By IFCMarkets

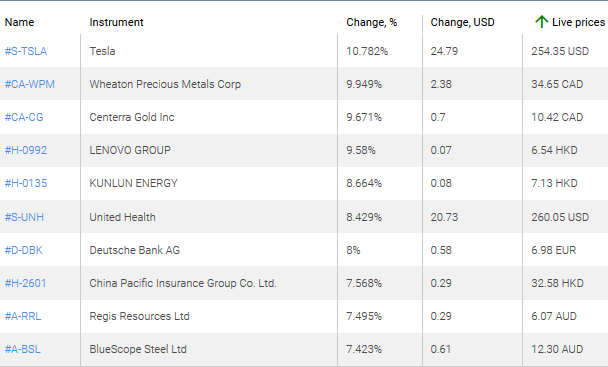

Top Gainers – The World Market

1. Tesla Motors Inc. – American company producing electric cars.

2. Wheaton Precious Metals Corp – Canadian Precious Metals Mining Company.

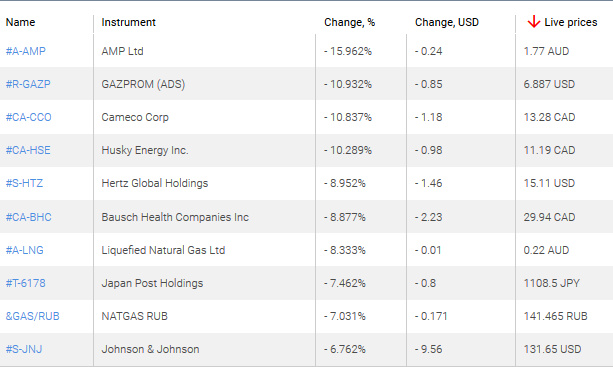

Top Losers – The World Market

1. AMP Ltd – Australian financial company.

2. OAO GAZPROM Level 1 ADS – depositary receipts of the Russian gas company.

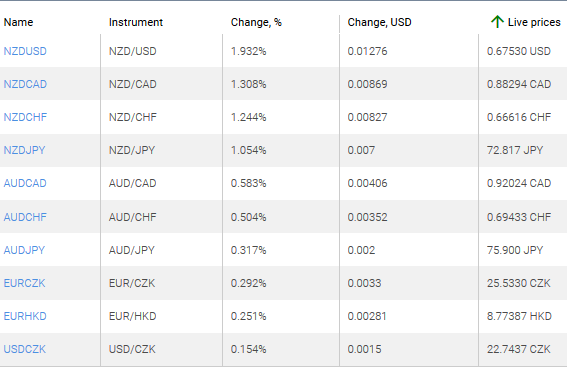

Top Gainers – Foreign Exchange Market (Forex)

1. NZDUSD, NZDCAD – an increase in this chart indicates the strengthening of the New Zealand dollar against the US and Canadian dollars.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

2. NZDCHF, NZDJPY – an increase in this chart shows the strengthening of the New Zealand dollar against the Swiss franc and the Japanese yen.

Top Losers – Foreign Exchange Market (Forex)

1. GBPNZD, EURNZD – the decrease in this charts shows the strengthening of the New Zealand dollar against the British pound and the euro.

2. USDRUB, GBPAUD – the decrease in this charts means the strengthening of the Australian dollar against the British pound and the Russian ruble against the US dollar.

Market Analysis provided by IFCMarkets

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.