By Orbex

With the backdrop of the current pandemic, the euro found temporary safe haven status finding willing buyers. The strength in the euro caused EURGBP to retest 10-year highs of the 0.9500 handle.

The pair likely has put on a temporary top and is currently on a retrace.

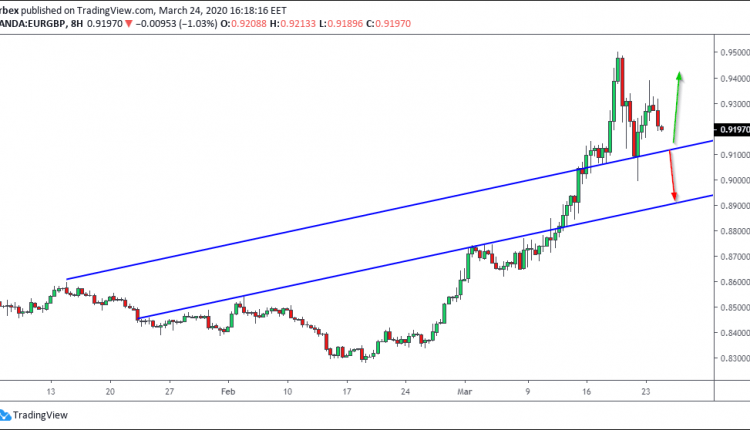

The 8-hour chart above shows two distinct levels where the retrace could end and swing back higher.

The first level comes to around the 0.9100 handle, while better-listed support would come lower to .8875.

As of now, we could expect a 0.9100 test and consolidation.

If the bounces remain shallow, we can potentially drop lower to the next resistance turning support at .8870.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

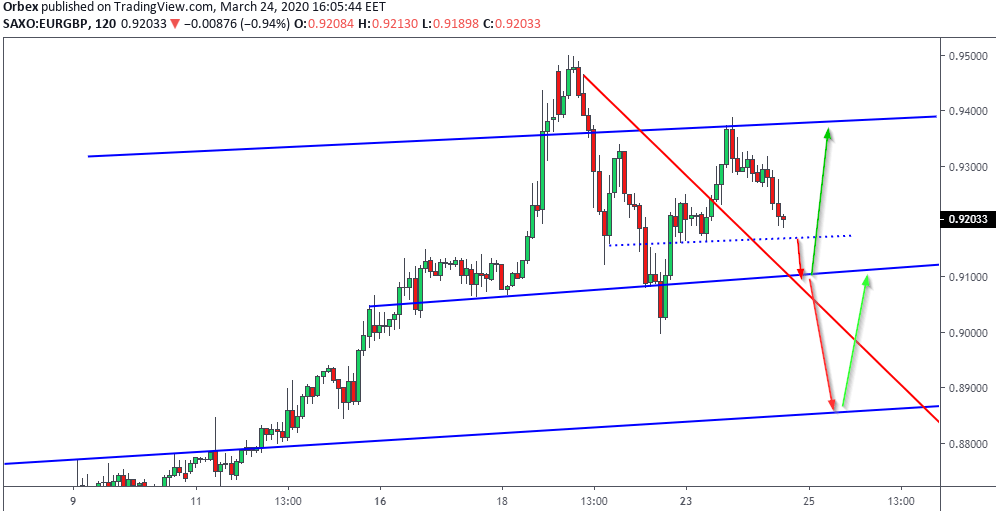

The 2-hour chart below shows an initial support to just under the 0.9200 handle. A break lower to expose 0.9110 is in line with the 8 hours.

The main resistance lies right around to the 0.9400 handle.

By Orbex