Article by ForexTime

After over a decade, the Bank of England has finally lifted interest rates by 25 basis points, to 0.5% from the 0.25% record low – but Sterling is not amused.

Under normal circumstances, such an auspicious event would have immediately elevated Sterling and boosted sentiment towards the UK economy, however, we are seeing a completely opposite reaction. With the central bank cautioning that future rate increases will be “at a gradual pace” and to “a limited extent”, this is clearly a dovish hike which has raised questions over the future path of interest rates beyond November. There is a suspicion that this could be a “one-and-done” move, especially when considering how the unsavory combination of Brexit uncertainty and weakening economic growth continues to weigh heavily on sentiment.

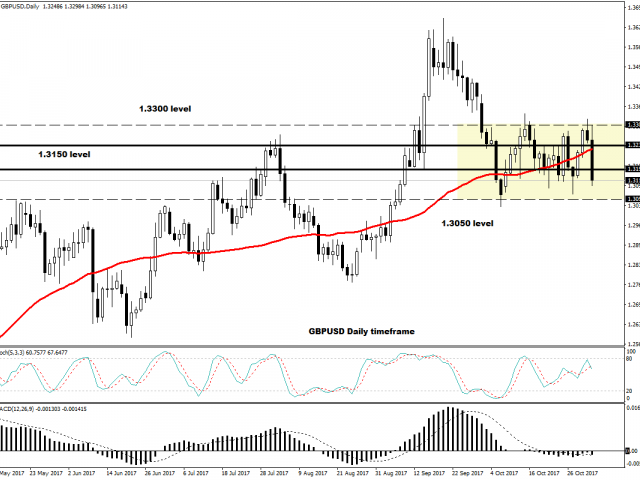

The GBPUSD found itself exposed to heavy losses following the dovish hike, with prices tumbling back below 1.3150. Pound bears have been re-awoken thanks to the BoE, with the next level of interest at 1.3050.

Bitcoin sprints past $7000….

It’s another day, another fresh record high for Bitcoin, which soared past $7000 during early trading on Thursday. This has been another incredibly bullish week for the cryptocurrency, with the visible upside attracting investors from all directions. With Bitcoin surging over 640% this year and its total value currently standing at a massive $100 billion, it’s fair to say the outlook is increasingly encouraging. It must be kept in mind that Bitcoin’s exponential gains are not only phenomenal, but somewhat frightening, and it will be interesting to see where prices close this year.

Taking a look at the technical picture, Bitcoin is extremely bullish on the daily charts. A weekly close above $7000 may inspire buyers to push the cryptocurrency towards $8000. With the upside gaining momentum almost by the day, could Bitcoin hit $10,000 before year end?

Dollar searches for catalyst

The Greenback surprisingly edged lower against a basket of major currencies on Thursday, as investors digested November’s relatively hawkish statement from the Federal Reserve.

With the central bank stating that “economic activity has been rising at a solid rate, despite hurricane-related disruptions”, expectations of a rate hike in December rose to 96.7%, according to CME’s FedWatch tool. Today’s main attraction in the United States and risk event for the Dollar, will be President Trump’s nomination for the next Chair of the Federal Reserve. With reports confirming that Jerome Powell, who is seen as less hawkish, will be Trump’s nominee, it will be interesting to see how the Dollar reacts. Taking a look at the technical picture, the Dollar Index remains bullish on the daily charts. Prices are currently in a wide range, with minor support at 94.40 and resistance at 94.90. A catalyst may be needed in order for the Dollar Index to break from the range, and this could come in the form of Trump’s nomination, or with the NFP report on Friday.

Currency spotlight – EURUSD

The Euro has had a calm trading session these past days, when compared to the chaos witnessed last week. With the political drama in Spain ebbing somewhat, after Madrid suspended Catalonia’s political autonomy and sacked Carles Puidgemont, investors have redirected their attention towards Europe’s fundamentals. On the data front, Eurozone inflation unexpectedly dipped to 1.4% in October, from 1.5% in September, which supported the dovish ECB QE tapering. From a technical standpoint, the EURUSD has traded in a range this week, with support at 1.1600 and resistance at 1.1680. Sustained weakness below 1.1680 may encourage a further decline towards 1.1600 and 1.1500, respectively. In an alternative scenario, prices need to break back above 1.1730 for bulls to jump back into the game.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com