By Lukman Otunuga, Research Analyst, ForexTime

There was no love for the Dollar this week as economic prospects improved outside of the United States while surging coronavirus cases across the country raised doubts about the pace of economic recovery.

Over the past few weeks, the Greenback has gone from hero to zero thanks to a range of factors including, shaky macro fundamentals, jitters ahead of November’s presidential election and the Federal Reserve pumping massive amounts of Dollar liquidity into markets.

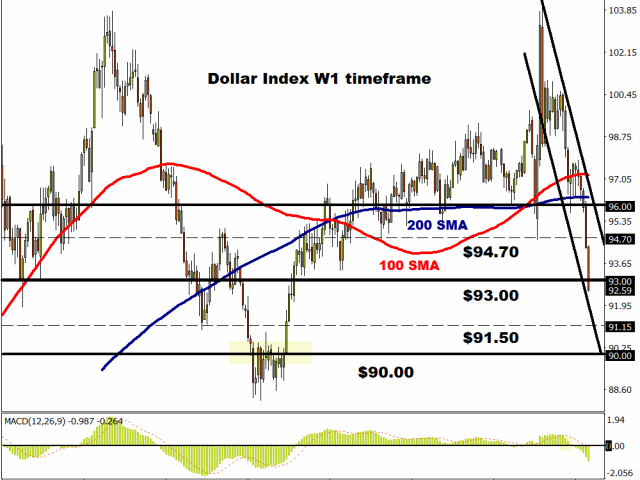

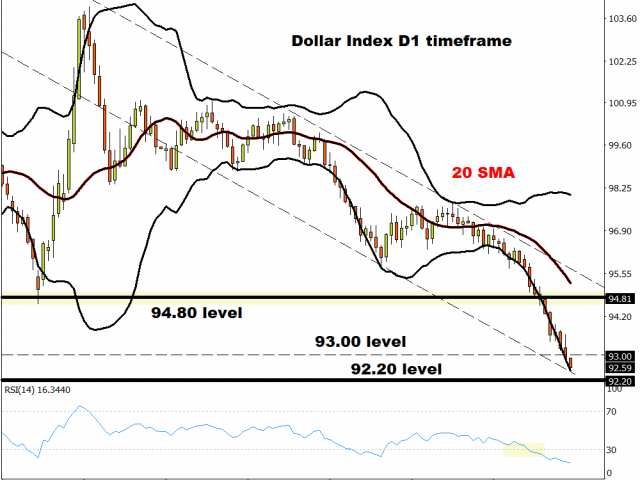

The road ahead for the Dollar is likely to be filled with many obstacles, especially after the US suffered its worst economic decline on record by contracting by 32.9% in the second quarter of 2020. As July slowly comes to an end, the Dollar Index (DXY) is on the verge of experiencing its worst month in 10 years!

Looking at the technical picture, prices have tumbled almost 5% this month – dragging the DXY towards the 92.50 support level. A monthly close under this point could encourage a decline towards 92.20 and 91.50, respectively.

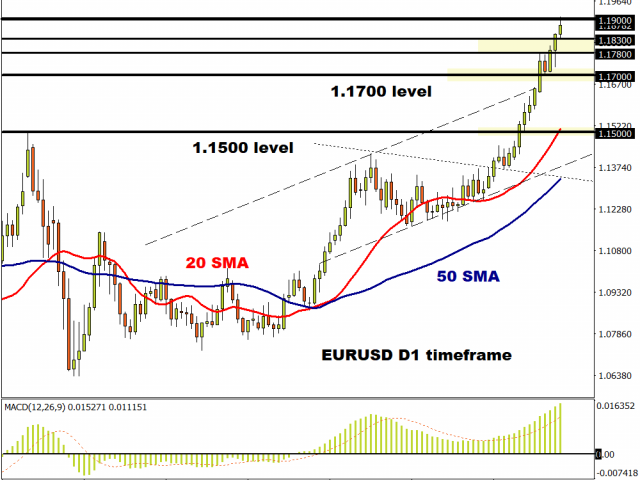

EURUSD slams into 1.1900.. what next?

A broadly weaker Dollar has injected Euro bulls with enough inspiration to charge towards the 1.1900 resistance level.

The last time the EURUSD touched such levels was back in August 2018. Prices remain heavily bullish on the daily charts with a strong close above 1.1900 opening a path towards 1.1200. If 1.1900 fails to budge, then prices could retrace to 1.1830 and 1.1780, respectively.

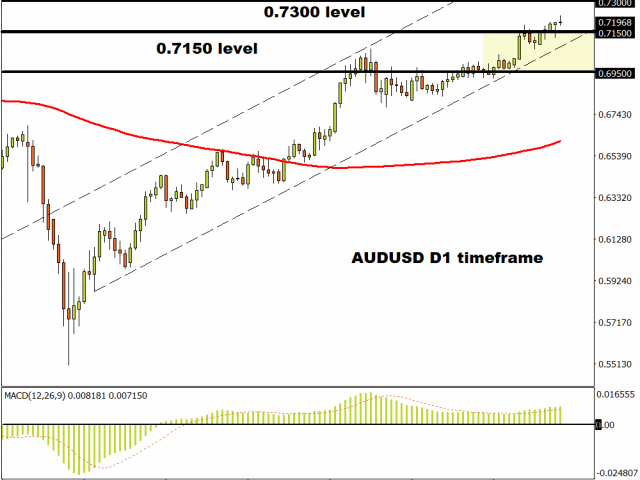

AUDUSD eyes 0.7300

Expect the AUDUSD to push higher in the week ahead if a weekly close above 0.7150 is achieved. Such a move may open the doors towards 0.7300 which is roughly 150 pips away.

Pound smiles into the weekend

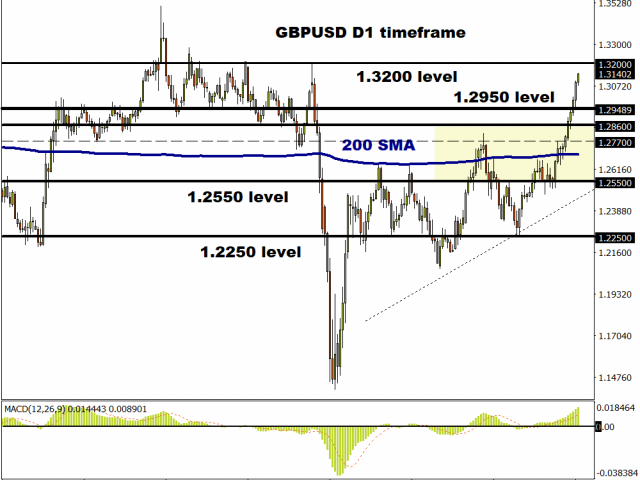

Surprisingly, the Pound has appreciated against every single G10 currency this week despite the uncertainty surrounding Brexit negotiations.

The GBPUSD looks mighty bullish on the daily charts with the upside momentum potentially taking prices towards the 1.3200 resistance level.

Commodity spotlight – Gold

Gold is on route to concluding the trading week almost 4% higher thanks to a broadly weaker Dollar, dovish Federal Reserve, pre-election jitters and rising coronavirus cases in the United States. Buying sentiment towards the precious metal may remain robust in the near term as negative themes fuel risk aversion. Looking at the technical picture, Gold is trading less than $30 away from the psychological $2000 level. A weekly close above $1950 may open the doors to fresh all-time highs in the week ahead.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com