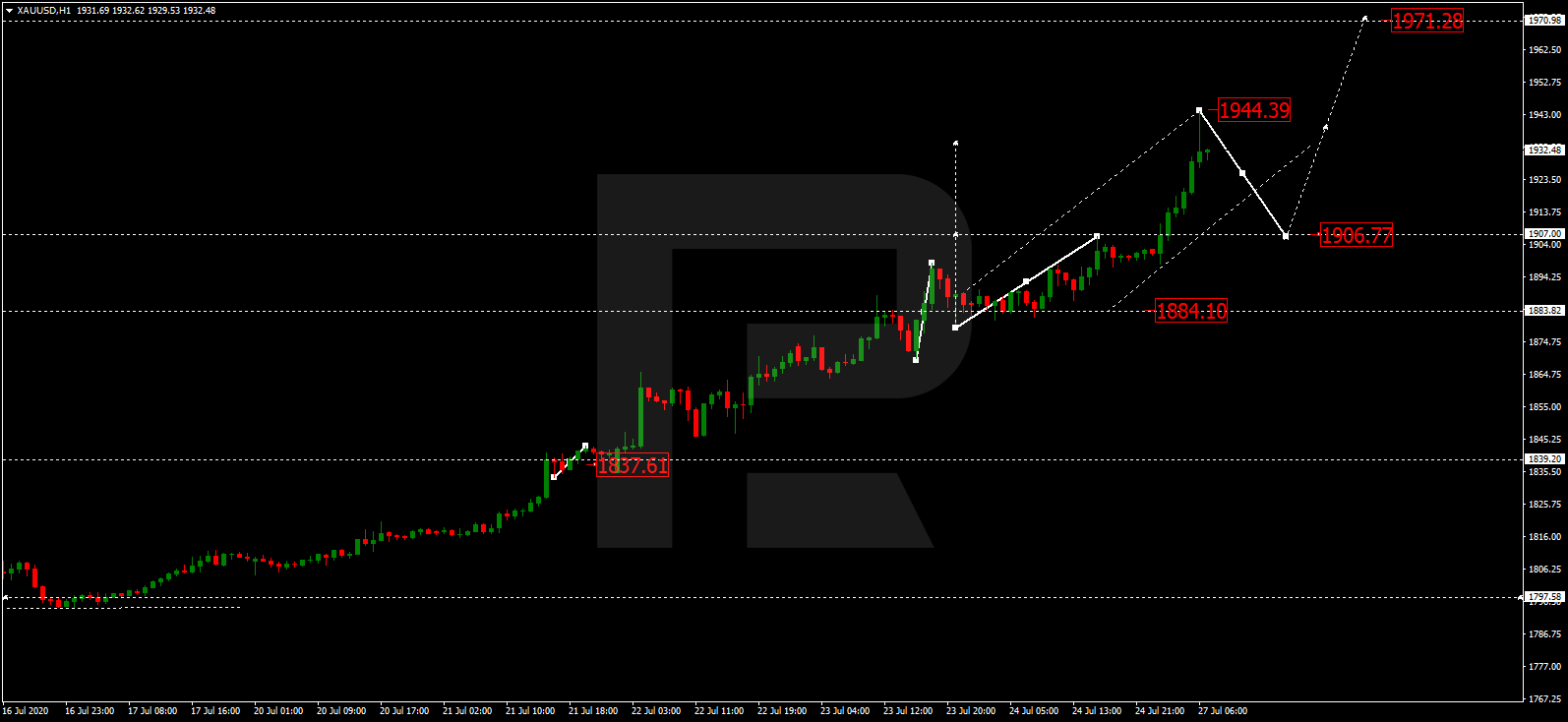

XAUUSD, “Gold vs US Dollar”

After completing the descending impulse at 1880.00 and rebounding from it to the upside, Gold has finished the ascending wave towards 1944.30. Today, the pair may form a new descending structure to reach 1900.00 and then resume trading upwards with the target at 1971.20 or even 2000.00.

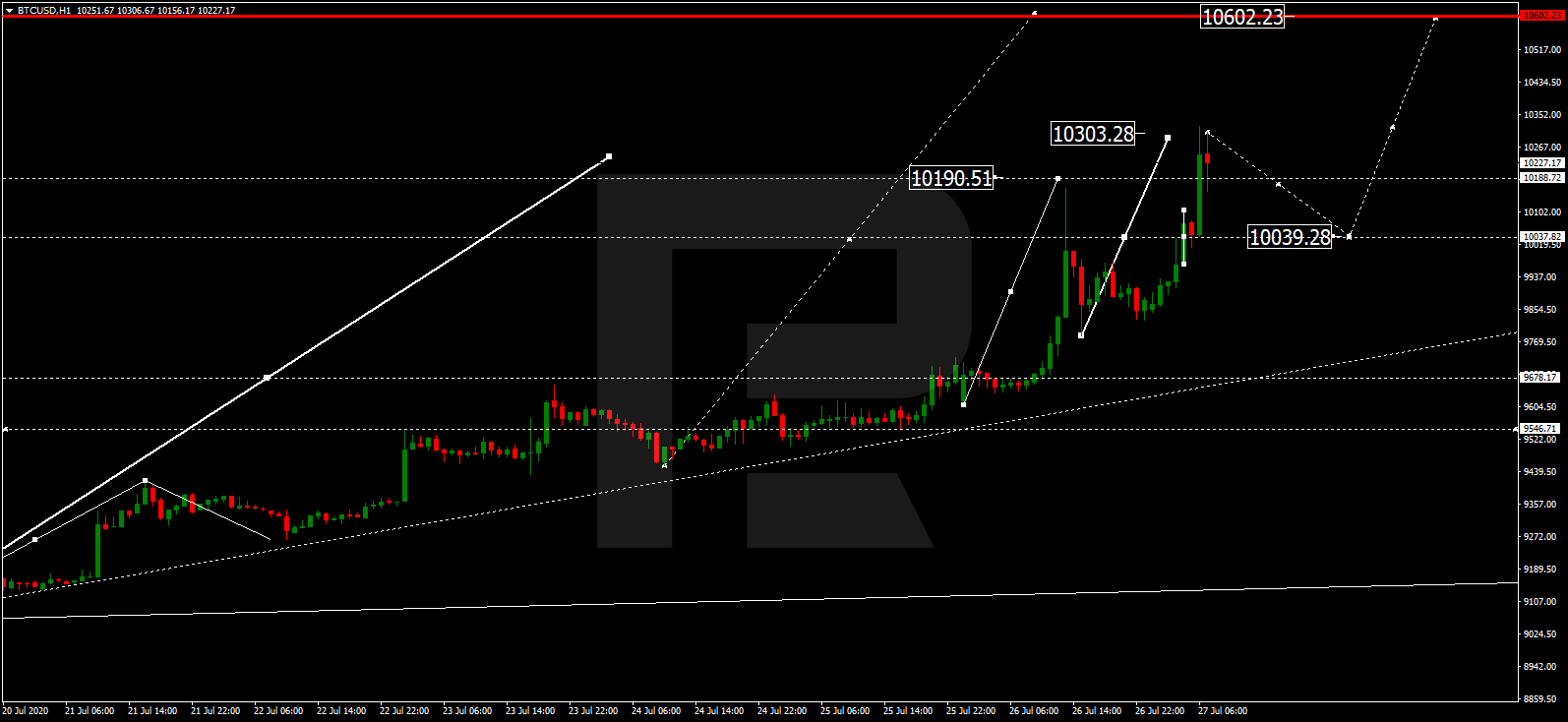

BTCUSD, “Bitcoin vs US Dollar”

After reaching 9678.00 and forming an upside continuation pattern, BTCUSD has extended the wave to reach 10300.00. Later, the market may start a new decline towards 10040.00 and then resume trading upwards with the target at 10600.00.

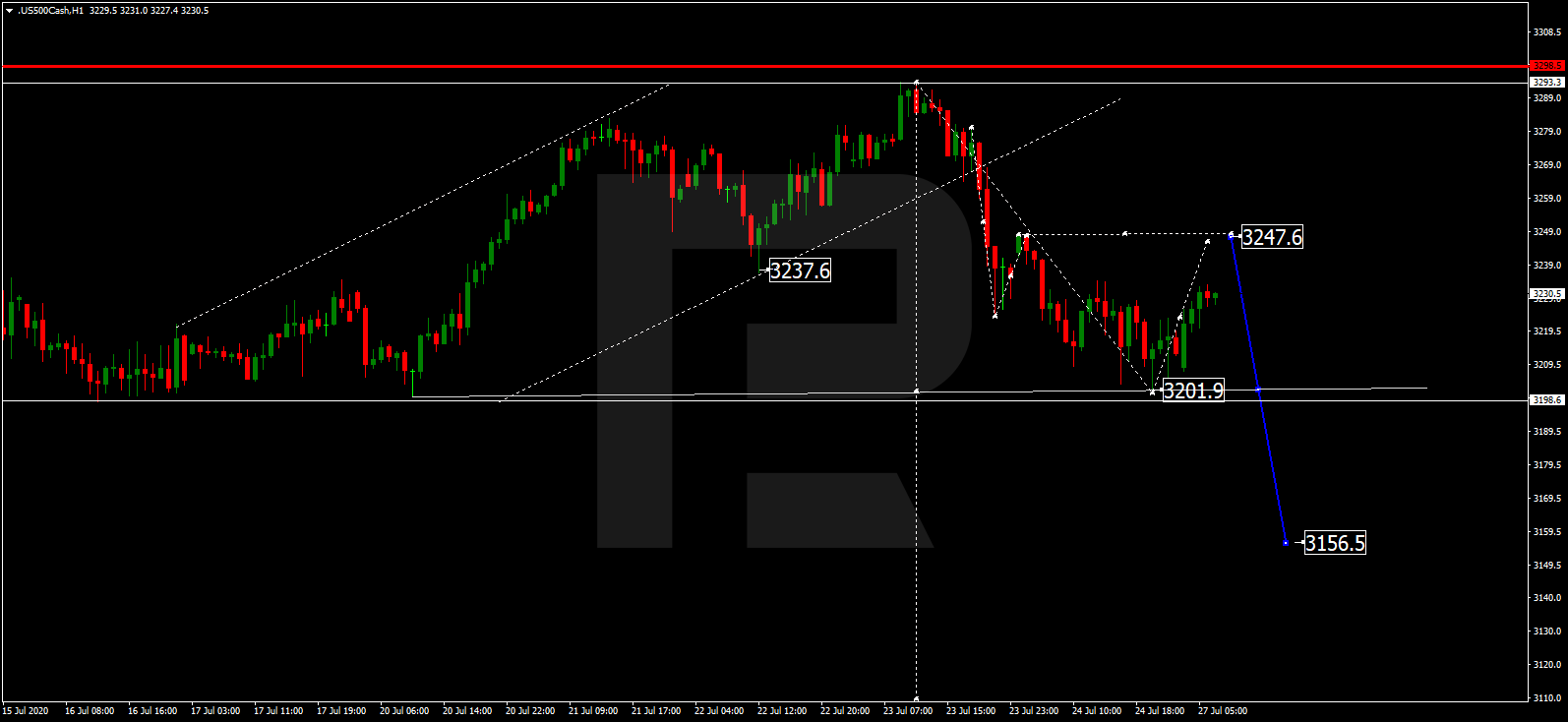

S&P 500

After completing the descending impulse at 3201.1, the S&P 500 Index is correcting with the target at 3247.6, at least. After that, the instrument may a new descending structure to break 3200.0 and then continue trading downwards with the short-term target at 3156.5.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.