By Lukman Otunuga, Research Analyst, ForexTime

One of the world’s largest e-commerce players is scheduled to release third quarter earnings before US markets open on Thursday.

There is a strong sense of optimism over the business outlook for Alibaba Group Holding Limited amid strong mobile growth, a firmer foothold in the digital and entertainment industry coupled with rising revenues from the cloud segment. However, the company’s domestics and international growth were probably impacted by US-China trade tensions during the third quarter of 2019, something that may hit profits. Nevertheless, Alibaba’s earnings could still surprise to the upside – especially when factoring how the e-commerce giant has a history of surpassing both earnings per shares and revenue estimates.

Alibaba is expected to report earnings of $2.25 per share on $22.68 billion in revenues. A positive earnings report could boost appetite for the company’s shares with prices rebounding towards 218.00 and potentially 226.15. Alternatively, if earnings disappoint this could drag shares back towards 200.00.

S&P 500 U turns despite virus concerns

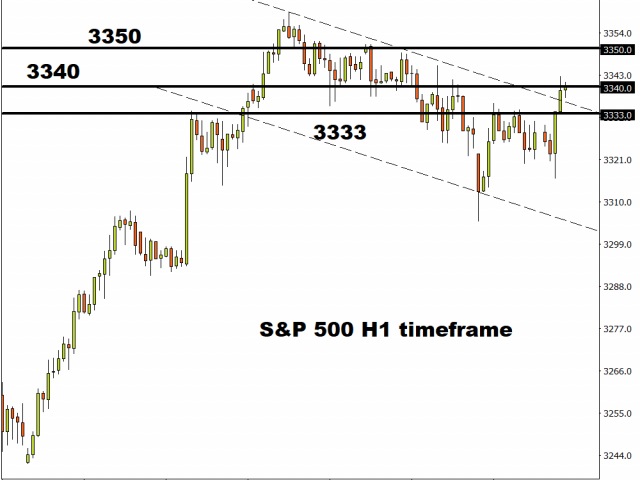

The S&P 500 has entered the week on positive note, gaining roughly 0.3% as of writing despite coronavirus fears fuelling market uncertainty and risk aversion.

The Index is trading around 3340 and could push higher towards 3350 on speculation around central banks easing monetary policy in the face of slowing global growth. Focusing on the technical picture, bulls need to break above 3340 to open a path towards 3345 and 3350. Alternatively, sustained weakness below this level should encourage a decline towards 3333 and potentially lower.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com