By CountingPips.com – Receive our weekly COT Reports by Email

Here are this week’s links to the latest Commitment of Traders data changes that were released on Friday.

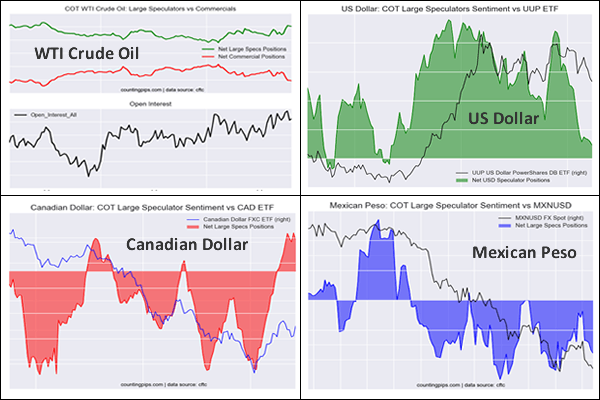

This week in the COT data, the USD Index Speculators raised their bullish bets after two down weeks. Euro and Japanese yen speculative positions saw huge improvements on the week (lower bearish levels) while the Mexican peso bullish positions rose after recent declines.

Precious metals speculators continued to boost their Gold bullish positions sharply for a third week and pushed Gold bets to the best level since January 30th of 2018. Silver bets also improved for a third week and are now in an overall bullish position for a second week.

Copper speculators reduced their short bets this week after a streak of bearishness that brought positions to the most bearish standing in 155 weeks.

VIX speculators added to their bearish positions again this week and have now added to short bets in four out of the past five weeks. The large speculator position had recently risen to a record high position of -180,359 contracts on April 30th before pulling back on negative bets. The spec bearish positions have recently started to rebuild.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The 10-Year Bond speculators raised their net short positions this week after a sharp selloff last week. The speculators have found themselves on the other side of the trend in 10-Year bond prices in recent months and continued that trend this week.

Finally, the WTI Crude oil speculators increased their bullish net positions for the first time in eight weeks this week although this was due to short-covering and not exactly a sign of strength. Positions had dropped by a total of -195,704 contracts in the previous seven weeks before this week’s turnaround.

US Dollar Index Speculators raised bullish bets while Euro & Yen bets surged

Large currency speculators increased their net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. See full article.

WTI Crude Oil Speculators bullish bets rebounded after 7 down weeks

The large speculator contracts of WTI crude futures totaled a net position of 363,087 contracts, according to the latest data this week. This was a change of 11,432 contracts from the previous weekly total. See full article.

10-Year Note Speculators added to their bearish bets this week

Large speculator contracts of the 10-Year Bond futures totaled a net position of -402,984 contracts, according to the latest data this week. This was a change of -36,996 contracts from the previous weekly total. See full article.

Gold Speculators continued to push their bullish bets higher this week

Large precious metals speculator contracts of the Gold futures totaled a net position of 204,323 contracts, according to the latest data this week. This was a change of 20,085 contracts from the previous weekly total. See full article.

VIX Speculators pushed their bearish bets higher this week

Large stock market volatility speculator contracts of the VIX futures totaled a net position of -108,644 contracts, according to the latest data this week. This was a change of -17,462 contracts from the previous weekly total. See full article.

Silver Speculators further boosted their bullish bets for a 3rd week

Large precious metals speculator contracts of the silver futures totaled a net position of 14,516 contracts, according to the latest data this week. This was a change of 11,856 contracts from the previous weekly total. See full article.

Copper Speculators reduced their bearish bets for 1st time in 9 weeks

Metals speculator contracts of the copper futures totaled a net position of -23,952 contracts, according to the latest data this week. This was a change of 6,569 contracts from the previous weekly total. See full article.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).