By IFCMarkets

US stocks edged lower on Friday and the dollar index higher. This was the investors’ reaction to the second estimate of Q1 GDP release. It slipped slightly less-than-expected. The economic growth in the second quarter is now estimated at 2%. Thus, the total increase in GDP in the first half of 2015 could be the smallest since 2011. Market participants deem that it won’t affect the Fed’s decision to raise the rates. In our opinion, this fact buoyed the US currency, as opposed to the stock market indices. By the way, other negative factor putting pressure on stock indices was the fallen Chicago PMI in May which outperformed the estimates. Personal Consumption Expenditures in the first quarter were also below expectations. Note that despite a pullback at the end of May, in general over the month the Dow advanced 1%, S&P 500 rose 1.1% and Nasdaq upped 2.6%. Friday’s trading volume on US exchanges was 15% above the monthly average and amounted to 7 billion shares. Today at 14-30 СЕТ Personal Spending and Personal Income in May will be released in US. The forecasts are negative. At 16-00 СЕТ ISM Manufacturing PMI in May and Construction Spending in April will be published. The outlook is positive.

European markets show sluggish growth after losses of Friday. They react to the risen US stock futures ahead of more or less optimistic statistics. Further positive news came from pharmaceutical companies. This morning weak data on Manufacturing PMI has been released: in euro zone as a whole and some countries in particular. At 14-00 СЕТ German Preliminary CPI is expected. It is forecasted to increase, which is quite good considering the ongoing struggle with deflation conducted by the authorities of the country and the EU. The euro is dipping against the US dollar today as Greece didn’t agree with its creditors upon the bailout on Sunday. The country is due to pay off the debt to the IMF on June 5.

Nikkei has climbed today. In addition to the positive global trends, strong Capital Spending data in the first quarter released in Japan underpinned the benchmark. Toshiba stocks are up 3.3% after the publication of a possible dividend payment. The yen didn’t fluctuate much on Friday and today, but in general in May it plunged 4%, the biggest monthly fall since last November. Only data of secondary importance will be published this week in Japan. A few BOJ officials are due to speak this week as well.

China’s Manufacturing PMI in May has been released this morning. It was positive and might support prices of some commodity futures.

Oil prices soared on Friday and are now retreating. The number of US operating oil rigs reduced to 986 units for the 12th consecutive week, according to Baker Hughes report. OPEC meeting will be held on June 5. Most market participants expect the oil output to remain unchanged at the current level of 30 million barrels a day.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Cocoa prices are posting losses for the sixth straight trading session after the two-month rally. International Cocoa Organization expects world cocoa shortage of supply amounting to 38 thousand tons in 2014/2015.

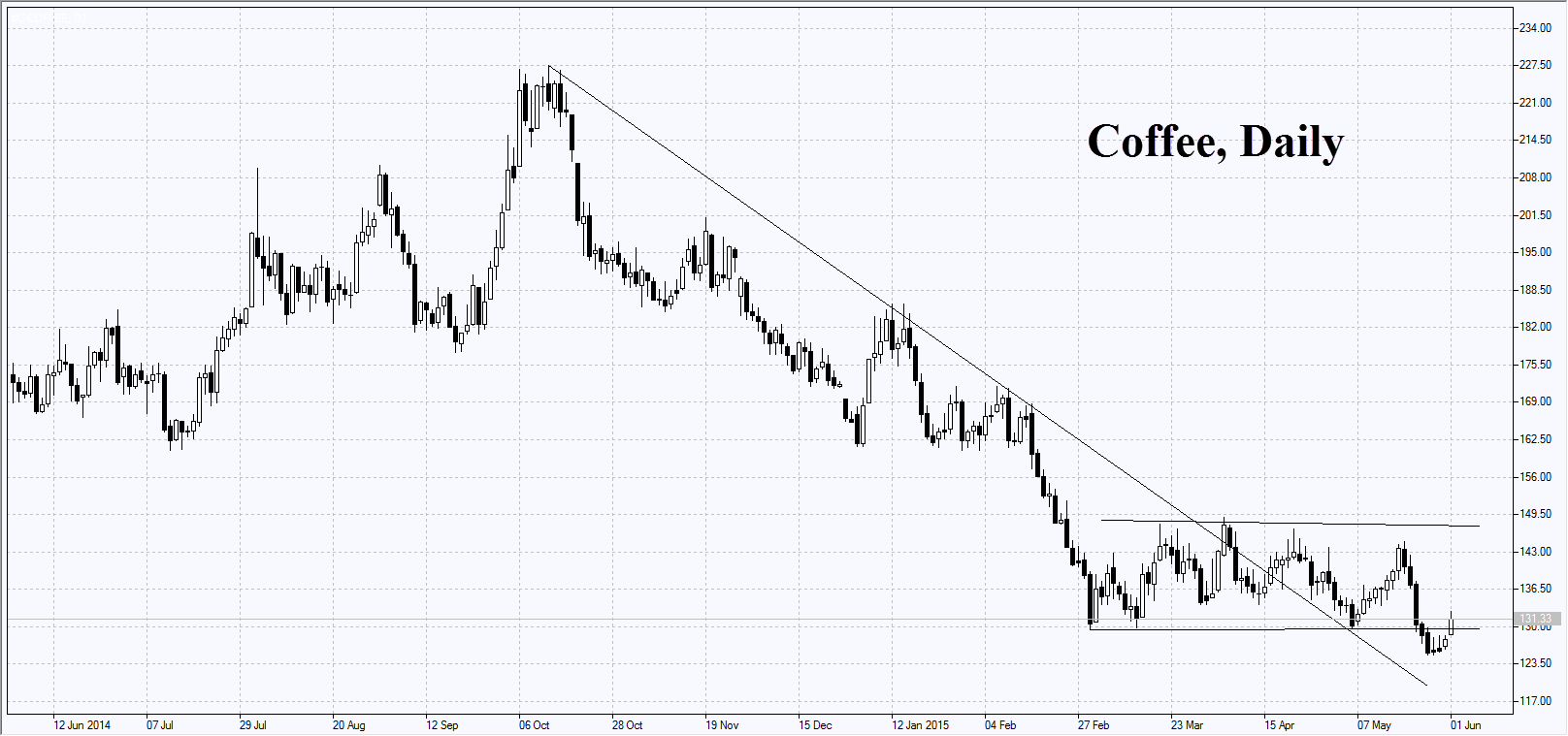

Sugar plummeted almost 8% in May, to six-year low. Currently prices are rebounding. Coffee prices also boosted, higher from the fresh record low since January 2014. Investors are concerned over the worsening of weather conditions in Brazil because of El Nino.

Market Analysis provided by IFCMarkets