Technical analyst Clive Maund explains why he believes investors should be looking at silver right now.

By The Gold Report – Source: Clive Maund for Streetwise Reports 05/21/2020

We are now entering the final part of the endgame of the latest fiat experiment and the actions of the Fed and other central banks virtually guarantee that most currencies, including and especially the dollar, will end up totally worthless, just like in the Weimar Republic in Germany in 1923. Needless to say, in such an environment, anything that has real value like gold and silver, will soar in price, and even make intrinsic gains as everyone eventually tries to get aboard the lifeboat.

Massive deflationary forces are already ravaging the economy, with the virus scare acting as a catalyst, and already millions have already lost their jobs and millions more will as the economy comes to a screeching halt. In the face of this the Fed and other central banks have mobilized to try to head off complete collapse and an implosion of the debt markets leading to an interest rate spike, and also to protect and advance the interests of the super wealthy still further. The Fed’s balance sheet is expanding like a supernova that is starting to explode and it is set to expand at an even more rapid rate, made necessary by a severe decline in productivity and serious disruption of global supply chains. The reason that the virus was dispersed when it was is that governments feared that collapsing economies and widespread unemployment and poverty would lead to revolution, so they needed a way to keep the population under tight control, hence the lockdowns as unemployment in the U.S. and elsewhere skyrockets with the virus as an excuse.

All of this means that both gold and silver are set to soar. As pointed out repeatedly by Egon Von Greyerz, it is not so much that gold and silver are gaining in value, but that currencies are losing value due to them growing in quantity exponentially. Gold and silver, whose value is intrinsic and cannot be destroyed, are simply moving to reflect the destruction in the purchasing power of fiat.

The “writing on the wall” was and is the yawning gap between the price of paper and the price of physical gold and silver. Recently it became huge, and given what is going on this gap was certainly not going to be closed by the price of physical gold and silver droppinginstead it would be closed by the price of paper gold and silver taking off higher, and that is what we have been seeing in recent weeks, as the biggest bull market in the Precious Metals sector in history by far gets started. Already, gold has broken out to new highs against most currencies and it is likely to do so before much longer against the dollar, even if a pullback occurs first.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

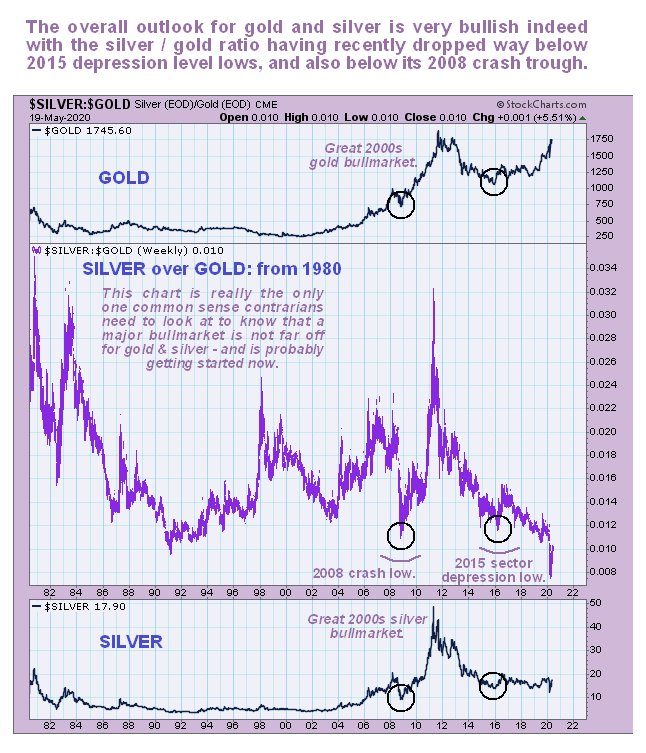

Another factor that we have for a long time now taken as a strong indication of an incubating bull market is the silver-gold ratio which recently reached an incredible low extreme as we can see on its long-term chart going back to 1980 below. Most low extremes on this indicator have coincided with sector bottoms, the most notable examples being at the 2008 crash low and 20152016 sector depression low, which were followed by major sector uptrends. Recently this ratio fell to a freak low which was a sure sign that the sector had hit bottom. Now it is recovering as silver at last starts to join the party. Gold has been rising for some time and is now starting to challenge its dollar highs and it has opened up a huge divergence with silver that will be resolved by a roaring bull market in silver.

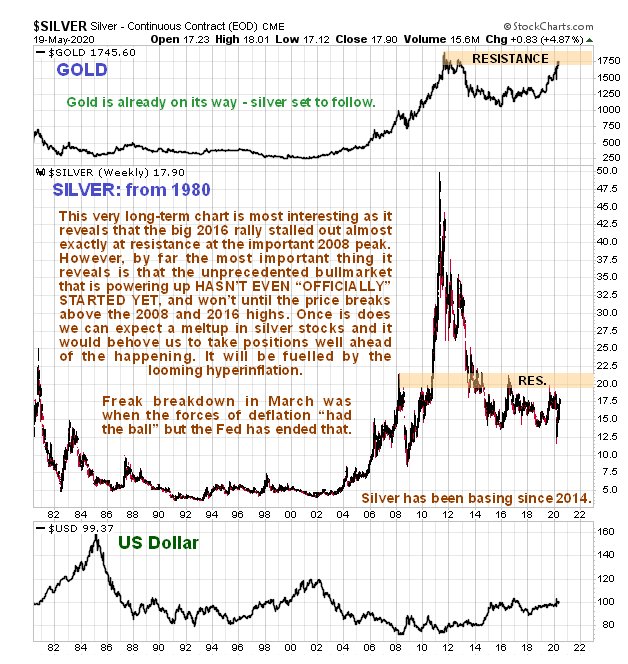

Now we will turn to the most interesting very long-term chart for silver, which also goes back to 1980 to allow direct comparison with the silver to gold ratio chart above. The first point to note is that the big rally during the 1st half of 2016 stalled out almost exactly at the resistance at the 2008 highs. But by far the most important point to observe is that the unprecedented massive bull market that is now incubating HAS NOT EVEN OFFICIALLY STARTED YET, AND WON’T UNTIL SILVER BREAKS ABOVE THE KEY RESISTANCE SHOWN ON THE CHART APPROACHING $21. Until that happens reactions are possible, but once this breakout occurs the entire sector is likely to go ballistic.

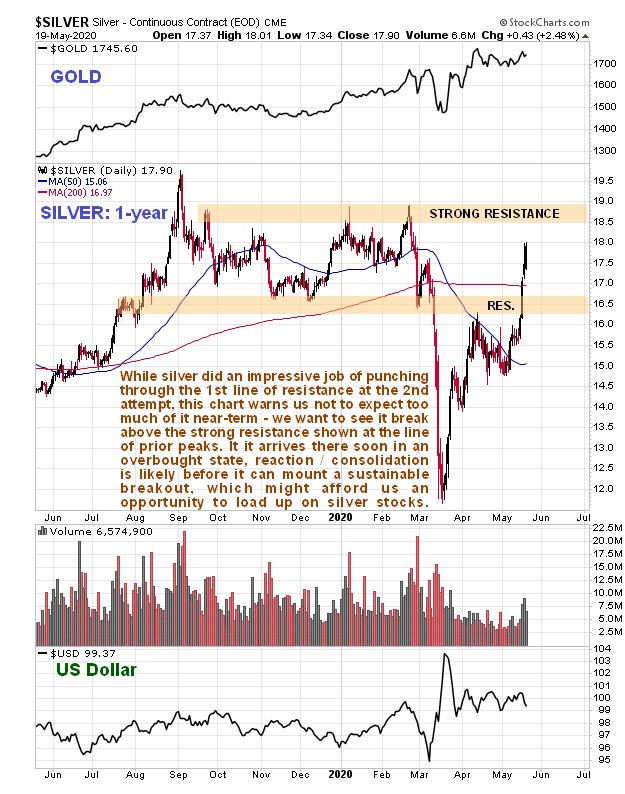

Now we will turn to the 1-year chart for silver to get a feel for what is going on right now. Whilst annotating this chart, I realized that we probably don’t need to panic about getting the silver stocks on board, because the really big action in most of them won’t start until the silver price breaks above the resistance approaching $21 that we looked at on the long-term chart, and on this chart we can see that it first has to contend with a quite strong zone of resistance approaching a line of peaks near to $19. While the current sharp advance looks like it will soon bring it to this resistance, it will arrive there in a very overbought state, which makes it quite likely that it will pause to react/consolidate, and any minor weakness at that juncture would provide us with an opportunity to load up the silver stocks on our list at somewhat better prices.

Originally posted on CliveMaund.com at 8.55 am EDT on 20th May 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.