By Orbex – The weekly crude oil inventories report is delayed this week due to the New Year’s Day holiday. So, the report will be released tomorrow instead of the usual Wednesday release date.

Last week, the EIA reported a 5.5 million barrel drawdown which took markets by surprise and helped crude prices continue to rally.

The market is now forecasting a subsequent 3.1 million barrel drawdown which should see prices higher again.

Oil Higher on Trade Deal News

The recent upside in oil prices has largely been driven by relief over the trade deal between the US and China.

Last month, the two sides announced that they have agreed to sign the phase-one trade deal which was initially laid out in October. The market had been expecting an announcement, which came just ahead of the December 15th date for the next round of US tariffs.

The reaction to the deal has been clearly visible in crude markets. Traders are buying oil in anticipation of increased demand thanks to more trade projected between the US and China.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The trade war took a heavy toll on crude prices last year. This was before the strong ten-dollar rally that followed the initial news of the deal in October.

Talks are due to move onto the second phase of the deal this month. This should continue to keep crude prices supported.

OPEC Cuts Supporting

Aside from the US-China developments, the oil market has also been boosted by the increase in OPEC production cuts.

The announcement came last month in response to ailing prices and a subdued demand outlook. The 13-member producer cartel stated that it will increase cuts from 1.2 million barrels per day to 1.7 million barrels per day. The increase was agreed upon by OPEC as well as a group of allied nations led by Russia.

The current cuts are due to run until the end of Q1. However, if OPEC deems it necessary, they could extend them.

That being said, there are concerns that Russia might pull out of the deal. These come following comments from the Russia Energy Minister last week stating that Russia will look to gradually leave the agreement over 2020.

For now, however, with the trade negotiations and OPEC production cuts, the near-term outlook remains bullish for crude. Therefore, prices are likely to remain supported.

Technical Perspective

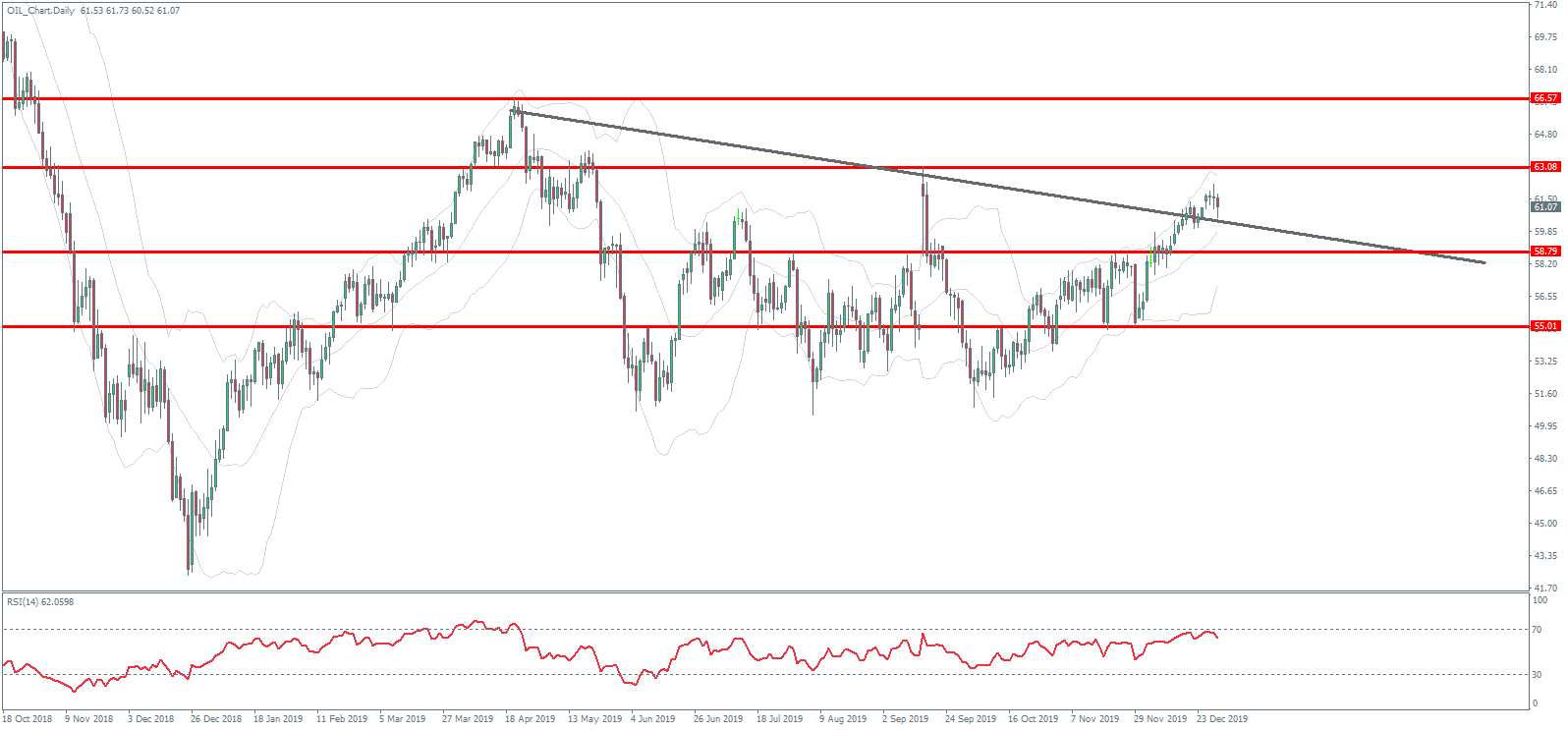

The rally in crude has seen price breaking back above the bearish trend line from 2019 highs. The trendline has held one retest so far. While above here, focus is on a challenge of the 63.08 level next. If we break back above that level, the next objective will be the 2019 highs around 66.57.

To the downside, the main support is sitting at the 55 level with some interim support around prior broken highs around 58.80.

By Orbex