August 3rd – By CountingPips.com – Receive our weekly COT Reports by Email

US Dollar Index Speculator Positions

Large currency speculators continued to add to their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 30,283 contracts in the data reported through Tuesday July 30th. This was a weekly advance of 1,155 contracts from the previous week which had a total of 29,128 net contracts.

This week’s net position was the result of the gross bullish position ascending by 7,087 contracts (to a weekly total of 49,305 contracts) and overshadowed the gross bearish position which saw a lift by 5,932 contracts for the week (to a total of 19,022 contracts).

Speculators raised their bullish bets for a fifth consecutive week and for the eighth time in the past eleven weeks. The current standing for USD Index speculators is back above the +30,000 net contract threshold and at the highest level since March 12th.

Individual Currencies Data this week:

In the other major currency contracts data, we saw two substantial changes (+ or – 10,000 contracts) in the speculators category this week.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Euro speculator positions went sharply more bearish this week by over -14,000 net contracts. This is the second straight week of higher bearish bets. Euro positions had been improving recently – coming down from a total of -101,102 contracts on May 21st to a total of -31,351 contracts on July 16th. Since then, bearish bets have crept back up and above the -50,000 contract level.

British pound sterling bearish positions rose for a seventh straight week and for the tenth time out of the past eleven weeks. Speculator positions had been positive for a brief time on April 16th but have since deteriorated to over -90,000 net contracts. This current level is the most bearish since April 25th of 2017.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (1,155 weekly change in contracts), Japanese yen (5,159 contracts) and the Mexican peso (3,513 contracts).

The currencies whose speculative bets declined this week were the euro (-14,979 weekly change in contracts), British pound sterling (-11,567 contracts), Swiss franc (-1,295 contracts), Canadian dollar (-9,028 contracts), Australian dollar (-5,462 contracts) and the New Zealand dollar (-94 contracts).

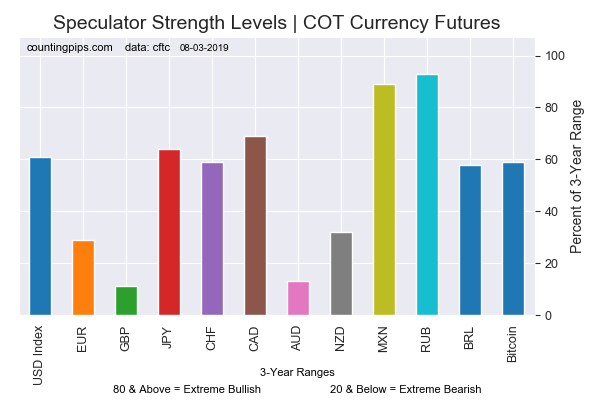

Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

| Currency | Net Speculator Position | Specs Weekly Change |

| USD Index | 30,283 | 1,155 |

| EuroFx | -53,983 | -14,979 |

| GBP | -90,150 | -11,567 |

| JPY | -4,218 | 5,159 |

| CHF | -14,488 | -1,295 |

| CAD | 21,722 | -9,028 |

| AUD | -53,442 | -5,462 |

| NZD | -12,319 | -94 |

| MXN | 128,268 | 3,513 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week came in at a net position of -53,983 contracts in the data reported through Tuesday. This was a weekly decrease of -14,979 contracts from the previous week which had a total of -39,004 net contracts.

British Pound Sterling:

The large British pound sterling speculator level resulted in a net position of -90,150 contracts in the data reported this week. This was a weekly fall of -11,567 contracts from the previous week which had a total of -78,583 net contracts.

Japanese Yen:

Large Japanese yen speculators came in at a net position of -4,218 contracts in this week’s data. This was a weekly lift of 5,159 contracts from the previous week which had a total of -9,377 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week was a net position of -14,488 contracts in the data through Tuesday. This was a weekly reduction of -1,295 contracts from the previous week which had a total of -13,193 net contracts.

Canadian Dollar:

Canadian dollar speculators came in at a net position of 21,722 contracts this week. This was a decline of -9,028 contracts from the previous week which had a total of 30,750 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures totaled a net position of -53,442 contracts this week in the data ending Tuesday. This was a weekly fall of -5,462 contracts from the previous week which had a total of -47,980 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing resulted in a net position of -12,319 contracts this week in the latest COT data. This was a weekly decline of -94 contracts from the previous week which had a total of -12,225 net contracts.

Mexican Peso:

Mexican peso speculators came in at a net position of 128,268 contracts this week. This was a weekly lift of 3,513 contracts from the previous week which had a total of 124,755 net contracts.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).