By IFCMarkets

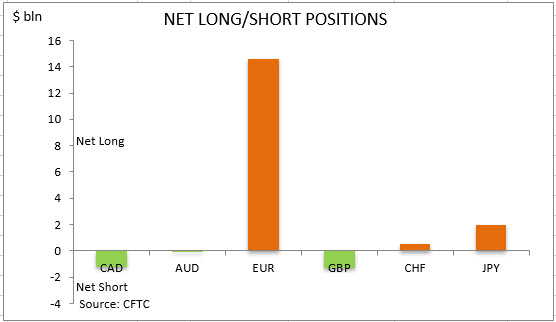

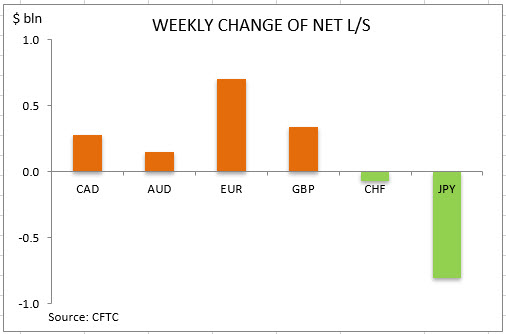

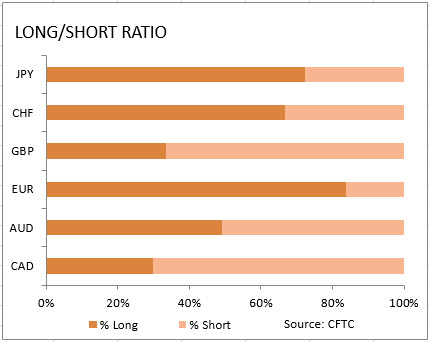

US dollar net short bets declined to $14.48 billion from $13.89 against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to July 7 and released on Friday July 10. The change in net short dollar bets resulted from significant decrease in bearish bets on Canadian dollar, British Pound and increase in bullish bets on euro, which outweighed a marked decrease in yen bullish bets. The Pound, Canadian and Australian dollars maintained net short positions against the dollar. The bearish dollar bets rose again despite US Labor Department data showed that the US added back 4.8 million jobs in June when a gain of 3.7 million jobs was expected, and Institute of Supply Management report its manufacturing purchasing managers index climbed to 52.6 from 43.1 in May. Readings above 50 indicate an expansion in economic activity. Bullish euro view was supported by sharp easing in euro-zone’s business activity contraction in June according to final services PMI reading.

CFTC Sentiment vs Exchange Rate

| July 07 2020 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | positive | -1236 | 275 |

| AUD | bearish | positive | -48 | 153 |

| EUR | bullish | positive | 14599 | 706 |

| GBP | bearish | positive | -1287 | 339 |

| CHF | bullish | positive | 501 | -71 |

| JPY | bullish | positive | 1954 | -809 |

| Total | 14483 |

Market Analysis provided by IFCMarkets

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.