September 28th – By CountingPips.com – Receive our weekly COT Reports by Email

VIX Non-Commercial Speculator Positions:

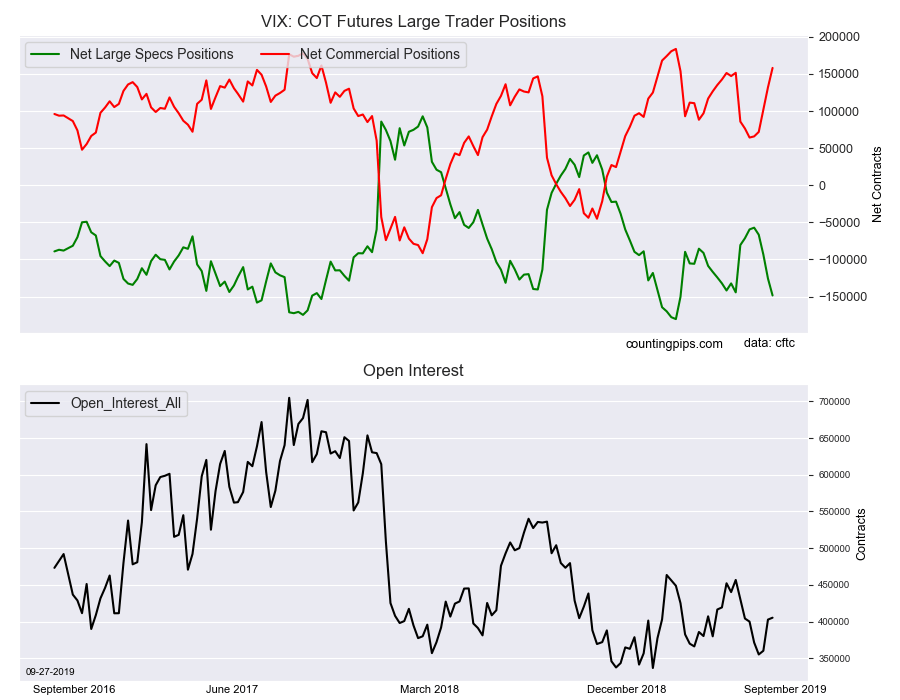

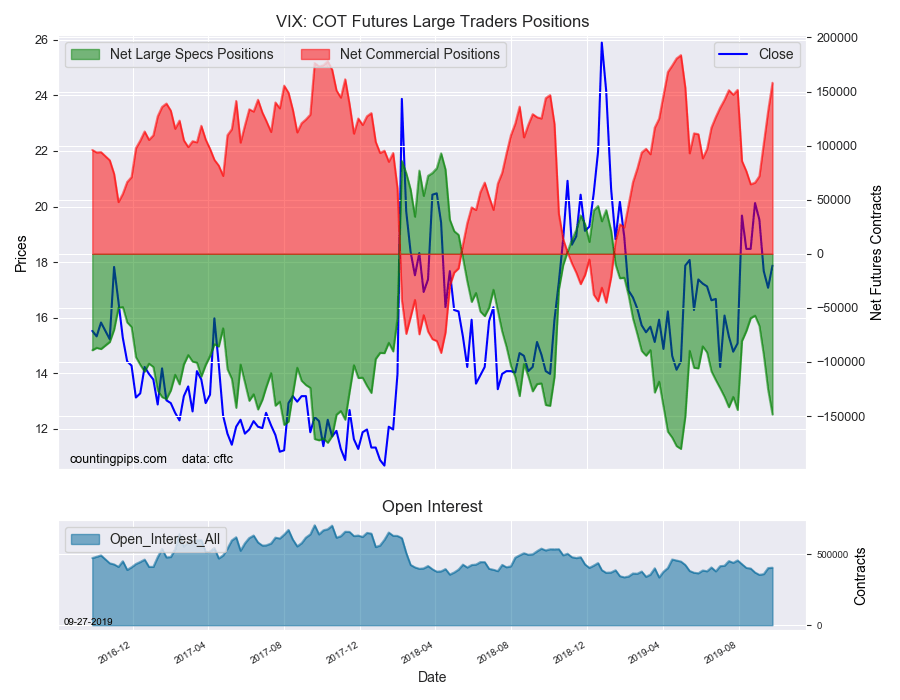

Large volatility speculators continued to add to their bearish net positions in the VIX futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -148,519 contracts in the data reported through Tuesday September 24th. This was a weekly change of -22,868 net contracts from the previous week which had a total of -125,651 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -1,387 contracts (to a weekly total of 84,701 contracts) while the gross bearish position (shorts) jumped by 21,481 contracts for the week (to a total of 233,220 contracts).

VIX speculators boosted their bearish bets for a 4th week overall while each of the last three weeks have jumped by at least -22,000 contracts. The large speculative position is now at the most bearish level in twenty weeks dating back to May 7th when the net position stood at -150,307 contracts. That was just one week after the VIX positions fell to an all-time record bearish position on April 30th at a total of -180,359 contracts.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Currently, the net position is now over the -100,000 net contract level for a second straight week.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 158,132 contracts on the week. This was a weekly gain of 26,196 contracts from the total net of 131,936 contracts reported the previous week.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $17.87 which was an increase of $0.80 from the previous close of $17.07, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article By CountingPips.com – Receive our weekly COT Reports by Email