By Dennis Miller, millersmoney.com

My wife Jo and I live in Central Florida, and having ridden out a few hurricanes in our lives, we’re as well prepared as we can be for emergencies. We have, among other things, a generator, food, batteries, candles, and a water purification kit.

My wife and I visited Punta Gorda, FL, after the town suffered severe hurricane damage in 2004. After driving one block to the grocery store, we raced out of there with burning eyes and handkerchiefs covering our noses and mouths. We immediately drove back to the motel, changed our clothes, and put what we were wearing in a plastic bag. We’d never seen anything like that before, and it left quite an impression.

Realistically, the chance of a hurricane doing that kind of damage to us is small—we’re over 50 miles inland from both coasts and 70 feet above sea level. However, in 2004, the eye of three hurricanes passed right over our little town for the first time in recorded history, so even if the probability is less than 1%, the fallout would be so bad that we prepare anyway.

What about a financial catastrophe? How well prepared do you need to be?

Folks near my age have lived through a few bubbles and the subsequent crashes and recoveries. Though we never experienced “the Big One” as our parents did in the 1930s, which was so bad that it shaped the attitudes and values of a couple of generations.

In a full-blown financial crisis, your material world collapses. It might come on the heels of medical problems and the resulting high bills and lost income, or it might come in tandem with runaway inflation or a political meltdown.

Financial Preparation

A full-blown financial crisis often develops so stealthily that only the most observant people will know what hit them, and it typically affects everyone. Those who prepared well are likely to fare much better and avoid the catastrophic consequences, which brings us to core holdings.

Core holdings are, quite literally, survival insurance. They are assets we sock away and hope we never have to sell. They should make up 10% of your overall net worth and be diversified in form and location.

In light of the warning signs that we see in the economy and the stock market, now is a good time to review your own core holdings.

What types of investments should be in that category depends on the type of risk you’re trying to protect against.

Protecting Against Inflation

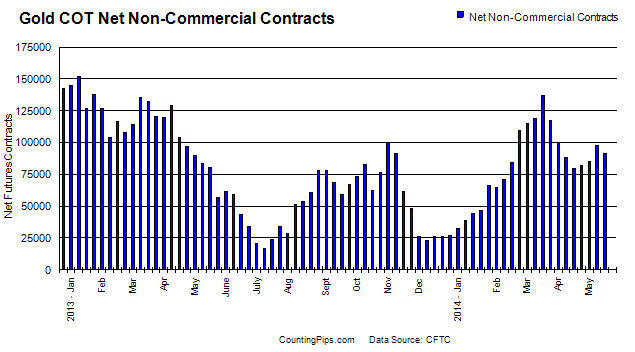

Start with precious metals—gold and silver, in particular. I recommend starting with “junk silver,” which you should be able to buy locally. Then add gold, silver, and platinum bullion coins. One of the best ways to buy competitively is to go to a coin show. You will find several dealers displaying their wares and can quickly determine the market price.

You can also buy bullion from reputable dealers online, and as you increase your holdings, consider holding some metal internationally. (For the best ways to invest in gold, see the free special report, The 2014 Gold Investor’s Guide.

Don’t confuse these holdings with exchange-traded funds like GLD. Those are not core holdings. They are paper investments purchased with the intention of selling them for a profit at a later date. While they may (or may not) move consistently with metal prices, your paper is not redeemable for metal. You may want to own these in your portfolio just like any other asset you think will go up in value.

Your core holdings, however, need not be limited to metals. We hold foreign-currency-denominated CDs from EverBank that are FDIC-insured in ours. While their yield is currently low, we hold them as a hedge against inflation.

When the US dollar buys less, certain foreign currencies increase in value and will buy more. By way of example, I have held Swiss francs for years. They used to be worth $0.80 to the dollar; now they are worth more than $1.10.

Farmland is another great hedge against inflation. It’s a valuable asset and is in limited supply. There’s no new land growing in Kansas.

Protecting Against Confiscation

Historically, governments have resorted to extreme measures like confiscation when their debt load gets out of hand. Confiscation can take more than one form.

In 1933, President Roosevelt, by Executive Order 6102, made it illegal to own gold. It required everyone to deliver all of their gold coins, bullion, and certificates to the Federal Reserve, in exchange for $20.67 per ounce. Once people had surrendered their gold, the government raised its official price from $20.67 to $35 per ounce. Does that mean gold went up in value overnight? No, the value of the dollar went down.

A second form of confiscation is taxes, sometimes marketed as “emergency taxes.” A government that is spending more than it takes in will eventually have its day of reckoning. Fearing a collapse, they’ll resort to extreme measures. I wrote about the confiscation in Cyprus last year, and we are seeing similar things happening in Argentina. Who are the targets? Anyone with money.

While no one can predict for sure what our government will do, prudent investors diversify some of their investment capital offshore. The example of Cyprus has shown that those who moved some of their money offshore were spared. Once the government shut the currency window, however, it was too late for the others.

How Bad Could Things Get?

I have no idea. When I attended the 2011 Casey Fall Summit, three of the speakers described what it was like to live through hyperinflation. Argentina has already confiscated much of its citizens’ retirement plans, forcing them to invest in government debt.

The speaker from Yugoslavia shared the following slide showing the magnitude of hyperinflation in his country:

Of course we can’t say for sure that hyperinflation will or will not happen in the United States. But the Federal Reserve had been in business for 95 years and had $800 billion on its balance sheet as recently as 2007. Now it has $4 trillion, which is somewhere between a 400- and 500-year money supply. The minute the world loses confidence in the dollar or it loses its status as the world’s reserve currency, the decline in purchasing power could be horrendous.

Even if the probability of hyperinflation is tiny, remember that your biological clock is ticking. You may be close to leaving the workforce or already out. The adverse consequences of high inflation, hyperinflation (which are two different conditions), and/or outright government confiscation of wealth are so catastrophic that an unprepared investor may never be able to recover. That could mean bunking in your adult child’s guest room instead of doing the million fun things you’d planned for retirement.

It’s time to make sure your core holdings are where they need to be, just in case. Jo and I review our financial holdings each year at tax time. That reminds me… We store our emergency food and mark the expiration date on the cases. About a month before expiration, we load the cases in the van and take them to the local food bank, then head to Sam’s Club to reload.

Hurricane season will be here before you know it. It’s time to check your inventory.

There are countless ways to protect yourself from a financial crisis—and only a few are mentioned here. The Miller’s Money team is constantly on the lookout for the best ways to protect and grow your nest egg. Sign up for our free e-letter, Miller’s Money Weekly, today.