Weekend Update

November 29, 2013

— VIX appears to be challenging its cluster of resistance between 13.66 and 14.13. The 5 week breakout point is at 14.45, which may give the VIX a “green light” for a higher rally. The next breakout point would be at 21.00, the neckline of a complex inverted Head & Shoulders formation.

SPX exceeds a common wave relationship.

— SPX spent its third week in a throw-over above its massive Ending Diagonal. While most throw-overs are measured in 60 to 90 day Ending Diagonals, this one is 2 ½ years old. Thanksgiving week is often considered the “peak week” of the positive season for stocks, so this week’s performance is no surprise. What is a surprise is a “key reversal” in which the SPX nearly gave up all of its gain for the week. The reversal from the top may be violent.

(ZeroHedge) Despite a significant tumble into the close ($3.25bn notional sold in last 4 seconds of S&P futures); for the first time since January 2004, the S&P 500 has risen for eight straight weeks.

NDX is at double resistance.

— This week NDX is again pressing against two upper trendlines, that of the Massive Ending Diagonal and the upper trendline of the Broadening Wedge formation. While Ending Diagonals often have throw-overs, Broadening Tops do not. This suggests that NDX may be approaching the end of the line as it presses to meet the Broadening Top trendline for the last time.

(ZeroHedge) With Thanksgiving comes Black Friday and Cyber Monday, two of the biggest days for retail stocks each year. Thanksgiving isn’t just an opportunity to gorge on turkey; it’s also one of the most important weekends of the year for the retail sector. As much as 40% of American shopping occurs on the now infamous Black Friday and Cyber Monday – the first two business days that fall after Thanksgiving. But to complicate the matter, meteorologists are tracking an epic super-storm that is slowly working its way east, threatening to bring even more chaos to the holiday season. So who will win?

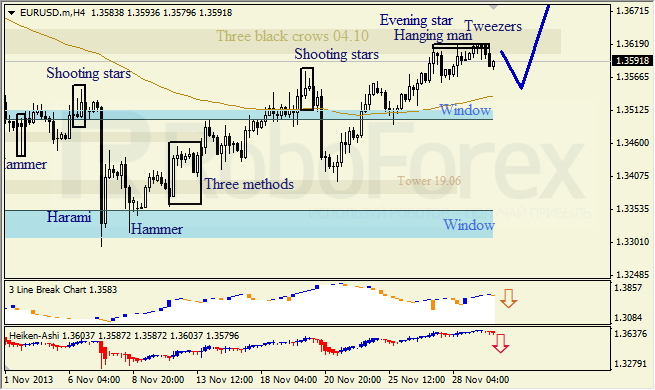

The Euro may have completed its bounce.

.

— The Euro bounce may be over after a 61% retracement of its decline from the October 24 high. The bounce appears to be complete, since the Cycles Model suggests the Euro may be due for a significant low by the end of the year.

(ZeroHedge) Following the “good” news in the inflationary front, in which European November CPI rose and beat expectations if posting the first sub-Japan inflationary rate in Eurozone history, Eurostat followed with more holiday cheer when it reported a surprising decline in the overall Eurozone unemployment rate from 12.2% to 12.1%, the first such drop since late 2010.

It was not all good news however, and when one looks at Europe’s weakest link – youth unemployment – the number once again rose to a fresh all-time high, of 24.4%…

The Yen slides toward its Head & Shoulders neckline.

–The Yen continues its slide toward the Head & Shoulders neckline at 96.00. The Yen may break down beneath the neckline in a Primary Wave [5] in a very strong Primary Cycle decline through that may last into the New Year.

(ZeroHedge) When Abenomics was unveiled in Japan upon the re-election of Shinzo Abe as prime minister in late 2012, it is safe to say that, having been mired in a 20-year deflationary spiral and with debt totaling 240% of GDP,Japan was nearing an endgame of sorts.

Realizing just how late in the game he found himself, Abe promised to change all this, but in order to do so he needed to pursue a high-risk strategy with a low probability of success.

The press (ever hungry for a new, catchy portmanteau word) dubbed it “Abenomics.”

The US Dollar completes a bullish Flag formation.

— USD appears to have completed a bullish Flag formation this week. If so, this may imply a potential breakout above the Head & Shoulders neckline in the very near future. Last week I suggested, “This may prove to be a head fake for dollar shorts since the next Cycle high may occur by mid-December.” The probability of a correct call may be rising…

Gold dips beneath its Head & Shoulders neckline.

— Gold dipped beneath a small Head 7 Shoulders neckline at 1235.00, but snapped back above it. Currently it is challenging its Cycle Bottom resistance at 1243.58, but may be losing its upward momentum. The nearer term target is the completion of its smaller Head & Shoulders formation at or near 1070.00. I hope that I am wrong on the lower target, which may arrive in 2014.

(ZeroHedge) There was a time when the merest mention of gold manipulation in “reputable” media was enough to have one branded a perpetual conspiracy theorist with a tinfoil farm out back. That was roughly coincident with a time when Libor, FX, mortgage, and bond market manipulation was also considered unthinkable, when High Frequency Traders were believed to “provide liquidity”, or when the stock market was said to not be manipulated by the Fed, and when the ever-confused media, always eager to take “complicated” financial concepts at the face value set by a self-serving establishment, never dared to question anything.

Treasuries loses upward momentum.

— USB stayed beneath Intermediate-term resistance at 131.97and appears uncertain about the direction it may take. It may retrace to its weekly Short-term resistance at 132.29, but will meet trendline resistance there, as well, so the upside potential is limited. However, crossing Cycle Bottom Support and its Broadening Wedge trendline at 129.71 may have devastating consequences for the Long Bond.

(WSJ) U.S. Treasury bonds fell Friday and wrapped up a monthly price loss as fears grew that the Federal Reserve might dial back its bond buying before the end of the year.

Next week’s nonfarm jobs report is seen by many bond traders and investors as the key factor determining the timing for the Fed to cut, or taper in Wall Street terms, its $85 billion monthly purchases in Treasurys and mortgage-backed securities.

Fed officials have said that when to adjust the pace of its bond buying, a key tool to stimulating the economy following the 2008 financial crisis, hinges on the health of the economy, especially U.S. employment.

Crude may be extending its decline.

— Crude may be extending its decline yet another week. In doing so, it may be forming point 4 in a Broadening Wedge formation. If it declines beneath 87.50, the probability of this becoming a successful formation may be reduced. However, if it makes a low in the next week or so at or above 87.50, the Broadening Wedge may be the dominant formation for up to 2 months.

(ABCNews) The price of oil was little changed above $92 a barrel Friday as holidays in the U.S. thinned trading and plentiful crude stocks showed the market was well supplied. By early afternoon in Europe, benchmark U.S. crude for January delivery was up 27 cents at $92.57 a barrel in electronic trading on the New York Mercantile. Crude’s last settlement was Wednesday as floor trading on the Nymex was closed Thursday for Thanksgiving.

Oil has declined from about $110 in September due to reduced tensions in the oil-rich Middle East, but above all due to muted demand and high supplies.

China stocks repelled at trading channel trendline.

–The Shanghai Index rally stopped at mid-Cycle resistance at 2231.69 its declining trading channel trendline, which has defined Cycle tops for the past 3 years. This is the third time the SSEC has been stopped at those markers since September 12 and the fifth time this year, attesting to the potency of that resistance. The next Pivot low may occur in late December, so this may be a strong decline.

The India Nifty gets whipsawed.

— The India Nifty index attempted to regain its losses from the prior week, but failed to make a new high. This suggests the current Ccycle may continue to decline into the end of December. The next bounce may be near Intermediate-term support at 5906.28.

The trigger to activate the Orthodox Broadening Top formation lies at the bottom trendline just above 4800.00 It appears that CNXN may be reaching the bottom of this chart by the end of December.

The Bank Index rally may have run its course.

— BKX came close to last week’s target before “giving it up.” On Friday it made a weekly key reversal, which suggests the rally is now done. Next week may give us the parameters for the downside targets.

(ZeroHedge) The Fed’s Catch 22 just got catchier. While most attention in the recently released FOMC minutes fell on the return of the taper as a possibility even as soon as December (making the November payrolls report the most important ever, ever, until the next one at least), a less discussed issue was the Fed’s comment that it would consider lowering the Interest on Excess Reserves to zero as a means to offset the implied tightening that would result from the reduction in the monthly flow once QE entered its terminal phase…After all, the Fed’s policy book goes, if IOER is raised to tighten conditions, easing it to zero, or negative, should offset “tightening financial conditions”, right? Wrong. As the FT reports leading US banks have warned the Fed that should it lower IOER, they would be forced to start charging depositors.

(ZeroHedge) In order to offset the lack of loan creation by commercial banks, the “Big 4” central banks – Fed, ECB, BOJ and BOE – have had no choice but the open the liquidity spigots to the max. This has resulted in a total developed world “Big 4” central bank balance of just under $10 trillion, of which the bulk of asset additions has taken place since the Lehman collapse.

How does this compare to what China has done? As can be seen on the chart below, in just the past 5 years alone, Chinese bank assets (and by implication liabilities) have grown by an astounding $15 trillion, bringing the total to over $24 trillion, as we showed yesterday. In other words, China has expanded its financial balance sheet by 50% more than the assets of all global central banks combined!

Bear Extinction. What happens when there’s no one left to sell to?

Regards,

Tony

Anthony M. Cherniawski

The Practical Investor, LLC

P.O. Box 129, Holt, MI 48842

www.thepracticalinvestor.com

Office: (517) 699.1554

Fax: (517) 699.1558

Disclaimer: Nothing in this email should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of certain indexes or their proxies using a proprietary model. At no time shall a reader be justified in inferring that personal investment advice is intended. Investing carries certain risks of losses and leveraged products and futures may be especially volatile. Information provided by TPI is expressed in good faith, but is not guaranteed. A perfect market service does not exist. Long-term success in the market demands recognition that error and uncertainty are a part of any effort to assess the probable outcome of any given investment. Please consult your financial advisor to explain all risks before making any investment decision. It is not possible to invest in any index.

The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

As my long-time readers know, contrarian investing is all about buying when others are selling and selling when others are buying. Getting in ahead of the crowd is the key to successful long-term investing.

As my long-time readers know, contrarian investing is all about buying when others are selling and selling when others are buying. Getting in ahead of the crowd is the key to successful long-term investing.