By Orbex

Crude prices were knocked lower yesterday as the latest EIA inventories report highlighted a further build in US crude stores.

The Energy Information Administration reported that in the week ending November 8th, US crude stocks rose by a further 2.2 million barrels. This was higher than the 1.6 million barrel rise forecast.

It also marks the third consecutive week of inventory surpluses, highlighting the increasing supply/demand imbalance in the market.

Crude Imports Fall

The EIA report also noted that commercial crude imports were lower by 5.8 million barrels over the week. This marks their lowest reading since February 1996. Net US crude imports were down by 590k barrels.

Regionally, the Cushing delivery hub in Oklahoma saw its crude stores falling by 1.2 million barrels. This decline is the first such reduction following five straight weeks of inventory builds.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The EIA noted that this change was due to the Keystone pipeline being cut off. This was as a result of an oil spill that caused a major disruption to Canadian crude imports.

Gasoline Stores Rise, Distillate Stores Fall

Following six consecutive weeks of drawdowns, gasoline stores in the US rose last week.

Gasoline levels rose by 1.9 million barrels. This was considerably higher than the expected 1.2 million barrel increase forecast.

Distillate inventories, however, including diesel and heating oil, were lower by 2.5 million barrels over the week. This was far worse than the 950k barrel drop analysts were looking for.

Despite the fall in distillate stockpiles, the pickup in refinery utilisation rates offset some of the support offered. Refinery crude runs came in higher by 155k barrels per day. Meanwhile, utilization rates rose by 1.8% to 87.8% of total capacity.

US Crude Production Hits Record Highs

US production was also heavily bearish for crude prices. Production rose to a fresh high of 12.8 million barrels per day.

The rise this year has been a major headwind for crude prices. Over the first part of the year, crude prices were rising steadily as OPEC supply cuts helped curb the supply/demand imbalance in the market.

However, into the middle of the year, the rising US crude production caused the rally to stall and ultimately reverse.

As US production continued to print record highs, OPEC was forced to announce an extension to its cuts when it met in June. Now, as US production continues to rise, expectations are for the oil producer cartel to announce further measures in December.

As a result of rising US crude production, the EIA has revised its US production outlook higher twice this year already, creating a bearish outlook for prices. With OPEC forecasting falling crude demand in the near term, oil faces further negative pressure in the near term.

Technical Perspective

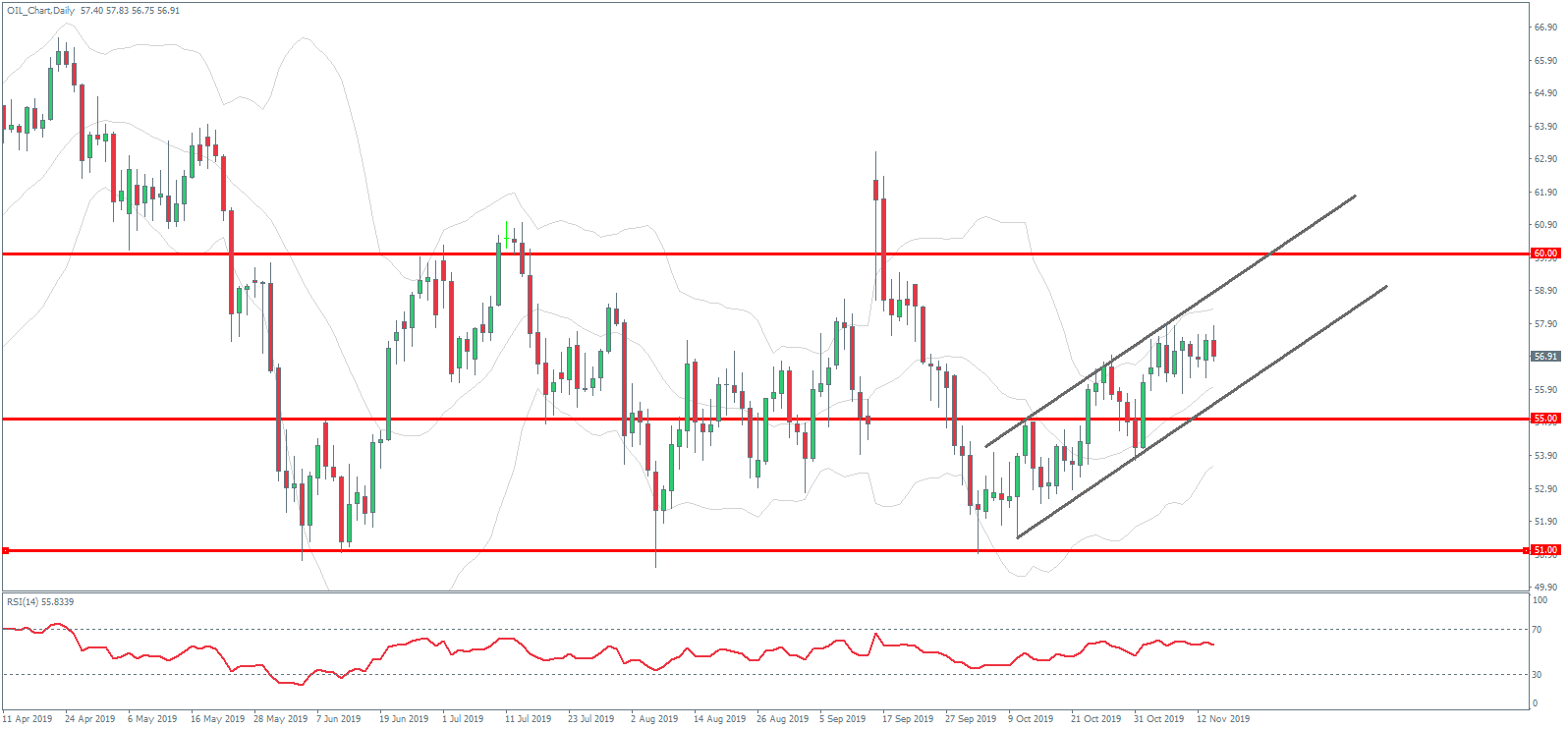

Crude prices have been moving higher from the latest test of the 51 level support. The rally, which has been framed by a bullish channel, has seen prices break above the 55 level.

While above here, focus remains on further upside with the 60 level the key marker to watch. However, momentum has stalled recently and with RSI flagging weakness, we could see a correction lower in the near term.

By Orbex