By The Gold Report – Source: Chris Temple for Streetwise Reports 06/23/2020

Chris Temple of The National Investor delves into what sets Omineca Mining and Metals apart.

I had been familiar with the story and potential of uber micro-cap (a valuation of little more than C$3 million or so for a LONG time!) Omineca Mining and Metals Ltd.’s (OMM:TSX.V; OMMSF:OTCMKTS) for years. But as gold was beginning to percolate and other necessary ingredients came together as last year got underway it was time for me to bring this incredible opportunity to my members.

“Back in late February/early March when gold stocks got annihilated for a while along with the broader market, Omineca didn’t flinch. The share price has fairly methodically “stair-stepped” higher for a while now.”

I and others that are in the business of researching and recommending “story” companiesespecially in the resource spacecontinuously stress the CRITICAL element of management. Many a promising company and project has been destroyed by bad management; whether that is of greedy execs milking an emerging company dry via high salaries, simply not having the right talent for the specific jobs at hand or whatever.

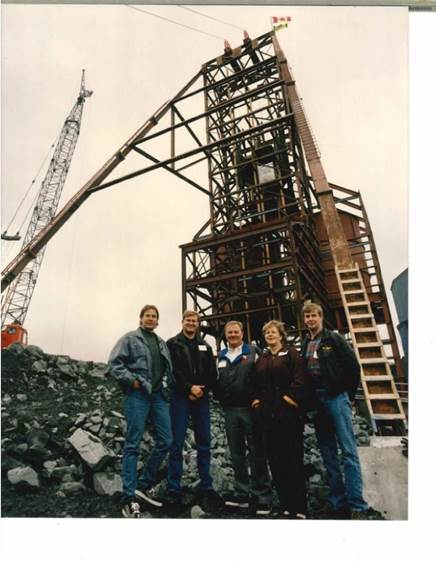

Over the years, few managements have served our Members better than have those led or initiated by the MacNeill family of Saskatoon, Saskatchewan. “Dad” Bill is one of the most accomplished resource investors in the province, most notably, for our purposes, as the founder and long-time chairman of the former Claude Resources, which was bought out in 2016 by SSR Mining (Nasdaq-SSRM). And as some of you know, SSRM has since demonstrated what Bill and many of us long believed: this little gold mine he founded is the anchor of one of Canada’s emerging new districts.

A trip down Memory Lane; the 1997 construction of the head frame at Claude’s Seabee Mine. The MacNeill clan L to R: Tom, Ken, Dad Bill, Mom Sharon and Jon.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

One son, Ken, is the president and CEO of Star Diamond Corporation. As I have said in years past upon my recommendation initially of the former Shore Gold and subsequently, I have seldom met a more frank, honest and understated chief executive of a company; notableamong other reasonsespecially given that the company owns the largest diamond-bearing kimberlites in the world. These days, Rio Tinto has joined Star as an advanced exploration and potential development partner.

Our longest-tenured members remember Star as one of THE most rewarding picks I’ve ever passed on; one of my Top Ten most profitable individual stocks ever. Getting into both Shore/Star and former fellow SK diamond explorer Kensington Resources (which Shore later absorbed) not too far from the C10 cents/share area, most of my recommended selling came in the neighborhood later of C$5.00/share. Those awesome gains were realized when the company’s kimberlite bodies in Saskatchewan’s Fort a la Corne provincial forest likewise vindicated what the MacNeills had believed: that much better, larger and higher-grade diamonds existed there than what had been seen in scant prior exploration.

Years later the family re-gathers (save for Tom who couldn’t make it, but was replaced by geologist daughter Laura) on the occasion of the one millionth ounce of gold poured at Seabee.

And as I first expressed back last March when I added Omineca to my recommended list, signs have been increasing here as well (not the least of which has been evidenced by that enviable stock price chart on the first page!) that it is now THIS MacNeill-run company’s turn to shine!

Omineca’s Wingdam Project

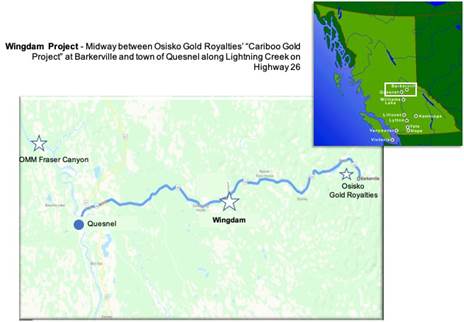

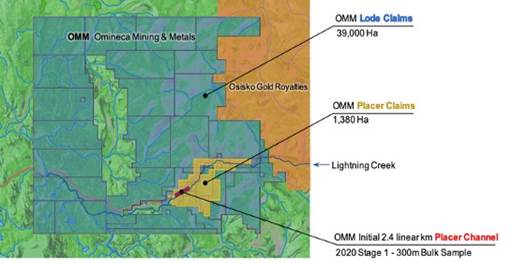

As you’ll see on Omineca’s website its chief asset is the Wingdam Gold Project, about 45 km east of Quesnel, British Columbia. Past exploration and sampling work there suggests that the area of a unique alluvial gold-bearing deposit OMM controls here has the richest gold grades of anything known of in the entire Cariboo District.

The material in question is what’s called an “unconsolidated conglomerate” about 50 meters below the present-day surface of Lightning Creek. Think of a typical stream channel that was at one point buried by gravel and glacial till. That there is such an apparent high grade of gold in this underground paleo channel is because it is so “hidden”; the prospectors who flocked to this area of British Columbia around 1860 after gold was discovered in the surface streams of Lightning and Williams Creeks in the Cariboo recovered what they could see. Obviously, they could not see the older buried stream below the one they were panning gold in!

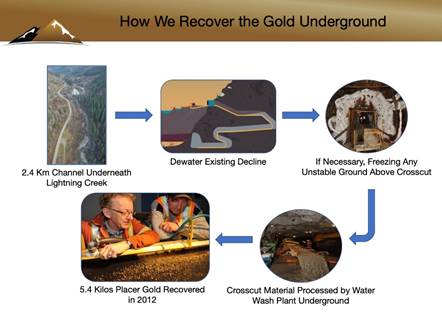

Of course, recovering this gold is challenging due to the “loose” nature of the material and the 50 meters or so of gravel, etc. on top of it. But back in 2012, management demonstrated that gold could be recovered from this underground paleo channel by freeze mining: freezing solid the area surrounding gold-bearing gravels so as to make it safe to take one “slice” at a time from the underground channel. Indeed, it was “sister” company 49 North Resources, Inc. (TSXV-FNR; OTC-FNINF) that was an original funder, bringing to Saskatchewan this kind of freezing technology.

Under the leadership of Len Sinclair and OMM’s lead geologist Steve Kocsis (left/right, respectively, in the nearby photo, examining some of the gold recovered) Wingdam (then a private company before being brought under the ownership of Omineca) successfully recovered 5.4 kilos of placer gold in one narrow “crosscut” underneath about 40 meters, in that location, of wet overburden underneath Lightning Creek. Sinclair is still part of the project, serving on Omineca’s Advisory Board. Kocsis”Mr. Cariboo” as C.E.O. MacNeill calls him due to his vast experience in the areais heading up exploration.

Two things were demonstrated in that successful recovery. The first was that this kind of freeze mining (still used to this day to mine potash and phosphates from underground mines in the province) could work to cover buried alluvial gold as well. So while a tedious prereparation process is required, this can be done!

Secondand more excitingis that the gold recovered in 2012 was double what management had expected to see in this one cross-cut. This further bolsters the company’s own estimate and that of geologists and engineers that have been involved that there could be in the neighborhood of 200,000-250,000 ounces of gold within the 2.4 kilometer-long focus area under Lightning Creek.

Yet management decided for a couple reasons to “sit” on Wingdam for a while. First of all, as you likely remember, this was the point at which the torrid gold run of late 2008-2011 was reversing. So with a falling gold price, financing the work and/or finding a partner here was not an attractive option. That was made more of a challenge by the fact that there is not an NI 43-101-compliant resource estimate at Wingdam. And as C.E.O. Tom MacNeill has pointed out to me over time in our conversations, the C$10 million-plus that would have to be spent to confirm a resource to that standard would largely be wasted money, since the company was confident of what it has.

The process to, at last, exploit the potential at Wingdam restarted in earnest last March 1, when Omineca announced that it had contracted with HCC Mining and Demolition, Inc. of Saskatoon, Saskatchewan to be its partner at Wingdam. A 125 year-old company that Omineca knows well, HCC is supplying all the equipment and up-front capital necessary to, initially, start a “bulk sampling” program in the paleo channel. Omineca gets half of the gold recovered at a cost to OMM of C$850.00 per ounce. The Canadian currency price of gold as of this writing is around C$2,350.00/ounce.

Compared to most any other kind of gold recovery (and with this alluvial deposit, it can’t be more simple as virtually all is so-called “free” gold) the process of recovering gold in the first bulk sample contemplated in the agreement will be relatively easy and likely won’t take terribly long. Having already successfully “plugged” an upstream source of waterand preparing the paleo channel as we speakit seems as though the first freezing and cross-cuts will be taking place this summer. Barring any surprises, the companies believe they can fully bulk sample an initial 1.5 kilometer area (working out from the middle of the 2.4 kilometer target) in the next 1824 months.

Keeping in mind that 1. There is NOT an NI 43-101-compliant “resource” and 2. There is no guarantee of anything (which is why Omineca is necessarily characterized a speculative stock) let’s “speculate” and say that the companies ultimately recover but 10% of the gold believed to be in the paleo channel. That to OMM would mean its share would be between 10,000 and 12,500 ounces. I’ll use the smaller number.

At a net to Omineca of C$1,500/ounce, that would mean cash to the company of C$15 million, or HALF its current market cap even after the strong move of recent months. If the companies’ prior estimates are realized, that’s C$150 million in cash for Omineca; FIVE TIMES ITS MARKET CAP.

Take your pick. But on this potential cash flow alone, I and others who listened to me were sufficiently excited in the recent past to participate in two private placements the company offered to fund an even more staggering potential. In the end, this could be even more of a blockbuster story than I first thought; and why I have on a few recent occasions suggested that one day Omineca Mining and Metals could supplant biotech Sarepta Therapeutics (NASD-SRPT) as my MOST profitable recommendation ever.

NOW WE’LL MAKE THINGS REALLY INTERESTING!

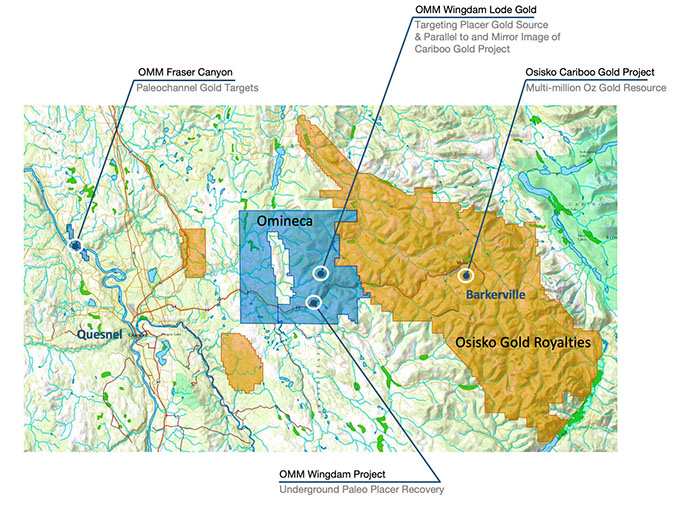

As the attention of a few people was beginning to turn to Omineca’s story last year, the potential of the broader Cariboo area got a much higher-profile shot in the arm. In late September, Osisko Gold Royalties (NYSE-OR) announced that it was paying a 44% premium for Barkerville Gold Mines whichas you see in the below graphicis essentially Omineca’s “next-door neighbor.” The acquisitive-minded Osisko was animated not only by Barkerville’s existing high-grade gold resource, but believe there’s more where that came from.

It needs to be understood that there is no place in the province of British Columbia that has ever produced higher gold grades than the Cariboo (for some very interesting history, check out Cariboo Gold Rush for some of the back story; indeed, B.C. became a province on the strength of the first Cariboo Gold Rush back when!)

It’s one thing to understand the hidden nature of the underground gold in the buried paleo channel at Wingdam. But it’s the potential “lode” (hard rock) gold nearby Wingdam that may be about to take on new meaning for Omineca as well.

Back around the time of the first announcement (January 17, which you can read with other recent a news) that Omineca had considerably increased its own foot print to, now, being the second-largest land holder in the Cariboo behind Osisko) I had a particularly fascinating conversation with Tom. In fact, it stretched into parts of two days, and was incredibly detailed to me by a man who is characteristically VERY understated as are his father and brother Ken, but who was now bubbling over with excitement.

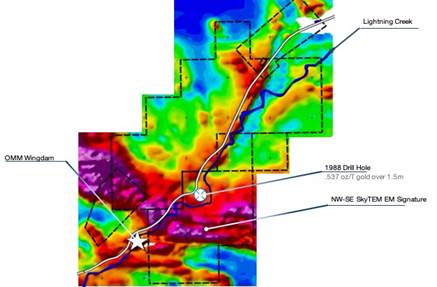

Among other things, Omineca had come into possession of additional historical information on Wingdam and the surrounding area; specifically for our present discussion purposes here, SKYTem geophysical data from a different company back in 2012 that had flown over the Wingdam area. Over a few days’ time, I went through the nearly 200-page wrap-up of that survey.

MacNeill and his brain trust began connecting some dots once they started to study this information. Previously, on the past small bulk sample at Wingdam, he had remarked, “One of the striking things that came out is the nature of the gold.” Without getting into technical details/definitions, it was clear by the coarse and “nuggety” nature of the gold recoveredand the relative lack of “fine” goldthat what was recovered so far at Wingdam did not travel very far at all.

Often timesin most any setting where there is placer golda search will ensue for the possible lode, or hard rock, source. Again, in simple terms, a combination of factors initially led to such gold being liberated from someplace and settling in one or more downstream places. That’s where gold ever found in streams came from, by and large. And MacNeill has always suspected that the gold they have seen thus far could well have come from a nearby source, given its appearance. Indeedas he also mentioned to me during one of our past discussionseven during that prior 2012 bulk sample, as the underground recovery finished gathering the unconsolidated/buried placer materialnoticeable in the wall was visible gold within quartz veining.

As other dataincluding that 2012 surveyhave been compiled, one astonishing possibility that has been revealed is that even that underground gold-bearing paleo channel about to be bulk sampled may be sitting right on top of or VERY near a heavily mineralized lode deposit.

Nearby, you see one graphic from that 2012 survey which is a “magnetic” look of the Wingdam area proper. The highly magnetic (purplish) signature is from a depth of 99 to 115 meters below surface.

Two things were immediately evident, even to me. First, the purplish coloration from, roughly, more West-to-East near the bottom of the graphic is hot. Typically, metals, etc. associated with gold will give off such a magnetic signal; this is always what you look for in doing airborne or other magnetic surveys.

Second, this area is not only fairly well-defined/constrained but cross-cuts the paleo channel and modern-day river bed above. Further, it is a bit upstream from the Wingdam camp area (which is specifically the thin white area in the bottom left portion of the nearby graphic, marked with a star.)

The hypothesis, in part, is that 1. Past activity could have ripped apart some of the “wall” in that purple/surrounding area and deposited some gold in the paleo channel area at Wingdam and 2. Almost all of that past wall appears still intact and heavily mineralized. So the second major priority for 2020and a potentially HUGE second catalyst for the company’s story and its stockwill be for Omineca to start drilling these and other nearby hard rock targets for gold.

Getting to Work!

On June 10, Omineca announced that it had closed an oversubscribed private placement and had commenced field work at Wingdam. Stephen Kocsis, P. Geo, has been appointed the lead geologist for the Wingdam hard rock exploration project. Based in nearby Quesnel, B.C., Kocsis has spent his career exploring for gold and other mineral deposits in the Cariboo Mining District and has authored numerous papers and technical reports covering the project area, including on Wingdam itself.

With snow cover now receded, management, Stephen and the geological team from Axiom Exploration Group have been to the site and surveyed the initial locations of interest identified by geophysics to coordinate plans and procedures for the 2020 exploration and drilling program. As you can read in the above-cited news release, ultimately the plan is to drill some 8,000 meters of core in 27 specific targets within about a three-kilometer “sphere” of the underground paleo channel area, once the work to narrow the specific targets is done and permits are in hand.

Separately, I expect before much longer to see an update on the underground bulk sample program work’s progress as well.

Summing Things Up

Those of you particularly who have more experience than the average investor in gold exploration know that the majority of smaller exploration companies do NOT make it for one reason or another. They are inherently speculative; but can carry very high rewards if things work out, to go along with the risk.

As I have shared Omineca’s story with, first, my members at The National Investor as well as colleagues, it’s exhibited itself as one that is truly unique. With not one but two major projects for a small company such as it isthe underground bulk sample-gold recovery via its partner HCC and now the aggressive hard rock exploration in its own rightOmineca’s potential is mind-boggling if even just one of these gambits is a success. If both are, this company could be one of those once-in-a-generation wealth builders for those who get in before the (hoped-for) fireworks start.

I need to quickly discuss the chart from the beginning of this article again. Among the important points I really need to drive home here is that back in late February/early March when gold stocks got annihilated for a while along with the broader marketOmineca didn’t flinch. The share price has fairly methodically “stair-stepped” higher for a while now.

About 75% of Omineca is owned by management and insiders (the lion’s share of that by 49 North.) None of them are going to take a five-bagger of recent months and cash in anything with such potential lying ahead. Likewise, those of us who have been getting into Omineca for the last year or so now understand the huge potential here, and I, for one, want to be along for ALL of this ride!

I urge you to do your own “homework” on Omineca, and quickly. Among other things, take the time to check out Omineca’s just-updated Corporate Presentation.

For more information, a good “primer” of sorts for you would be CEO Tom MacNeill’s presentation at the Metals Investor Forum in Vancouver earlier this year; it can be seen here.

Finally, here’s a lengthy interview as well with Tom given to our mutual friend Peter Bell (on the far left in the photo above, visiting with Tom at the M.I.F.).

Wrapping it all up from the end of that interview to bring my

own interest in and excitement about Omineca back home, heres that interviews close, after kudos to analyst David Morgan for highlighting Omineca at that Forum:

Peter Bell: And a shout-out to Chris Temple, as well. Another voice in the wilderness there.

Tom MacNeill: He was the first person to talk about us in print. And that’s because, Chris, very much like you Peter, is early onto stories. He was up in Saskatchewan back in the 1980s when my father was originally developing the Seabee project in Saskatchewan. Like you, he gets there early because he’s a deep thinker and he knows exactly where to look for wins. One of the things I think he understands is to bet on the jockey, not the horse.

Don’t forget that those of you so inclined can follow my thoughts, focus and all daily.

- On Twitter, at twitter.com/NatInvestor

- On Facebook at www.facebook.com/TheNationalInvestor

- Via my (usually) daily podcasts/commentaries at www.kereport.com

- On my You Tube channel, at www.youtube.com/channel/UCdGx9NPLTogMj4_4Ye_HLLA

To become a Member of The National Investor for ALL my sector and individual stock recommendations and MUCH MORE, visit me at https://nationalinvestor.com/subscribe-renew/

A Reminder. . .

HOW TO PURCHASE SHARES OF OMINECA MINING IF YOU ARE A U.S. INVESTOR USING A U.S.-BASED BROKERAGE ACCOUNT

For those of you who are not already used to buying shares of companies such as Omineca that are listed primarily in Canada, I want to give you a quick and easy “tutorial.” It’s MUCH easier than you think, if you have never done so, to buy such companies in any U.S. brokerage account. Indeed, as I have explained in one of my investor tutorials, it’s just as easy and inexpensive to buy shares in an Omineca as it is to buy Apple!

Many larger Canadian and other foreign companies have primary listings on more than one major exchange. For those listed on the New York Stock Exchange or the Nasdaq as well as Toronto, you need only buy/sell using the U.S. market. Generally, there would be no reason to check prices and such on the Toronto Exchange first.

More often than not, smaller companiesfor both cost and logistical reasonsdo not LIST their shares on a major U.S. exchange. But they are still easily TRADABLE in the U.S. via the NASDAQ’s OTC Market. All you need to know is the company’s symbol; unlike most U.S.-listed companies, it will always be a five-letter symbol ending with an “F.”

In Omineca’s case, its ticker symbol in the U.S. is OMMSF , while on the Toronto Venture Exchange in Canada it is OMM.

The main consideration in buying shares of Canadian stocks via the U.S. OTC market is that SOMETIMESif you look at the OTC quote FIRSTyou are not getting as fresh and accurate a price as you would if you went to the Canadian Exchange. This is because with most, the majority of their activity is on the Canadian market where it is listed; sometimes hours can go by between trades on the OTC, if the company you’re looking to buy isn’t actively traded at the time. Thus, you simply need to insure, via a simple process, that you are neither overpaying for a stock when you buy it, nor getting less than you should when you sell. That is easy to accomplish.

The most reliable and current quotes for shares of companies such as Omineca are to be found first on the Canadian Exchange where they are primarily LISTED. Prices and volume activity are updated all through the trading day on the Toronto Exchange, TSX.V and the TSXV, just as they are on the NYSE or NASDAQ, and are generally fresh/instantaneous.

I will use the following example to show the simple process that will normally take you LESS THAN TWO MINUTES to enter a trade to buy Omineca’s stock via the OTC market in the U.S., in a typical U.S.-domiciled brokerage account:

1. First check the Canadian quote for the company, via its ticker symbol on the TSXV, which is OMM. You’ll find this at the Exchange’s web site, https://tmx.com/. Plug in “OMM.” We’ll say for purposes of this lesson that the current asked price for OMM’s shares is C$0.30, or 30 cents per share in Canadian currency.

2. Next determine what that price is in U.S. currency. If you don’t follow exchange rates on a daily basis, you can get a fresh picture by going to Kitco’s website, at www.kitco.com (or your own favorite one that lists currency differentials; there are many.) Near the bottom of Kitco’s front page, you will find a table of various currency exchange rates. At this writing the Canadian dollar, rounded off, is worth 73.5 cents in U.S. currency.

3. Do the math as to what OMM’s U.S. asked (selling) price on the OTC market should be:

C 30 cents per share X .735 = US 22.05 cents per share.

4. Finally, enter a LIMIT ORDER to buy the number of shares of Omineca you want in your U.S. brokerage account at or very near that price. Personally, I would first start with US 22.1 cents per share. If the order doesn’t fill right away, bump it up by a tenth of a cent once or twice until it does (these days, most online brokers will allow you to use tenths of a cent in pricing.)You would use the company’s 5-letter symbol, which is OMMSF.

It’s that simple! And, of course, you would do much the same thing when it was time to sell some of your holdings. But in the case of a sale, you would focus on the bid price listed on the TSX’s site for the company in question.

Chris Temple is editor and publisher of The National Investor. He has had an over 40-year career now in the financial/investment industry. Temple is a sought-after guest on radio stations, podcasts, blogs and the like all across North America, as well as a sought-after speaker for organizations. His ability to help average investors unravel, understand and navigate today’s markets is unparalleled; and his ability to uncover “off-the-radar” companies is likewise.

His commentaries and some of his recommendations have appeared in Barron’s, Forbes, CBS Marketwatch, Wall Street’s Best Investments/The Cabot Group, Kitco.com, the Korelin Economics Report, Benzinga.com, Palisade Radio, Mining Stocks Education, Mining Stock Daily and other media.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Chris Temple’s and The National Investor disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Omineca Mining and Metals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Omineca Mining and Metals. Please click here for more information. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Omineca Mining and Metals. Please click here for more information.The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals, a company mentioned in this article.

The National Investor is published and is e-mailed to subscribers from [email protected]. The Editor/Publisher, Christopher L. Temple may be personally addressed at this address, or at our physical address, which is: National Investor Publishing, P.O. Box 1257, Saint Augustine, FL 32085. The Internet web site can be accessed at https://nationalinvestor.com/. Subscription Rates: $275 for 1 year, $475 for two years for “full service” membership (twice-monthly newsletter, Special Reports and between-issues e-mail alerts and commentaries.) Trial Rate: $75 for a one-time, 3-month full-service trial. Current sample may be obtained upon request (for first-time inquirers ONLY.) The information contained herein is conscientiously compiled and is correct and accurate to the best of the Editors knowledge. Commentary, opinion, suggestions and recommendations are of a general nature that are collectively deemed to be of potential interest and value to readers/investors. Opinions that are expressed herein are subject to change without notice, though our best efforts will be made to convey such changed opinions to then-current paid subscribers. We take due care to properly represent and to transcribe accurately any quotes, attributions or comments of others. No opinions or recommendations can be guaranteed. The Editor may have positions in some securities discussed. Subscribers are encouraged to investigate any situation or recommendation further before investing. The Editor receives no undisclosed kickbacks, fees, commissions, gratuities, honoraria or other emoluments from any companies, brokers or vendors discussed herein in exchange for his recommendation of them. All rights reserved. Copying or redistributing this proprietary information by any means without prior written permission is prohibited. No Offers being made to sell securities: within the above context, we, in part, make suggestions to readers/investors regarding markets, sectors, stocks and other financial investments. These are to be deemed informational in purpose. None of the content of this newsletter is to be considered as an offer to sell or a solicitation of an offer to buy any security. Readers/investors should be aware that the securities, investments and/or strategies mentioned herein, if any, contain varying degrees of risk for loss of principal. Investors are advised to seek the counsel of a competent financial adviser or other professional for utilizing these or any other investment strategies or purchasing or selling any securities mentioned. Chris Temple is not registered with the United States Securities and Exchange Commission (the SEC): as a broker-dealer under the Exchange Act, as an investment adviser under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

Notice regarding forward-looking statements: certain statements and commentary in this publication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 or other applicable laws in the U.S. or Canada. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of a particular company or industry to be materially different from what may be suggested herein. We caution readers/investors that any forward-looking statements made herein are not guarantees of any future performance, and that actual results may differ materially from those in forward-looking statements made herein.

Copyright issues or unintentional/inadvertent infringement: In compiling information for this publication the Editor regularly uses, quotes or mentions research, graphics content or other material of others, whether supplied directly or indirectly. Additionally he makes use of the vast amount of such information available on the Internet or in the public domain. Proper care is exercised to not improperly use information protected by copyright, to use information without prior permission, to use information or work intended for a specific audience or to use others’ information or work of a proprietary nature that was not intended to be already publicly disseminated. If you believe that your work has been used or copied in such a manner as to represent a copyright infringement, please notify the Editor at the contact information above so that the situation can be promptly addressed and resolved.

Additional disclosure: Omineca Mining & Metals was formally recommended to paid subscribers/Members of The National Investor in

March, 2019. Neither this nor any company recommended by Chris Temple pay for such recommendations, which the Editor makes based on his own research, opinions, due diligence, best efforts, etc. In some cases, following a recommendation to subscribers/Members, companies will work with National Investor Publishing in regard to media placement and added advertising/distribution of Editors recommendation of the company. In the case of Omineca, the company has paid to National Investor Publishing a total of approximately US$7,500.00 prior to and concurrent with this particular report for the companys profile being included in a separate, Gold-centric Special Issue, for this particular individual Profile of the Company and for reprint rights/rights to separately distribute the same as it sees fit. This is simply an advertising/editorial service provided to Omineca by National Investor Publishing. National Investor Publishing does not engage in investor relations, brokerage, investment advisory or any similar, regulated activity in conjunction with the publishing of this Special Report. As of the date of this Special Report, the Editor owns securities of Omineca.

( Companies Mentioned: OMM:TSX.V; OMMSF:OTCMKTS,

)