By CountingPips.com – Get our weekly COT Reports by Email

This week’s data showed 7 out of 8 major currency levels are bearish

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators continued to increase their bets for the US dollar Index this week while dragging euro bets into a new bearish standing.

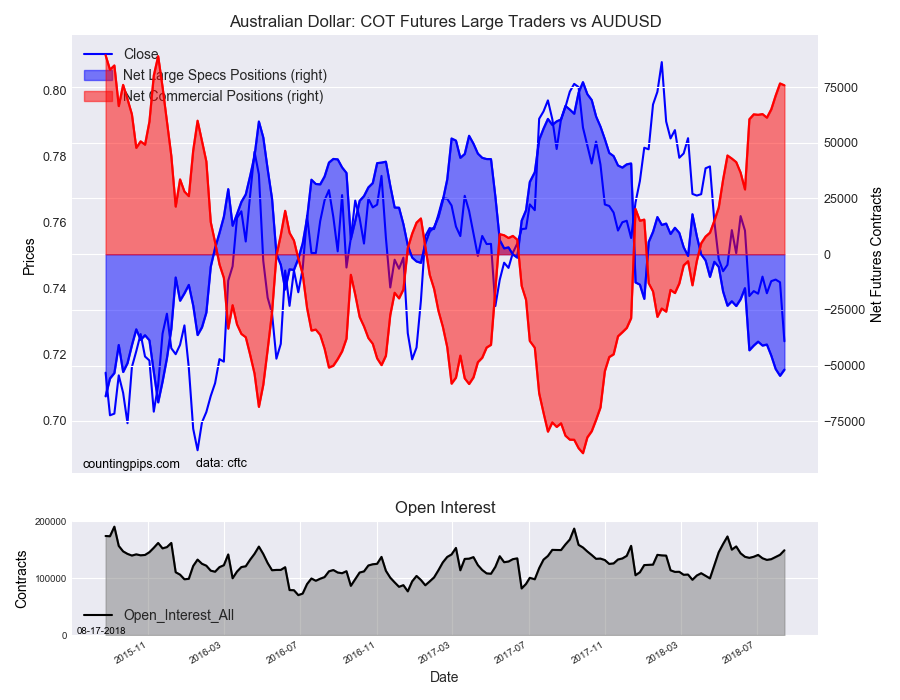

Non-commercial large futures traders, including hedge funds and large speculators, bet in favor of the US Dollar Index (1,931 weekly change in contracts), Japanese yen (4,439 contracts), Swiss franc (259 contracts) and the Australian dollar (2,757 contracts), according to the data reported through Tuesday August 14th.

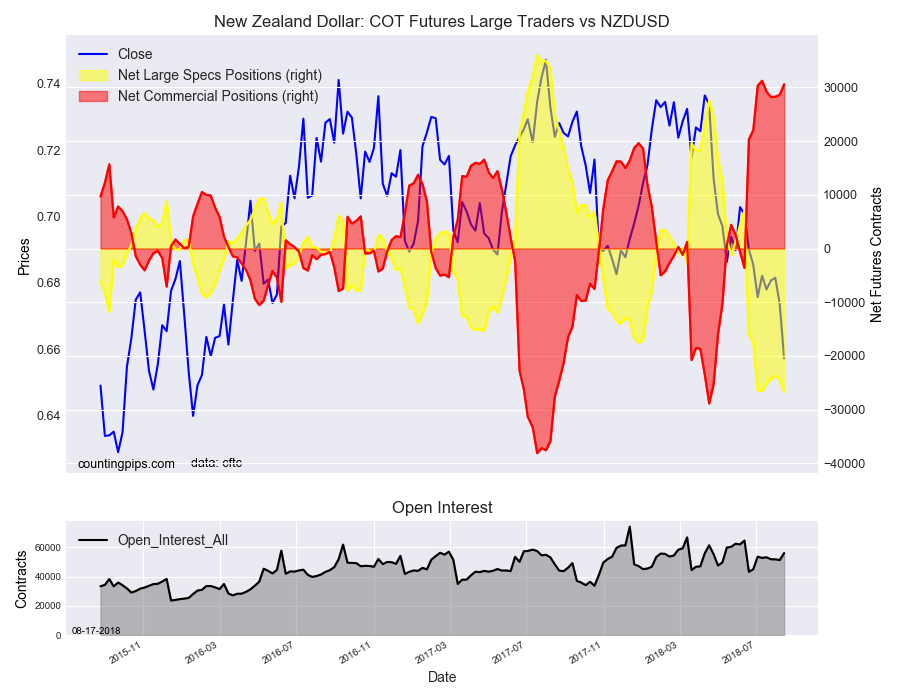

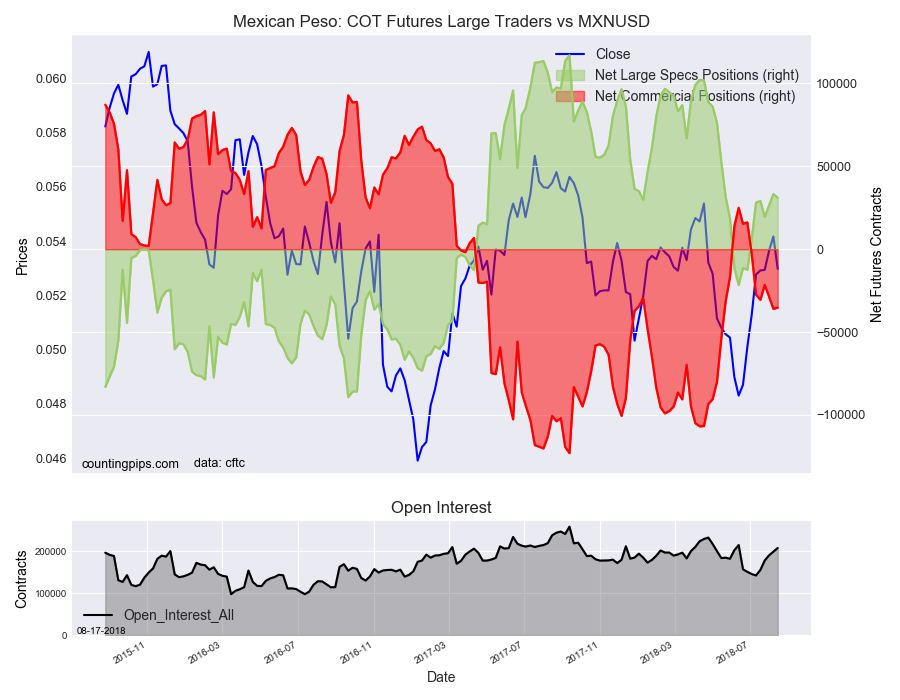

On the down side, the currencies whose speculative bets declined this week were the euro (-12,354 weekly change in contracts), British pound sterling (-1,889 contracts), Canadian dollar (-1,300 contracts), New Zealand dollar (-2,166 contracts) and the Mexican peso (-2,186 contracts).

Overall, with the euro now dipping into bearish territory, the number of individual currencies that are in a bearish standing has increased to seven out of the eight that we currently track. The only one still with an overall bullish standing is the Mexican peso.

Table of Weekly Commercial Traders and Speculators Levels & Changes:

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

| Currency | Net Commercials | Comms Weekly Chg | Net Speculators | Specs Weekly Chg |

| EuroFx | -10,307 | 15,787 | -1,789 | -12,354 |

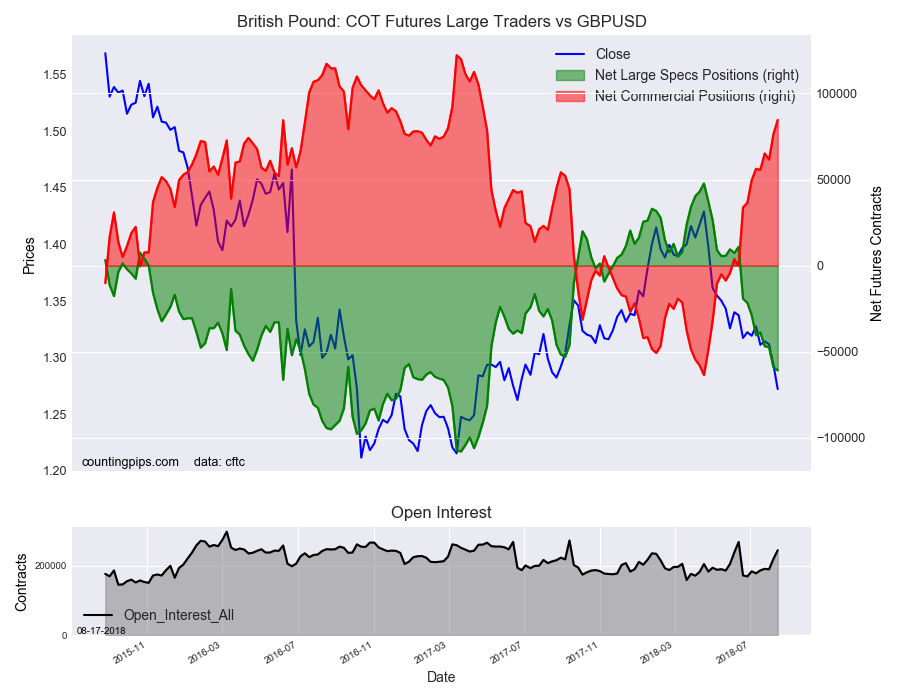

| GBP | 84,554 | 8,315 | -60,741 | -1,889 |

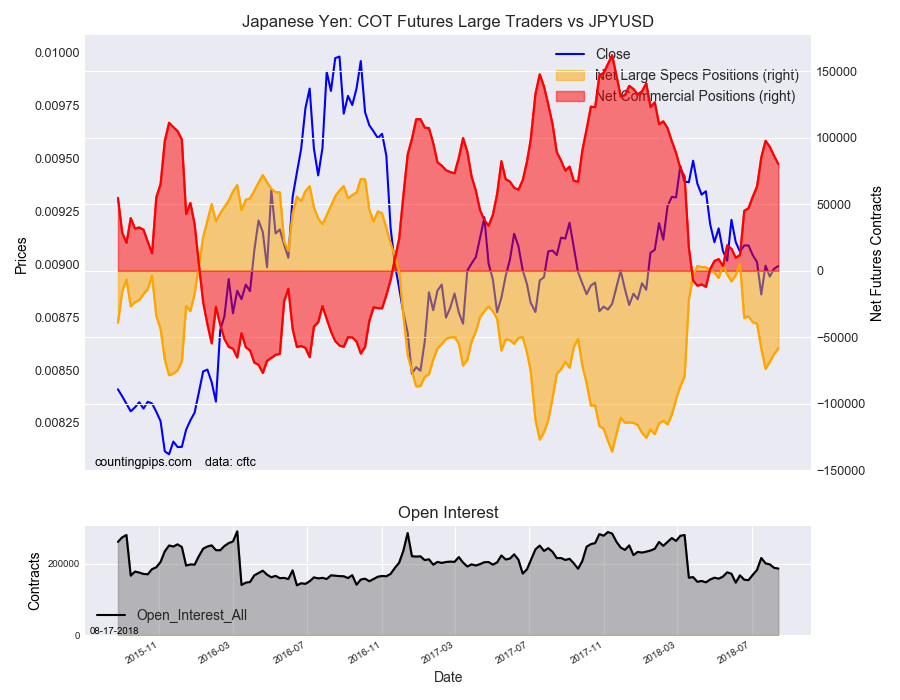

| JPY | 80,210 | -6,148 | -58,368 | 4,439 |

| CHF | 65,775 | -333 | -45,849 | 259 |

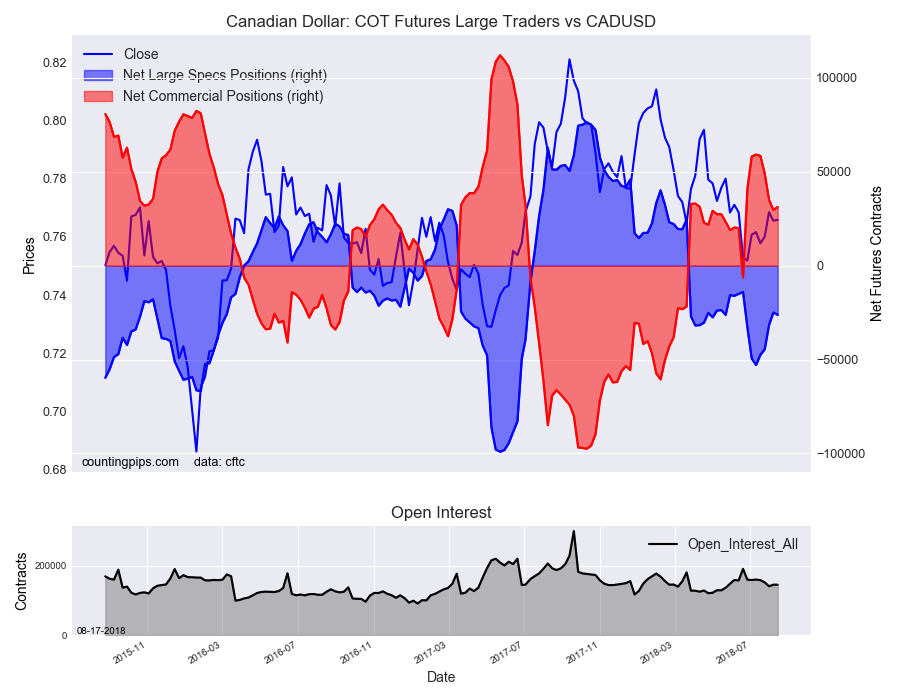

| CAD | 31,283 | 1,555 | -26,198 | -1,300 |

| AUD | 75,774 | -843 | -51,783 | 2,757 |

| NZD | 30,586 | 1,938 | -26,693 | -2,166 |

| MXN | -35,256 | 748 | 31,074 | -2,186 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

US Dollar Index bullish bets keep rising

Large speculators continued to raise their bullish net positions in the US Dollar Index futures markets again this week.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 32,033 contracts in the data reported through Tuesday August 14th. This was a weekly advance of 1,931 contracts from the previous week which had a total of 30,102 net contracts.

Bets for the US dollar index have now improved for seventeen straight weeks to the highest bullish level since May 16th of 2017 when the net positions totaled 34,275 contracts.

Elsewhere, we only saw one substantial change (+ or – 10,000 contracts) in the individual currency contract levels for the speculators category.

- Euro contracts decreased by over -12,000 contracts for a second straight week as the overall position fell into a bearish spec positioning for the first time since May 2nd 2017. The euro bets have now declined for three straight weeks and contracts have gone from +88,225 contracts to -1,789 contracts in just the last ten weeks.

Other Notables:

- New Zealand dollar bearish bets rose for a second straight week and to the most bearish level on record, according to our data dating back to 1999

- British pound sterling bets fell for a fourth straight week and to the most bearish level since May 2nd 2017 when the standing was -81,364 contracts

- Japanese yen bets have improved for three weeks and are now at the least bearish position of the past five weeks

Weekly Charts: Large Trader Weekly Positions vs Price

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

(The charts overlay the forex closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.) See more information and explanation on the weekly COT report from the CFTC website.

Article by CountingPips.com