By Orbex

The latest report from the Energy Information Administration has added further downside pressure for crude prices this week.

The EIA update showed that US crude inventories fell by 400k barrels last week.

News of a drawdown is typically positive. However, on the back of last week’s 2.5 million barrel drawdown, the market had been expecting a 1 million barrel decline. Therefore, it was disappointed by the news of a weaker than expected draw.

Gasoline Inventories Increase

Other elements of the report were also more obviously bearish.

The data showed that gasoline inventories were higher by 1.75 million barrels over the week. This increase was above the expected 1 million barrel level.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

However, distillate stockpiles were far lower than expected. These dropped by 1.2 million barrels over the week versus an expected build of 3 million barrels.

Crude prices have been weighed down due to the outbreak of the Wuhan virus in China. This has already claimed the lives of nearly 20 people while infecting a further several hundred.

The virus has already spread across Asia, with one confirmed case in America and further possible cases identified as far as Scotland.

Wuhan Virus Causing Concern

A wave of reduced risk appetite has hit the markets. Traders are fearing a SARS-like outbreak which could cause widespread economic damage and reduced fuel demand.

The SARS outbreak in 2003 caused a sharp drop in fuel demand. It also sparked a recession in Hong Kong and a sharp economic hit to China.

If the outbreak continues to intensify, there are fears that the local economy, already in the throes of a downturn, will suffer significantly.

EIA Forecasts Lower Prices

In its January short-term energy outlook, the EIA forecast crude prices to fall over 2020.

The driver behind this projection is the passing of geopolitical risks such as the tension between the US and Iran.

However, there are several factors providing upward pressure. These include the progress being made towards ending the US/China trade war, the greater clarity around Brexit and the increase in OPEC production cuts announced in December.

Technical Perspective

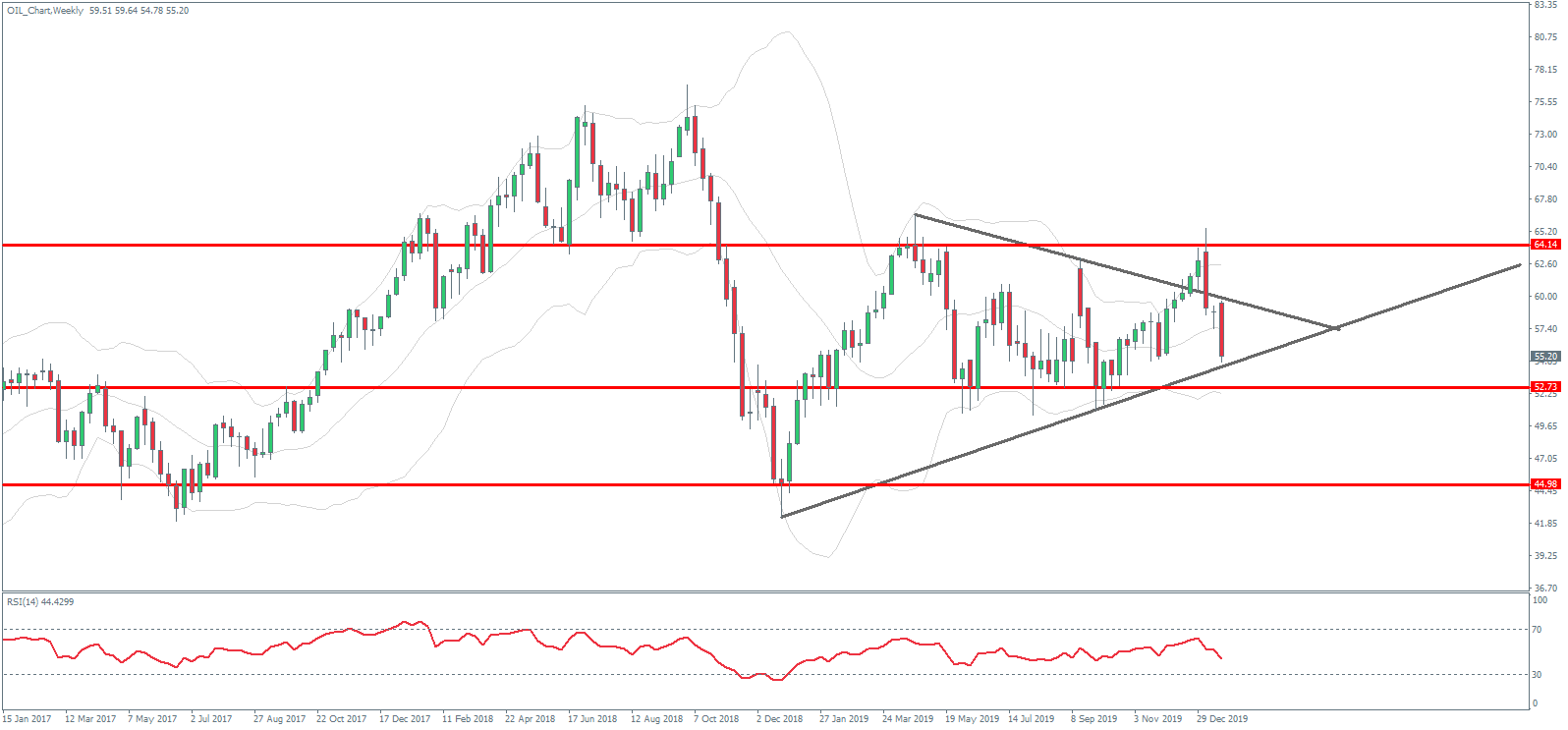

Frustratingly for crude traders, if we look at the higher timeframe you can see that not much has changed.

Price is essentially trading where it was a year ago. Despite having broken above 64, the reversal has brought price right back down into the middle of the range which framed much of last year’s price action.

Crude is currently challenging the rising trend line from last year’s lows. If we break here, the next level to watch will be the 57 mark, with the 2018 lows below that as the main downside marker.

By Orbex