April 27th – By CountingPips.com – Receive our weekly COT Reports by Email

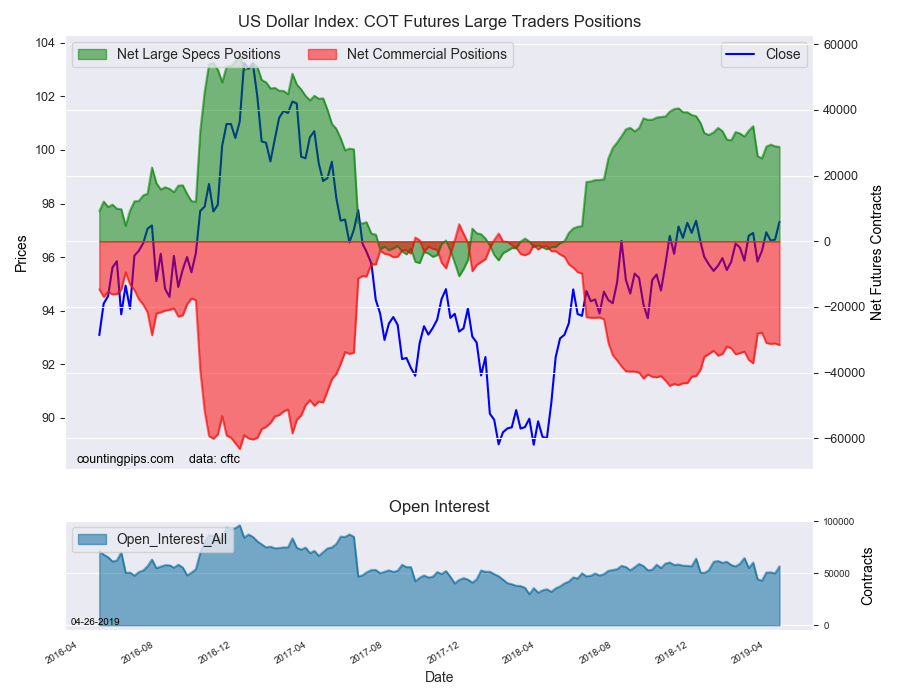

US Dollar Index Speculator Positions

Large currency speculators lowered their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 28,755 contracts in the data reported through Tuesday April 23rd. This was a weekly decline of -183 contracts from the previous week which had a total of 28,938 net contracts.

This week’s net position was the result of the gross bullish position growing by 6,046 contracts to a weekly total of 49,172 contracts but being slightly overcome by a gain in the gross bearish position by 6,229 contracts for the week to a total of 20,417 contracts.

The net speculator position dipped for a second consecutive week after gaining in the previous two weeks. The current standing remains bullish for USD bets but the overall level has now been under the +30,000 net contract level for six weeks in a row. Previously, bets had been above this threshold for thirty-two consecutive weeks through March 12th.

Individual Currencies Data this week:

In the other major currency contracts data, we did not see any substantial changes (+ or – 10,000 contracts) in the speculators category this week.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Overall, the only major currency to see improving speculator positions this week was the Canadian dollar with a gain of 1,669 contracts.

The currencies whose speculative bets declined this week were the US dollar index (-183 weekly change in contracts), euro (-7,395 contracts), British pound sterling (-2,757 contracts), Japanese yen (-7,308 contracts), Swiss franc (-4,952 contracts), Australian dollar (-3,569 contracts), New Zealand dollar (-2,229 contracts) and the Mexican peso (-5,325 contracts).

Notables for the week:

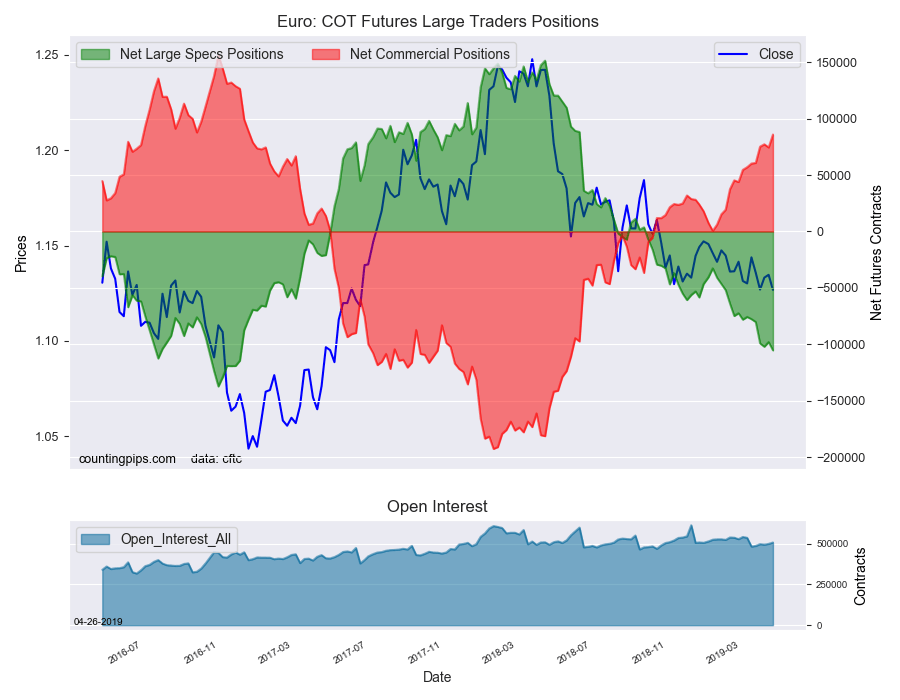

Euro speculator sentiment continued to deteriorate as bearish bets have now risen for five out of the past six weeks to a total of -105,418 net contracts. This is the most bearish standing since December 6th of 2016 when the position totaled -114,556 contracts.

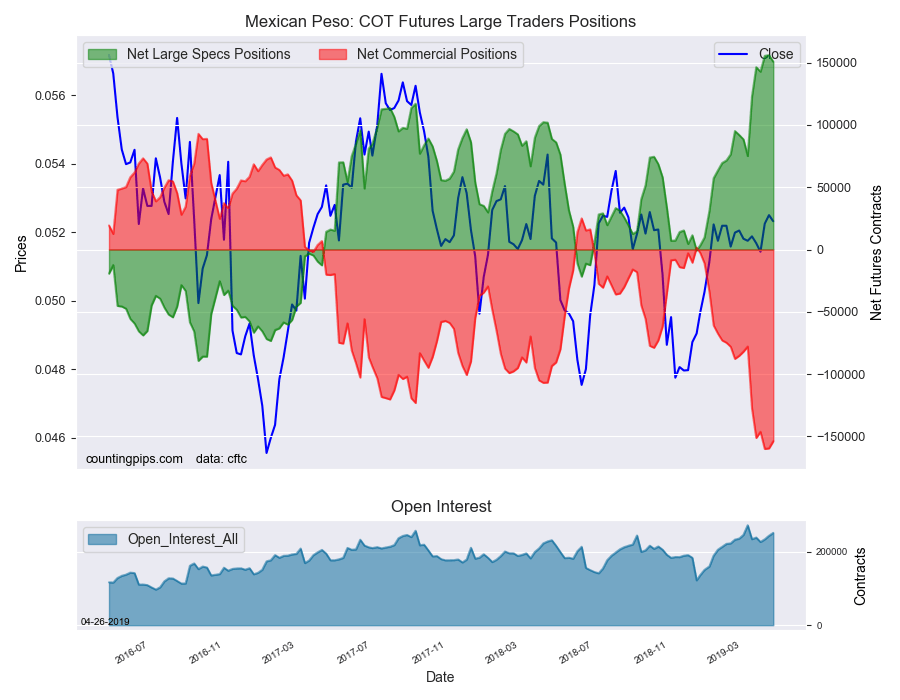

Mexican peso positions dipped this week after ascending to a record high bullish position last week. The net position has been above +150,000 contracts for three straight weeks.

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

| Currency | Net Speculator Position | Specs Weekly Change |

| USD Index | 28,755 | -183 |

| EuroFx | -105,418 | -7,395 |

| GBP | -1,835 | -2,757 |

| JPY | -94,414 | -7,308 |

| CHF | -37,536 | -4,952 |

| CAD | -47,493 | 1,669 |

| AUD | -50,449 | -3,569 |

| NZD | -5,450 | -2,229 |

| MXN | 150,705 | -5,325 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week totaled a net position of -105,418 contracts in the data reported through Tuesday. This was a weekly fall of -7,395 contracts from the previous week which had a total of -98,023 net contracts.

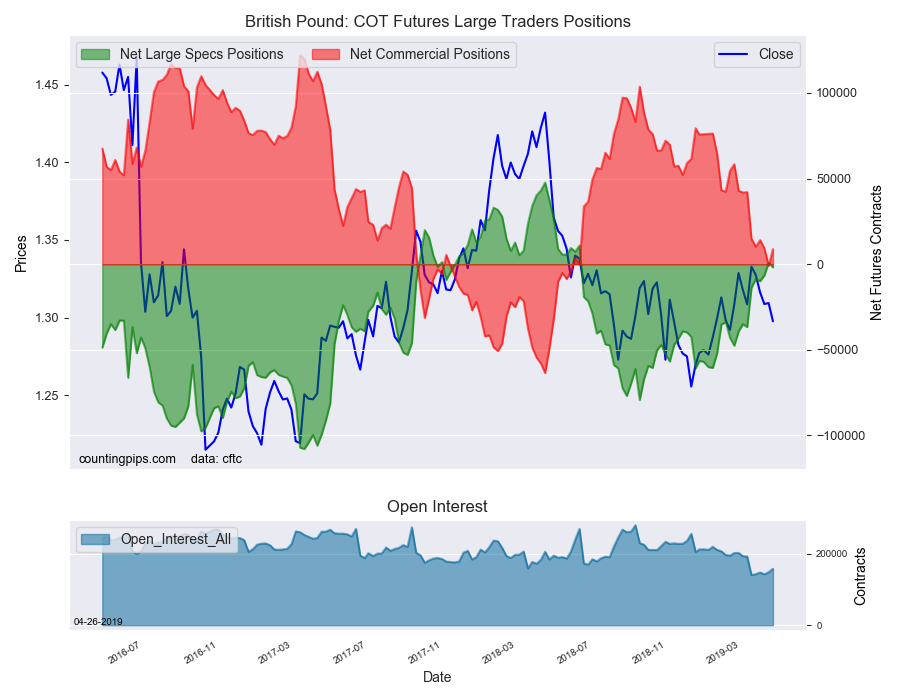

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -1,835 contracts in the data reported this week. This was a weekly decrease of -2,757 contracts from the previous week which had a total of 922 net contracts.

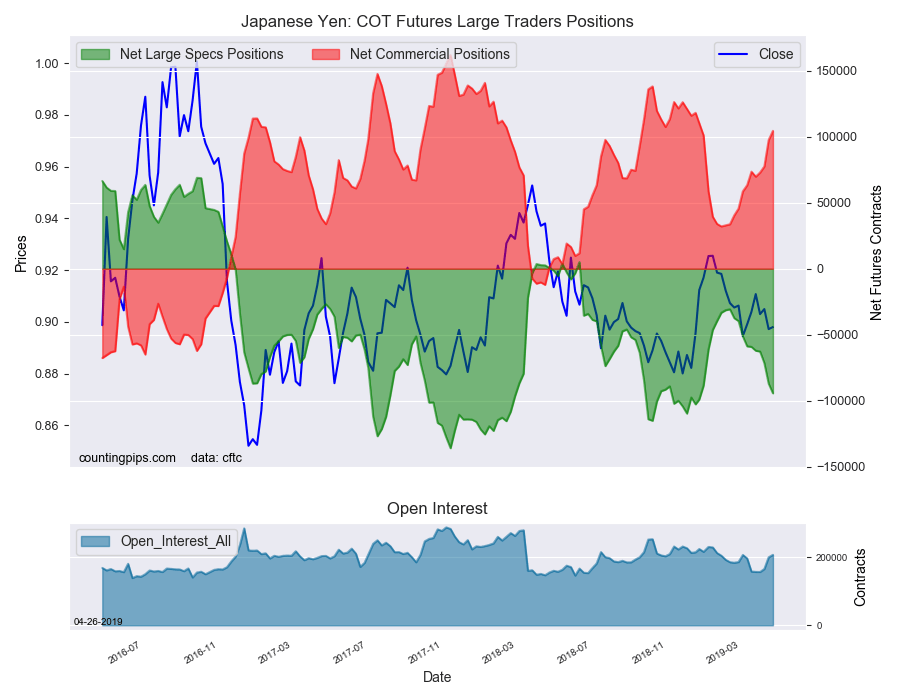

Japanese Yen:

Large Japanese yen speculators resulted in a net position of -94,414 contracts in this week’s data. This was a weekly decline of -7,308 contracts from the previous week which had a total of -87,106 net contracts.

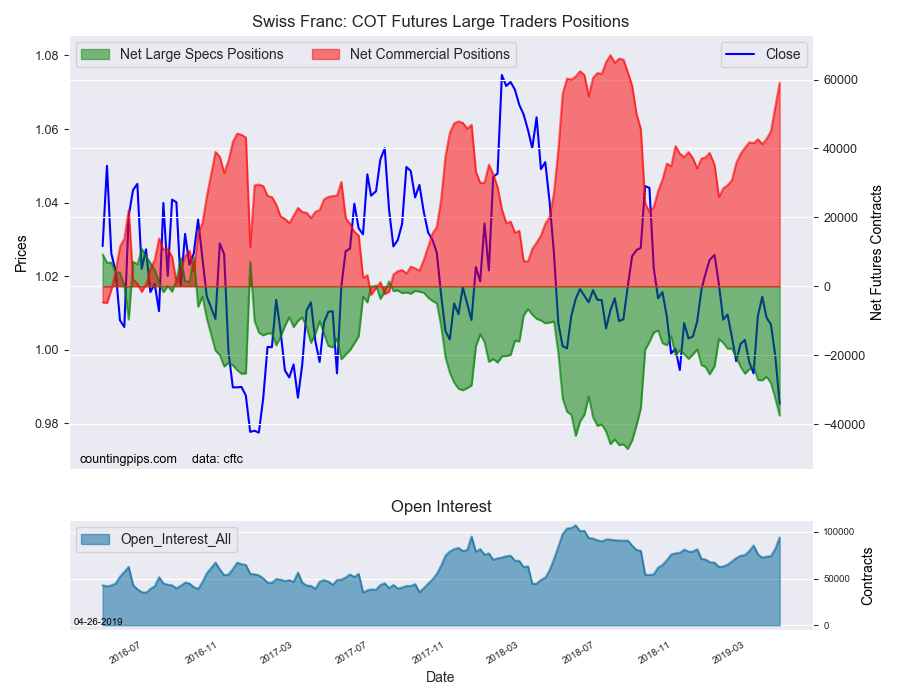

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of -37,536 contracts in the data through Tuesday. This was a weekly reduction of -4,952 contracts from the previous week which had a total of -32,584 net contracts.

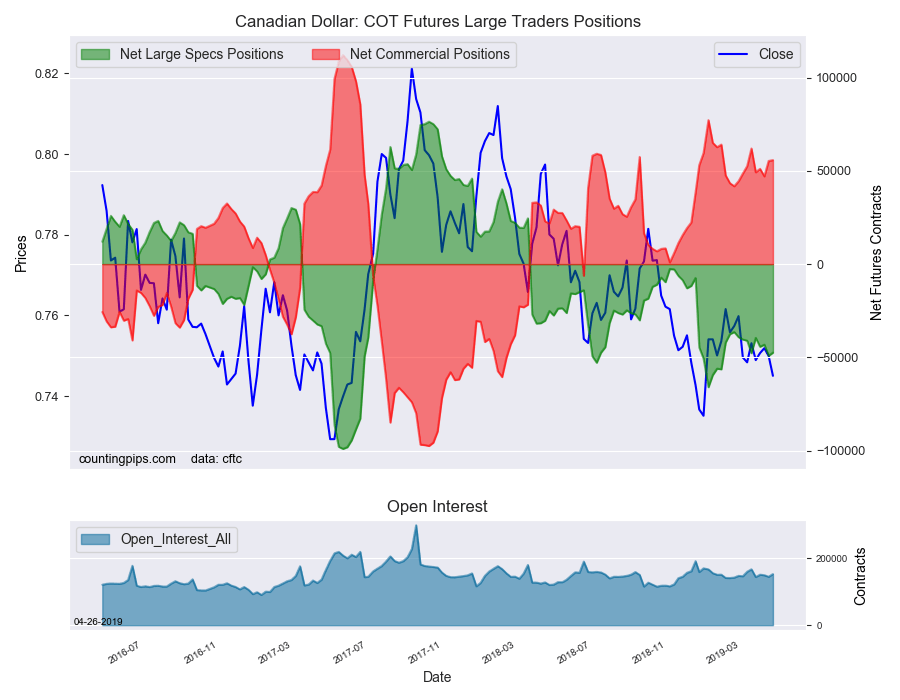

Canadian Dollar:

Canadian dollar speculators resulted in a net position of -47,493 contracts this week. This was a lift of 1,669 contracts from the previous week which had a total of -49,162 net contracts.

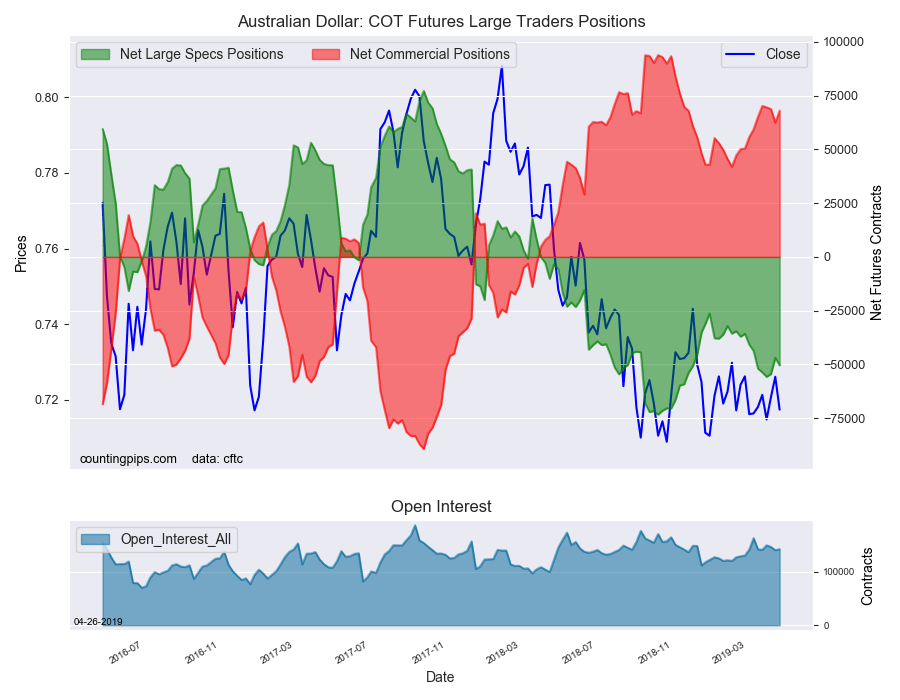

Australian Dollar:

The large speculator positions in Australian dollar futures totaled a net position of -50,449 contracts this week in the data ending Tuesday. This was a weekly fall of -3,569 contracts from the previous week which had a total of -46,880 net contracts.

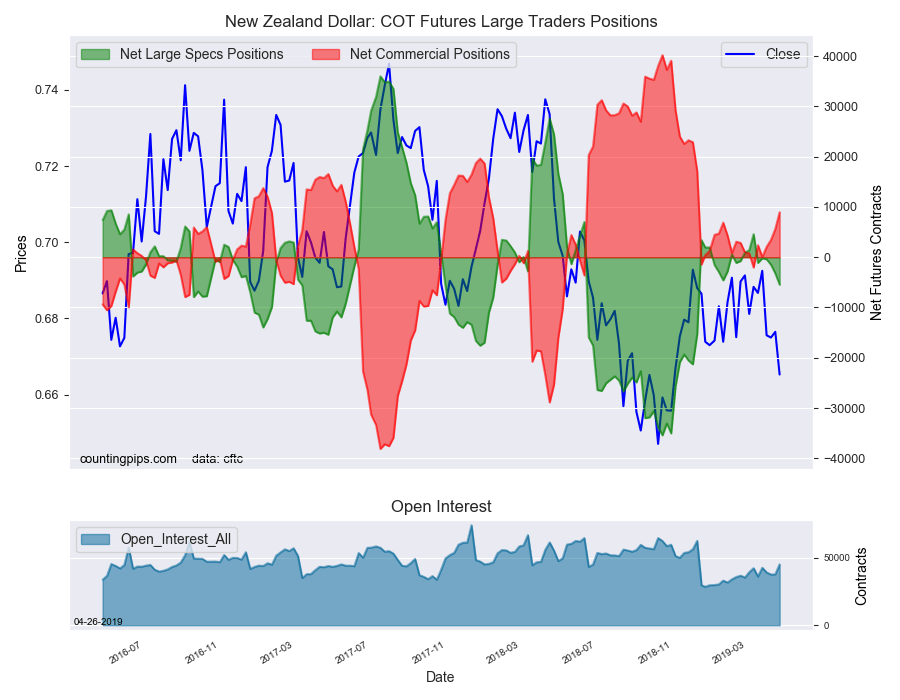

New Zealand Dollar:

The New Zealand dollar speculative standing came in at a net position of -5,450 contracts this week in the latest COT data. This was a weekly decrease of -2,229 contracts from the previous week which had a total of -3,221 net contracts.

Mexican Peso:

Mexican peso speculators totaled a net position of 150,705 contracts this week. This was a weekly lowering of -5,325 contracts from the previous week which had a total of 156,030 net contracts.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).