By Orbex

After nearly a year since President Trump started his trade war rhetoric against China, both parties have signed a deal.

The phase one of the trade deal is seen by many as a first step towards easing trade tensions between the two economic powerhouses of the world.

Equity markets charted into new highs intraday ahead of the signing of the deal.

Euro Rises on a Softer USD

The euro was recovering from the weakness earlier in the week. The gains came largely due to a weaker dollar.

Economic data from the eurozone saw the industrial production figures rising 0.2% on the month, falling below estimates. The common currency, however, brushed aside the data.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

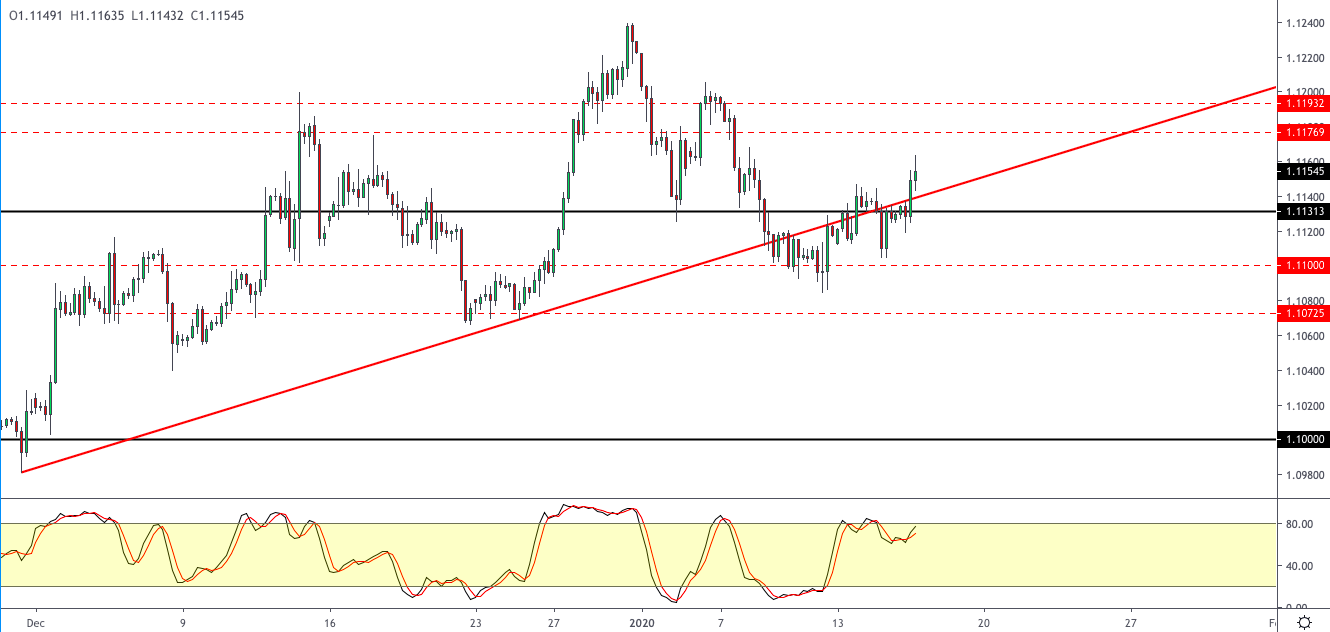

EURUSD to Move into a New Range

The currency pair is rebounding off the support area near the 1.1131 level. This is pushing the currency pair higher. However, the gains will be limited as the EURUSD will settle into the new range.

The resistance level at 1.1180 and the 1.1131 support will set the new corridor for the currency pair. A breakout from this level is needed to further confirm the direction.

UK Inflation Weaker than Forecasts

Consumer prices in the United Kingdom were tame in December. On a year over year basis, headline CPI rose just 1.3%. This was below the estimates of a 1.5% increase and down from 1.5% in November.

The pound sterling was, however, unmoved by the report.

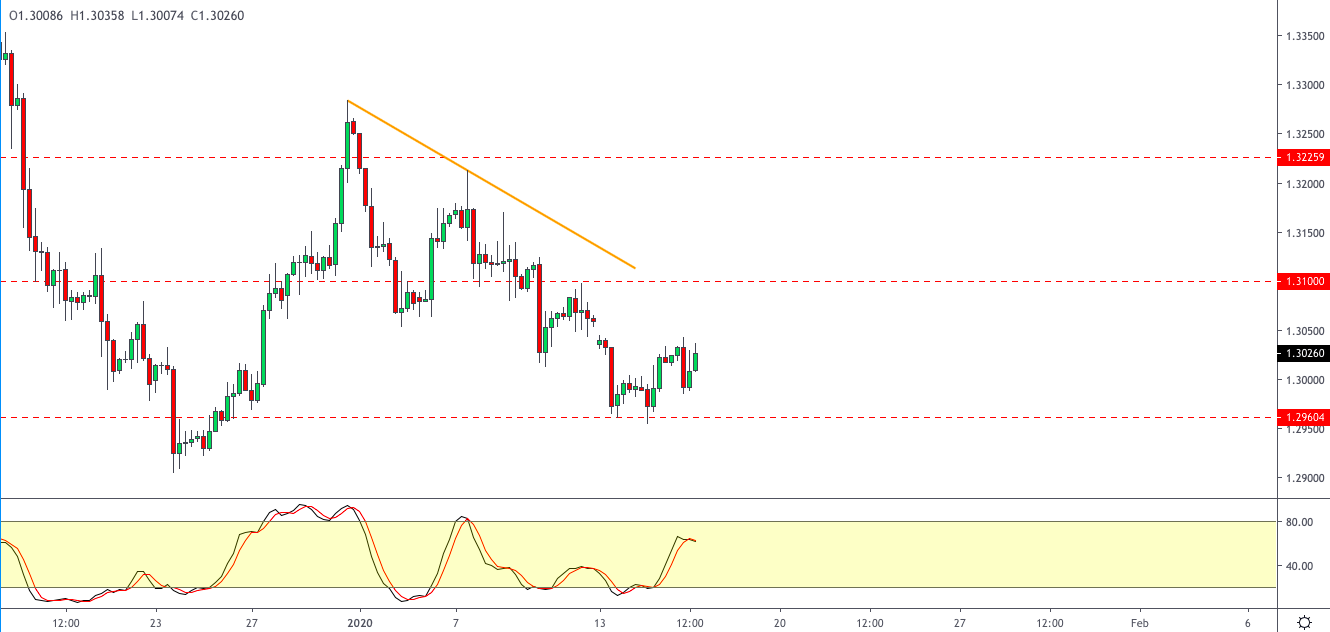

GBPUSD Consolidating Near the Bottom

Cable is gradually rising off the lows near 1.2960. Price action is forming a higher low currently. This will potentially indicate a move to the upside as the bullish divergence is forming.

The upside target remains at the 1.3100 region, with the possibility to breakout slightly higher. However, given the fact that the lower support at 1.2960 is not tested, we could see a move lower.

Gold Prices Turn Weaker on Rising Risk Appetite

The precious metal is trading weaker on the day as the risk appetite remains in favor. Investors are bullish on the US and China trade deal. The fourth-quarter earnings report kicked off with the financial companies reporting, adding to the risk appetite.

XAUUSD Could Decline Lower in the Near Term

The precious metal is forming a hidden bearish divergence. The Stochastics indicate a higher high against a lower high in price. This supports the downside test toward the 1534 region. A breakdown below this level will indicate further declines to the 1514 support area next.

By Orbex