June 7th – By CountingPips.com – Receive our weekly COT Reports by Email

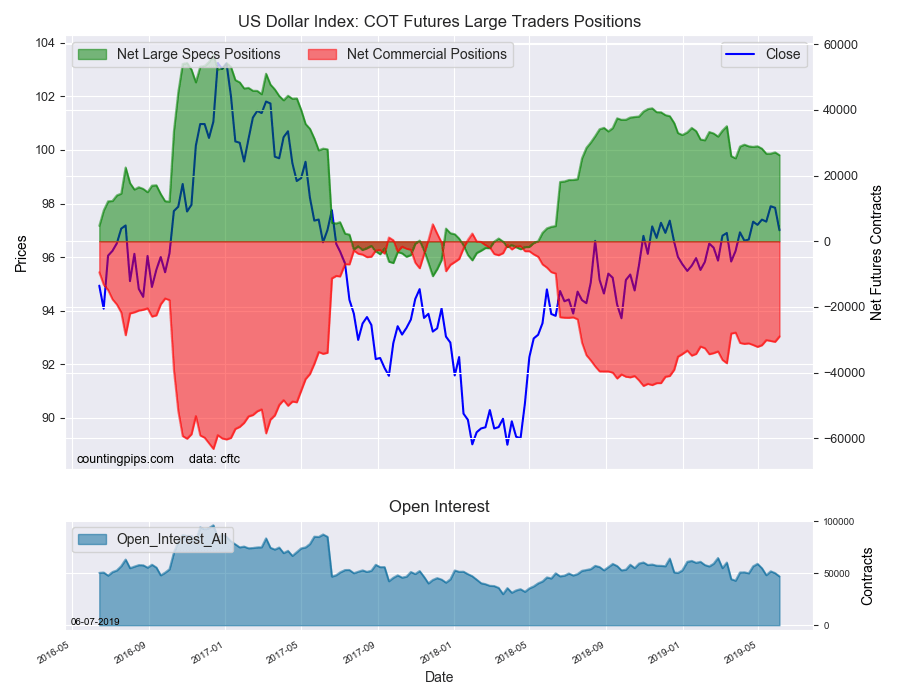

US Dollar Index Speculator Positions

Large currency speculators cut back on their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 26,234 contracts in the data reported through Tuesday June 4th. This was a weekly decrease of -864 contracts from the previous week which had a total of 27,098 net contracts.

This week’s net position was the result of the gross bullish position lowering by -2,571 contracts (to a weekly total of 39,348 contracts) while the gross bearish position declined by -1,707 contracts for the week (to a total of 13,114 contracts).

The net speculative position dipped this week after a couple of small gains in the previous two weeks. The dollar index speculator positions have continued to be on a slow and steady downtrend over the past several months after reaching a high-point of 40,513 contracts on January 13th. This week’s level marked the least bullish position since the end of March.

Individual Currencies Data this week:

In the other major currency contracts data, we saw four substantial changes (+ or – 10,000 contracts) in the speculators category this week.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

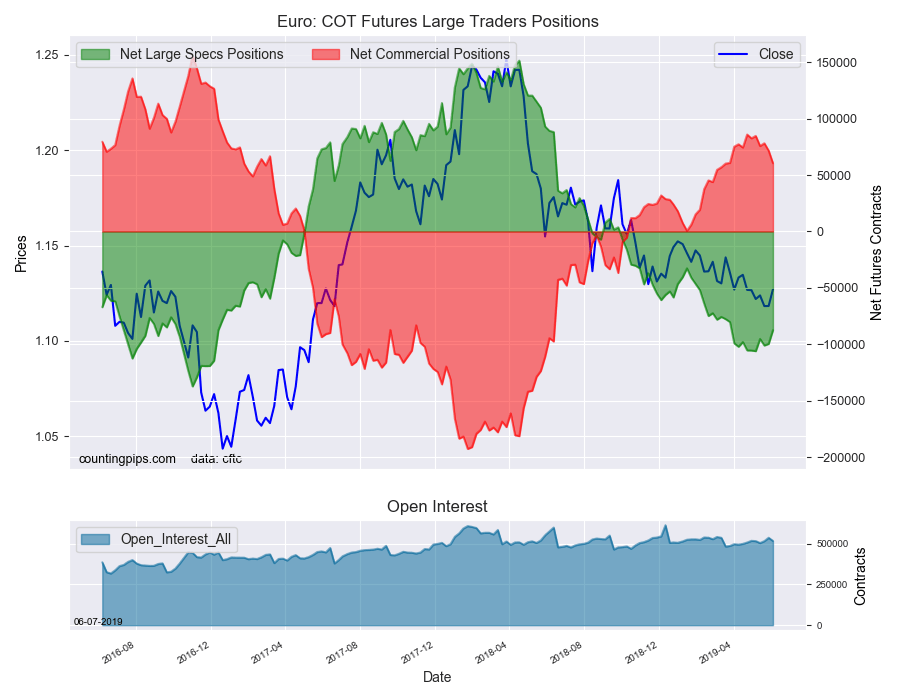

Euro speculative positions increased by over +12,000 contracts this week. Bets improved for a second straight week and for the third time in the past four weeks. The overall position is now under the -100,000 net contract level for a second week and perhaps signalling that the extreme negative sentiment by speculators is waning.

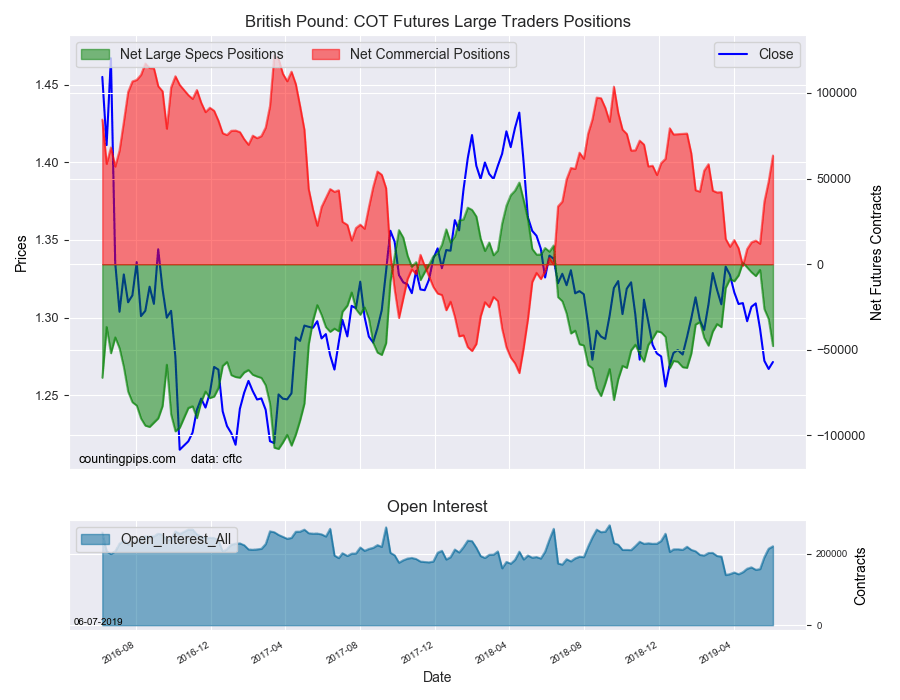

British pound speculator bets went strongly bearish again this week. The net level has seen higher bearish bets in three straight weeks and for six out of the past seven weeks as sentiment has soured on the GBP. The current level (-47,762 contracts) is at the most bearish standing since January 22nd.

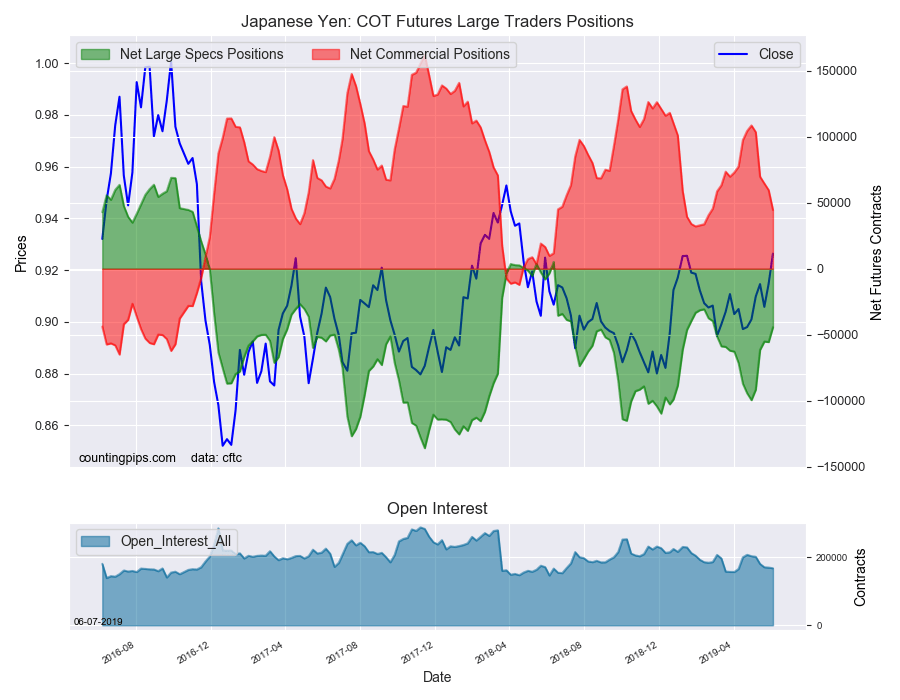

Japanese yen position rose by over +11,000 contracts this week and has improved for four out of the past five weeks. The JPY speculator position is now at the least bearish level of the past fourteen weeks as some recent risk-off market sentiment has helped the yen.

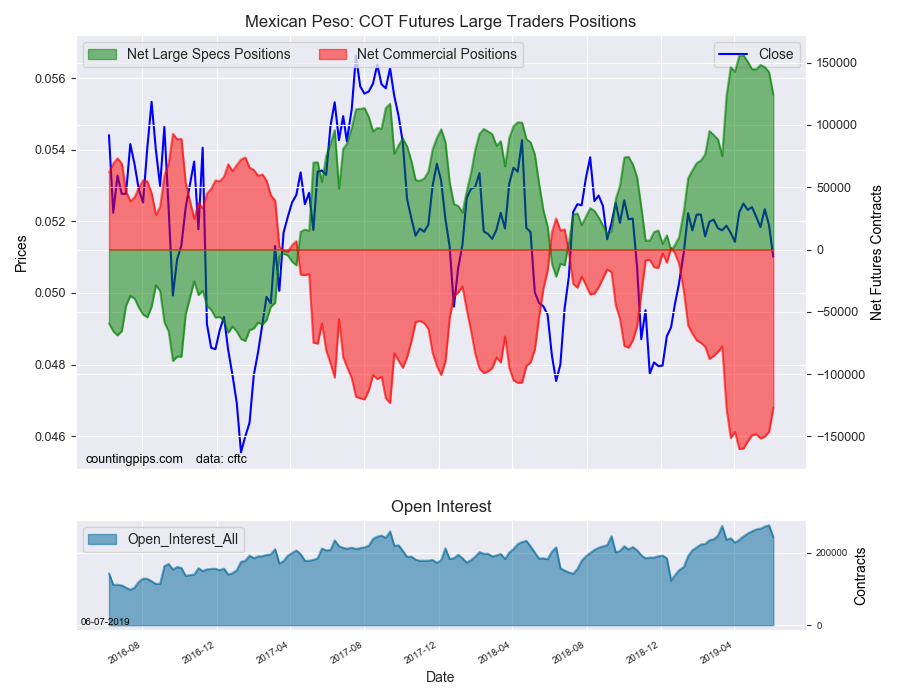

Mexican peso positions dropped sharply this week and have now fallen for three straight weeks as well as six out of the past seven weeks. Peso bets had risen to an all-time record high position of +156,030 contracts on April 16th before starting to cool off. Currently, the net position is down to +124,229 contracts which is still very bullish and the Peso remains the only other currency with bullish speculator sentiment besides the US Dollar Index.

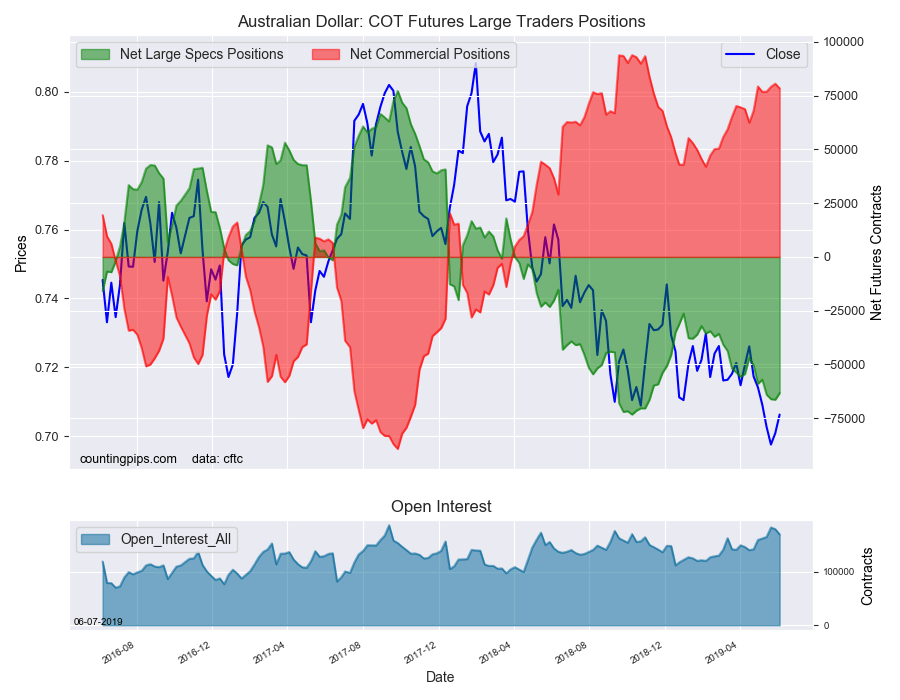

Overall, the major currencies that saw improving speculator positions this week were the euro (12,140 weekly change in contracts), Australian dollar (3,102 contracts) and the Japanese yen (11,188 contracts).

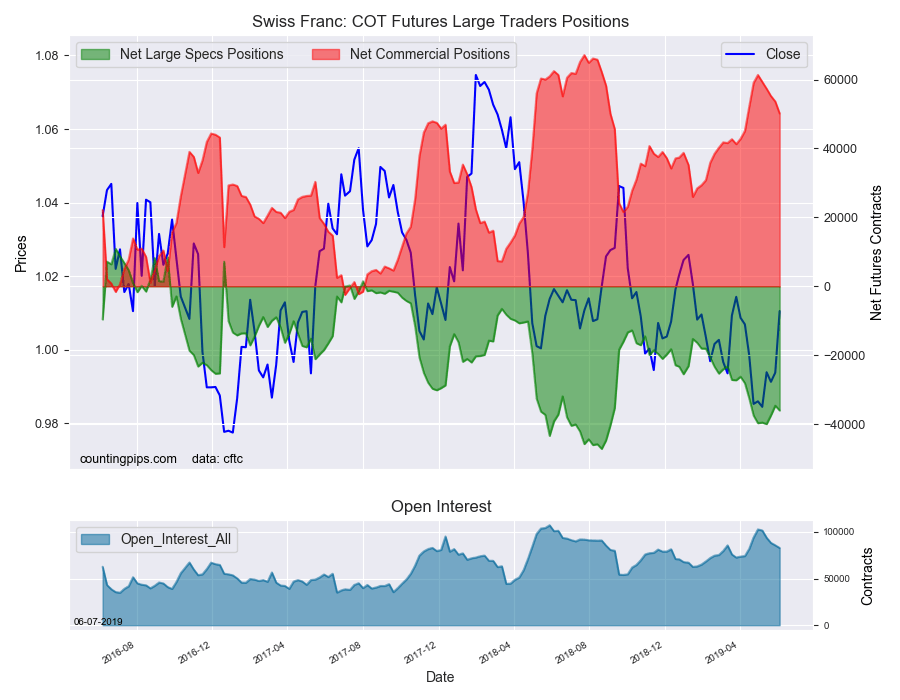

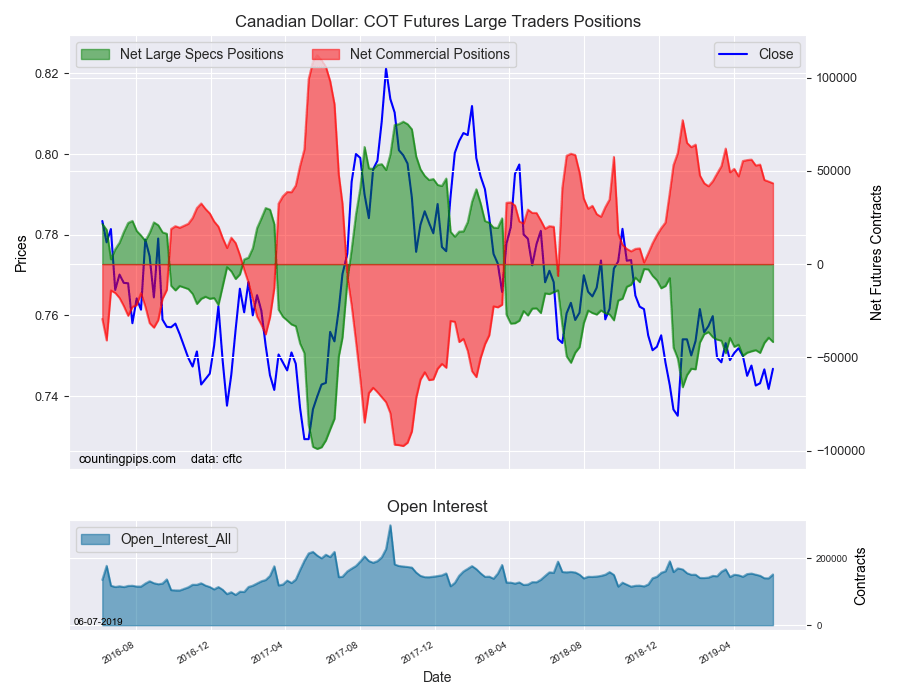

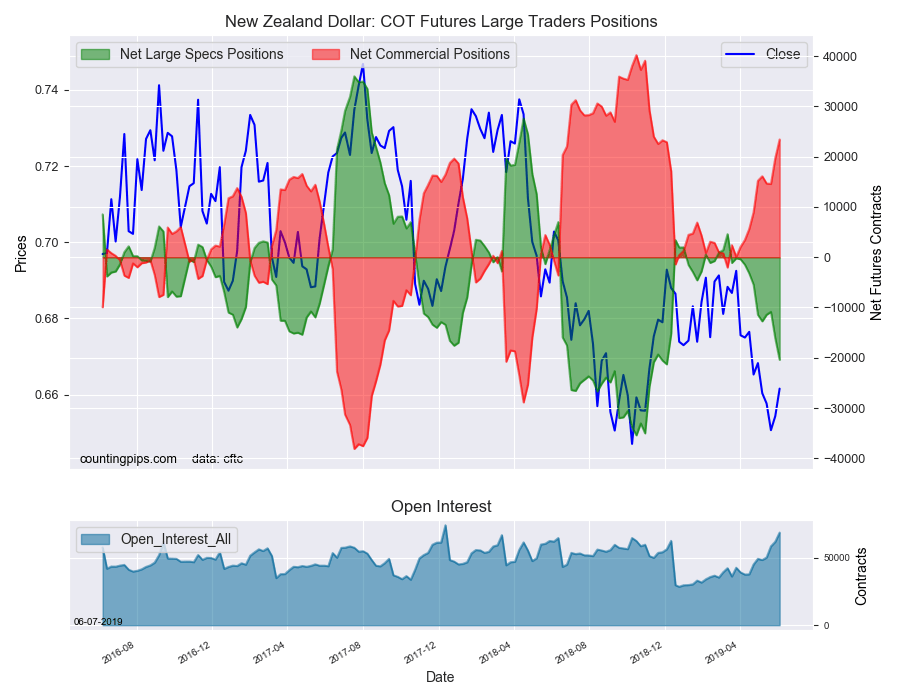

The currencies whose speculative bets declined this week were the US dollar index (-864 weekly change in contracts), British pound sterling (-15,766 contracts), Swiss franc (-1,390 contracts), Canadian dollar (-2,336 contracts), New Zealand dollar (-4,248 contracts) and the Mexican peso (-18,238 contracts).

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

| Currency | Net Speculator Position | Specs Weekly Change |

| USD Index | 26,234 | -864 |

| EuroFx | -87,551 | 12,140 |

| GBP | -47,762 | -15,766 |

| JPY | -44,389 | 11,188 |

| CHF | -36,065 | -1,390 |

| CAD | -41,759 | -2,336 |

| AUD | -63,291 | 3,102 |

| NZD | -20,396 | -4,248 |

| MXN | 124,229 | -18,238 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week came in at a net position of -87,551 contracts in the data reported through Tuesday. This was a weekly rise of 12,140 contracts from the previous week which had a total of -99,691 net contracts.

British Pound Sterling:

The large British pound sterling speculator level equaled a net position of -47,762 contracts in the data reported this week. This was a weekly fall of -15,766 contracts from the previous week which had a total of -31,996 net contracts.

Japanese Yen:

Large Japanese yen speculators was a net position of -44,389 contracts in this week’s data. This was a weekly advance of 11,188 contracts from the previous week which had a total of -55,577 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week equaled a net position of -36,065 contracts in the data through Tuesday. This was a weekly reduction of -1,390 contracts from the previous week which had a total of -34,675 net contracts.

Canadian Dollar:

Canadian dollar speculators was a net position of -41,759 contracts this week. This was a decline of -2,336 contracts from the previous week which had a total of -39,423 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures equaled a net position of -63,291 contracts this week in the data ending Tuesday. This was a weekly rise of 3,102 contracts from the previous week which had a total of -66,393 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing totaled a net position of -20,396 contracts this week in the latest COT data. This was a weekly decrease of -4,248 contracts from the previous week which had a total of -16,148 net contracts.

Mexican Peso:

Mexican peso speculators came in at a net position of 124,229 contracts this week. This was a weekly decline of -18,238 contracts from the previous week which had a total of 142,467 net contracts.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).