May 25th – By CountingPips.com – Receive our weekly COT Reports by Email

10-Year Note Non-Commercial Speculator Positions:

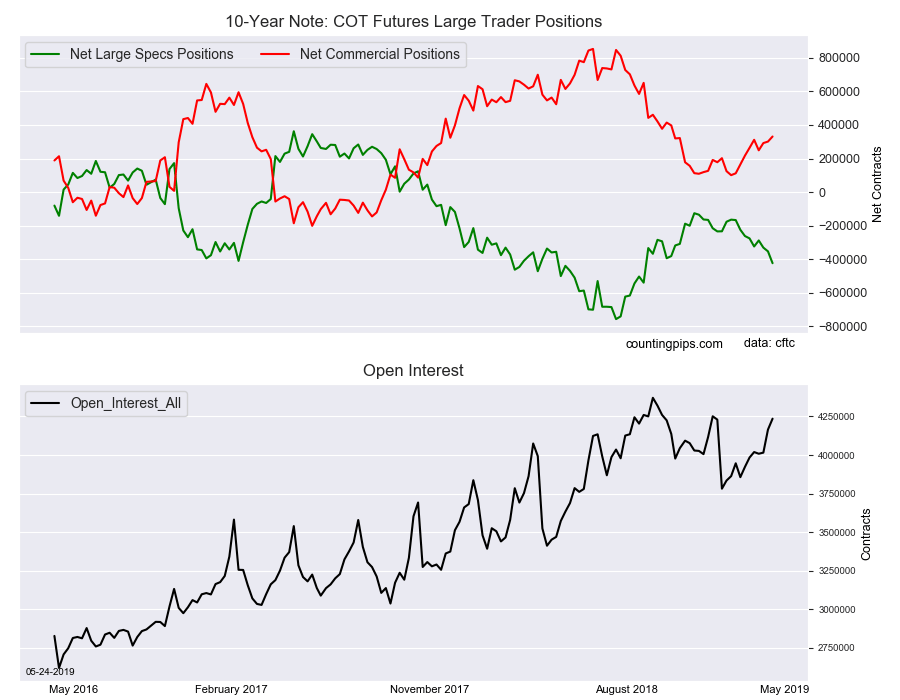

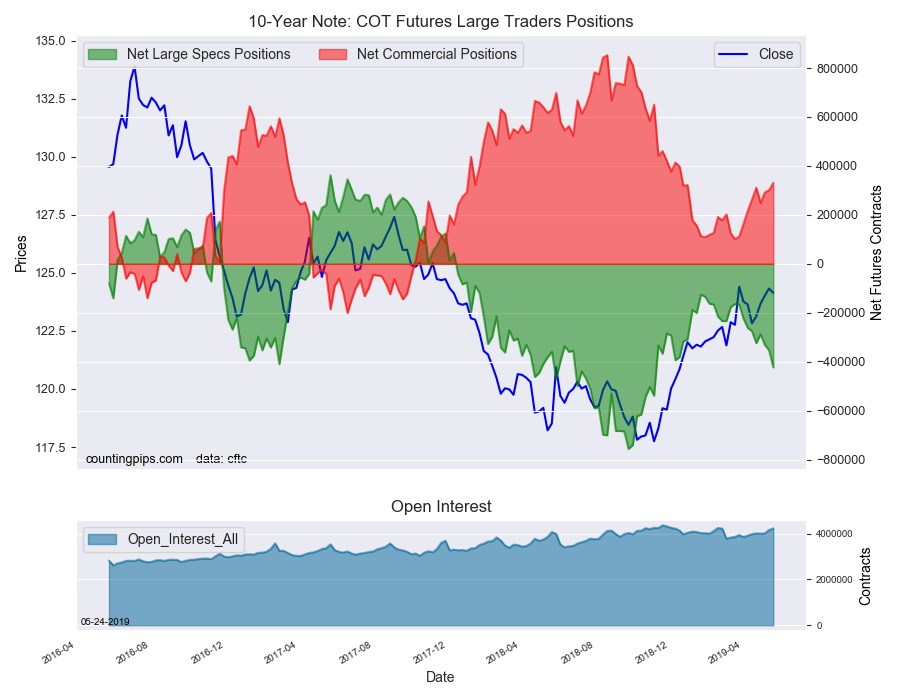

Large bond speculators continued on their path of higher bearish positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -423,351 contracts in the data reported through Tuesday May 21st. This was a weekly change of -70,534 net contracts from the previous week which had a total of -352,817 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 3,092 contracts (to a weekly total of 619,494 contracts) while the gross bearish position (shorts) jumped by 73,626 contracts for the week (to a total of 1,042,845 contracts).

The net speculative bearish has risen for a three straight weeks and by a total of -135,430 contracts over that period. The bearish bets have also increased for eight out of the past nine weeks.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The overall bearish standing is now at the highest level since November 6th when the net position stood at -539,186 contracts. The speculator position and the 10-Year bond price share a generally strong correlation so looking forward we could expect either the specs to cut back on their bearish bets or the 10-year bond may start to see some weakness from here.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 331,218 contracts on the week. This was a weekly advance of 30,243 contracts from the total net of 300,975 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $124.14 which was a fall of $-0.18 from the previous close of $124.32, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article By CountingPips.com – Receive our weekly COT Reports by Email